Region:Asia

Author(s):Shubham

Product Code:KRAB5561

Pages:96

Published On:October 2025

By Type:

The market is segmented into Hard Services, Soft Services, Integrated Services, Facility Management Software, and Others. Among these, Hard Services dominate the market due to the essential nature of maintenance and repair services required for building operations. The increasing complexity of building systems and the need for compliance with safety regulations further drive the demand for Hard Services. Soft Services, while significant, are often seen as supplementary, leading to a stronger focus on Hard Services in facility management strategies.

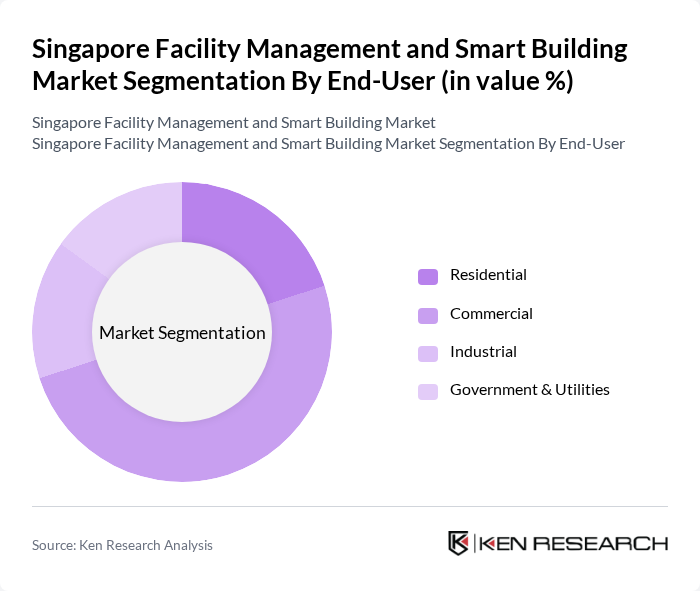

By End-User:

The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Commercial sector leads the market, driven by the high demand for office spaces and retail establishments in urban areas. The rapid growth of e-commerce and the need for efficient logistics and warehousing solutions in the Industrial sector also contribute to the market's expansion. Government & Utilities play a crucial role in driving standards and regulations, further influencing the demand for facility management services.

The Singapore Facility Management and Smart Building Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE Group, Inc., JLL (Jones Lang LaSalle), ISS Facility Services, Sodexo, Cushman & Wakefield, G4S plc, Knight Frank, Apleona, Engie Services Singapore, SATS Ltd., Serco Group plc, OCS Group, C&W Services, Mitie Group plc, Dalkia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Singapore facility management and smart building market appears promising, driven by technological advancements and government support. As urbanization continues, the integration of smart technologies will enhance operational efficiency and sustainability. In the future, the market is expected to witness a significant shift towards integrated facility management solutions, emphasizing user experience and predictive maintenance. Companies that adapt to these trends will likely gain a competitive edge, positioning themselves for long-term success in a rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Hard Services Soft Services Integrated Services Facility Management Software Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Building Maintenance Energy Management Security Services Cleaning Services Others |

| By Service Model | Outsourced Services In-House Services |

| By Market Structure | Public Sector Private Sector |

| By Geographic Coverage | Central Region East Region West Region North Region |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Facility Management | 100 | Facility Managers, Operations Directors |

| Smart Building Technology Adoption | 80 | IT Managers, Building Automation Specialists |

| Energy Management Solutions | 70 | Energy Managers, Sustainability Officers |

| Real Estate Development Insights | 60 | Property Developers, Investment Analysts |

| End-user Experience with Smart Buildings | 90 | Tenants, Facility Users |

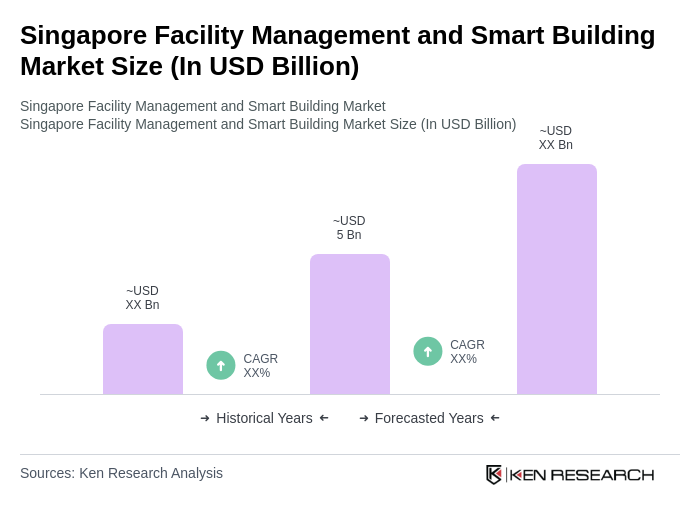

The Singapore Facility Management and Smart Building Market is valued at approximately USD 5 billion, reflecting a significant growth driven by the demand for efficient building management solutions and advancements in smart building technologies.