Region:Asia

Author(s):Dev

Product Code:KRAA7257

Pages:98

Published On:September 2025

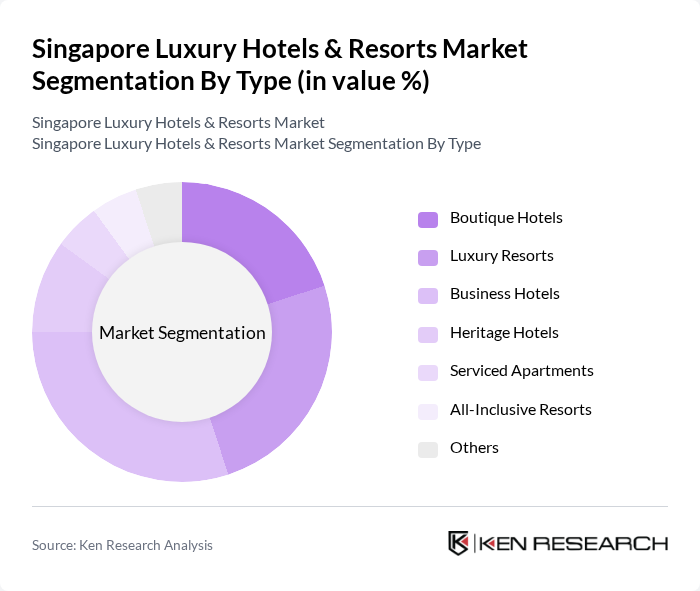

By Type:The luxury hotels and resorts market can be segmented into various types, including Boutique Hotels, Luxury Resorts, Business Hotels, Heritage Hotels, Serviced Apartments, All-Inclusive Resorts, and Others. Each of these sub-segments caters to different consumer preferences and travel purposes. Boutique hotels are gaining popularity for their unique designs and personalized services, while luxury resorts attract travelers seeking comprehensive leisure experiences. Business hotels are tailored for corporate travelers, offering amenities conducive to work and meetings.

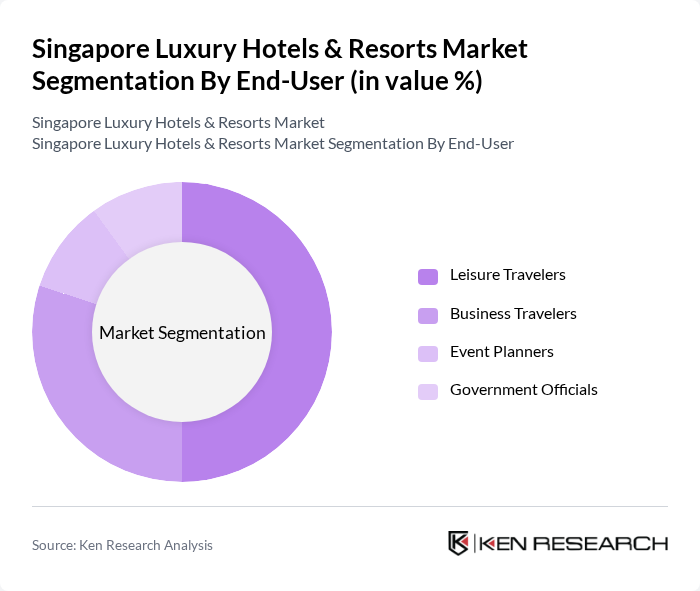

By End-User:The end-user segmentation of the luxury hotels and resorts market includes Leisure Travelers, Business Travelers, Event Planners, and Government Officials. Leisure travelers dominate the market, driven by the increasing trend of experiential travel and luxury vacations. Business travelers also contribute significantly, as Singapore is a major business hub in Asia. Event planners and government officials represent a smaller yet important segment, often utilizing luxury accommodations for conferences and official visits.

The Singapore Luxury Hotels & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Marina Bay Sands, Raffles Hotel Singapore, The Fullerton Hotel Singapore, Shangri-La Hotel Singapore, The St. Regis Singapore, Four Seasons Hotel Singapore, The Ritz-Carlton, Millenia Singapore, Conrad Centennial Singapore, Capella Singapore, W Singapore - Sentosa Cove, Sofitel Singapore City Centre, InterContinental Singapore, Grand Hyatt Singapore, Hilton Singapore Orchard, Park Hyatt Singapore contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Singapore luxury hotels and resorts market appears promising, driven by a combination of increasing tourist arrivals and a growing emphasis on personalized guest experiences. As the city-state continues to enhance its appeal as a premier travel destination, luxury hotels are expected to innovate and adapt to evolving consumer preferences. The integration of smart technologies and sustainable practices will likely play a crucial role in attracting discerning travelers, ensuring that the market remains competitive and vibrant in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Boutique Hotels Luxury Resorts Business Hotels Heritage Hotels Serviced Apartments All-Inclusive Resorts Others |

| By End-User | Leisure Travelers Business Travelers Event Planners Government Officials |

| By Price Range | Premium Ultra-Premium Luxury Others |

| By Location | City Center Coastal Areas Suburban Areas Others |

| By Amenities Offered | Spa Services Fine Dining Conference Facilities Recreational Activities |

| By Booking Channel | Direct Booking Online Travel Agencies Travel Agents Others |

| By Customer Loyalty Programs | Membership Programs Reward Points Systems Exclusive Offers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Guests | 150 | Frequent travelers, Business executives, Leisure tourists |

| Hotel Management Professionals | 100 | General Managers, Marketing Directors, Revenue Managers |

| Travel Agents Specializing in Luxury | 80 | Luxury Travel Advisors, Corporate Travel Planners |

| Tourism Board Officials | 50 | Policy Makers, Tourism Development Officers |

| Luxury Service Providers | 70 | Concierge Managers, Spa Directors, Event Coordinators |

The Singapore Luxury Hotels & Resorts Market is valued at approximately USD 3.5 billion, reflecting a significant recovery post-pandemic, driven by an increase in affluent tourists and business travel demand.