Region:Asia

Author(s):Geetanshi

Product Code:KRAB1648

Pages:83

Published On:October 2025

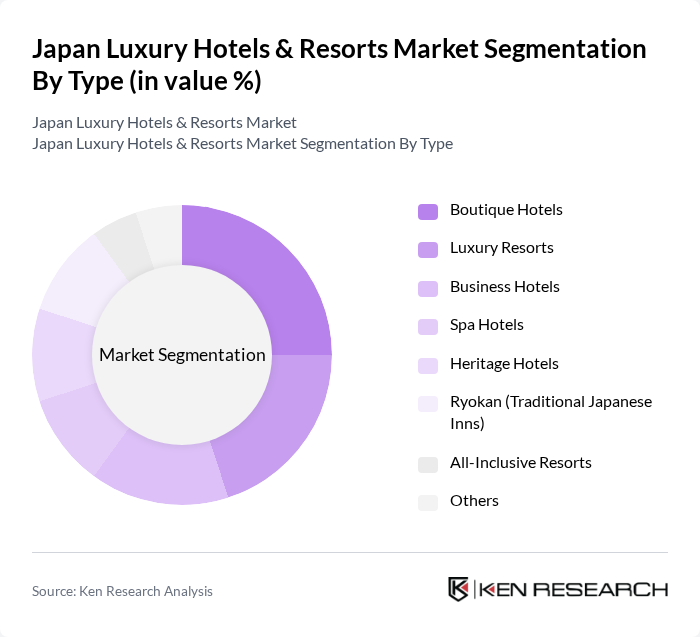

By Type:The market is segmented into various types of accommodations, including Boutique Hotels, Luxury Resorts, Business Hotels, Ryokans (Traditional Japanese Inns), All-Inclusive Resorts, Spa Hotels, Extended Stay Luxury Hotels, and Others. Each type caters to different consumer preferences and travel purposes. Boutique Hotels and Luxury Resorts are especially popular among affluent travelers seeking unique, personalized experiences, while Ryokans remain a distinctive choice for those interested in traditional Japanese hospitality. The recent entry of international luxury brands and the rise of themed and wellness-focused properties have further diversified the market offering .

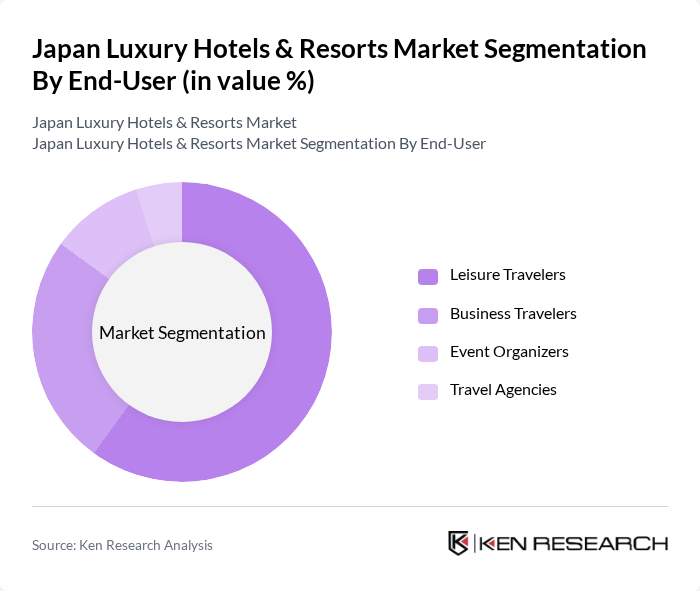

By End-User:The market is segmented by end-users, including Leisure Travelers, Business Travelers, Event Planners, Travel Agencies, and Corporate Clients. Leisure Travelers dominate the market, driven by a growing trend of experiential travel and luxury vacations. Business Travelers also contribute significantly, supported by Japan's robust MICE (Meetings, Incentives, Conferences, and Exhibitions) sector and the country's appeal as a destination for international business events. The rise in high-profile events and global summits has further boosted demand from event planners and corporate clients .

The Japan Luxury Hotels & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Ritz-Carlton, Tokyo, Aman Tokyo, Park Hyatt Tokyo, Mandarin Oriental, Tokyo, Four Seasons Hotel Tokyo at Marunouchi, Grand Hyatt Tokyo, Conrad Tokyo, The Peninsula Tokyo, Shangri-La Hotel, Tokyo, Hyatt Regency Kyoto, The St. Regis Osaka, Hotel New Otani Tokyo, The Westin Tokyo, Hilton Tokyo, InterContinental Tokyo Bay, Raffles Tokyo, Hoshinoya Tokyo, Imperial Hotel, Tokyo, The Okura Tokyo, Palace Hotel Tokyo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan luxury hotels and resorts market appears promising, driven by a combination of increasing domestic and international travel. With the anticipated rise in affluent travelers and the expansion of international flight routes, luxury accommodations are likely to see a surge in demand. Additionally, the integration of technology and personalized services will enhance guest experiences, positioning hotels to capitalize on evolving consumer preferences. Sustainable practices will also play a crucial role in attracting eco-conscious travelers, further shaping the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Boutique Hotels Luxury Resorts Business Hotels Ryokans (Traditional Japanese Inns) All-Inclusive Resorts Spa Hotels Extended Stay Luxury Hotels Others |

| By End-User | Leisure Travelers Business Travelers Event Planners Travel Agencies Corporate Clients |

| By Price Range | Premium Luxury Ultra-Luxury |

| By Location | Urban Areas Coastal Regions Mountain Resorts Cultural Heritage Sites Airport Proximity |

| By Service Type | Full-Service Hotels Limited-Service Hotels Extended Stay Hotels Wellness Retreats |

| By Amenities Offered | Spa and Wellness Facilities Fine Dining Restaurants Conference and Meeting Rooms Concierge Services Private Villas/Suites |

| By Distribution Channel | Direct Booking Online Travel Agencies (OTAs) Travel Agents Corporate Bookings Luxury Travel Advisors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Management Insights | 50 | General Managers, Operations Directors |

| Consumer Preferences in Luxury Travel | 60 | Frequent Luxury Travelers, Travel Enthusiasts |

| Travel Agency Perspectives | 50 | Luxury Travel Agents, Tour Operators |

| Market Trends and Economic Impact | 40 | Market Analysts, Economic Advisors |

| Luxury Hotel Customer Experience | 40 | Hotel Guests, Customer Experience Managers |

The Japan Luxury Hotels & Resorts Market is valued at approximately USD 7 billion, reflecting a significant growth driven by increased international tourism, rising disposable incomes, and a preference for luxury experiences among both domestic and international travelers.