Region:Asia

Author(s):Dev

Product Code:KRAA7222

Pages:89

Published On:September 2025

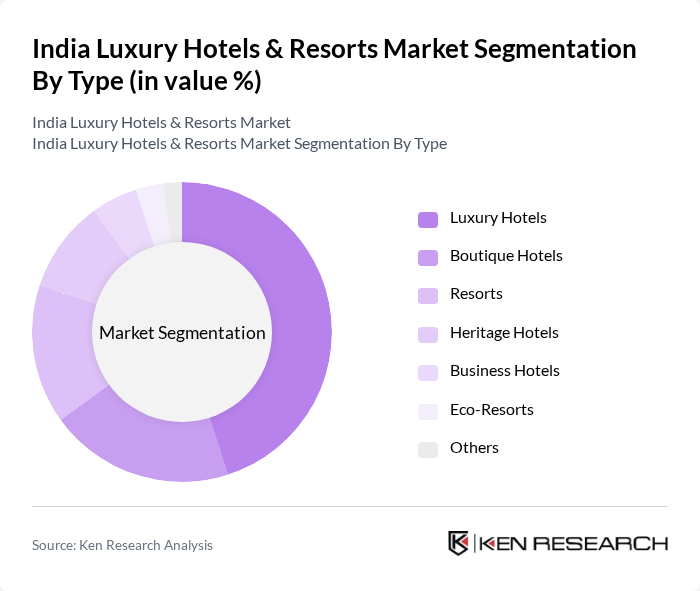

By Type:The luxury hotels and resorts market can be segmented into various types, including Luxury Hotels, Boutique Hotels, Resorts, Heritage Hotels, Business Hotels, Eco-Resorts, and Others. Among these, Luxury Hotels are the most dominant segment, driven by the increasing demand for high-end accommodations that offer premium services and amenities. Boutique Hotels are also gaining traction, appealing to travelers seeking unique and personalized experiences. The growing trend of wellness tourism has led to a rise in Eco-Resorts, which focus on sustainability and eco-friendly practices.

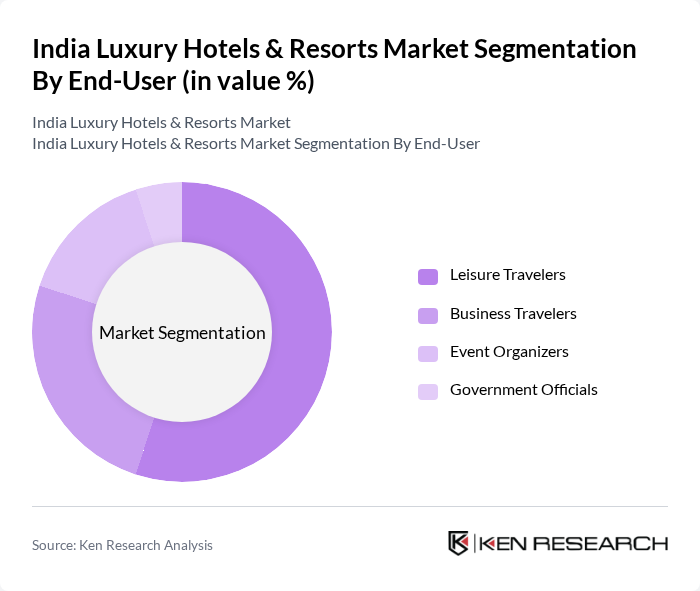

By End-User:The market can also be segmented based on end-users, including Leisure Travelers, Business Travelers, Event Organizers, and Government Officials. Leisure Travelers represent the largest segment, driven by the increasing trend of experiential travel and the desire for luxury vacations. Business Travelers are also significant, as corporate travel continues to grow, particularly in major cities. Event Organizers and Government Officials contribute to the market through conferences, meetings, and official visits, further boosting demand for luxury accommodations.

The India Luxury Hotels & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Taj Hotels, Oberoi Hotels, ITC Hotels, Marriott International, Hilton Hotels, Hyatt Hotels, Radisson Hotels, Accor Hotels, Wyndham Hotels, Lemon Tree Hotels, The Leela Palaces, Shangri-La Hotels, Four Seasons Hotels, Marriott Resorts, Club Mahindra Holidays contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury hotel market in India appears promising, driven by increasing disposable incomes and a growing middle class eager to explore premium travel options. As the tourism sector rebounds post-pandemic, luxury hotels are expected to adapt by enhancing guest experiences through personalized services and technological innovations. Additionally, the focus on sustainability and eco-friendly practices will likely shape the market, attracting environmentally conscious travelers and ensuring long-term growth in this competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Hotels Boutique Hotels Resorts Heritage Hotels Business Hotels Eco-Resorts Others |

| By End-User | Leisure Travelers Business Travelers Event Organizers Government Officials |

| By Region | North India South India East India West India |

| By Service Type | Room Services Food and Beverage Services Spa and Wellness Services Event Management Services |

| By Customer Segment | Families Couples Solo Travelers Corporate Groups |

| By Booking Channel | Direct Booking Online Travel Agencies Travel Agents Corporate Bookings |

| By Price Range | Premium Luxury Ultra-Luxury Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel General Managers | 100 | General Managers, Operations Directors |

| Affluent Travelers | 150 | High Net Worth Individuals, Frequent Luxury Travelers |

| Travel Agents Specializing in Luxury | 80 | Luxury Travel Advisors, Agency Owners |

| Hospitality Industry Experts | 60 | Consultants, Market Analysts |

| Luxury Service Providers (Spa, Dining) | 70 | Service Managers, Business Development Heads |

The India Luxury Hotels & Resorts Market is valued at approximately USD 8.5 billion, reflecting a significant growth driven by increasing disposable incomes and a rise in both domestic and international tourism.