Region:Europe

Author(s):Geetanshi

Product Code:KRAA8129

Pages:84

Published On:September 2025

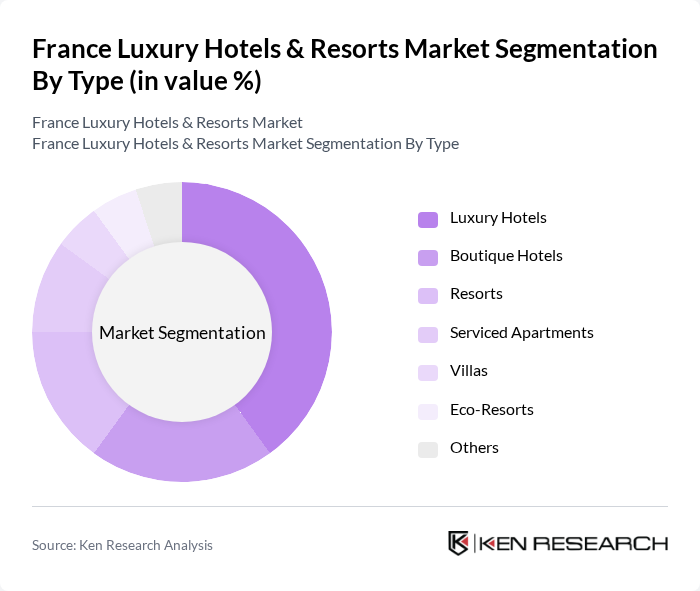

By Type:The luxury hotels and resorts market can be segmented into various types, including Luxury Hotels, Boutique Hotels, Resorts, Serviced Apartments, Villas, Eco-Resorts, and Others. Each of these sub-segments caters to different consumer preferences and travel experiences. Luxury hotels are often characterized by their high-end amenities and services, while boutique hotels offer a more personalized experience. Resorts typically provide comprehensive leisure facilities, and serviced apartments cater to long-stay guests. Eco-resorts focus on sustainability, appealing to environmentally conscious travelers.

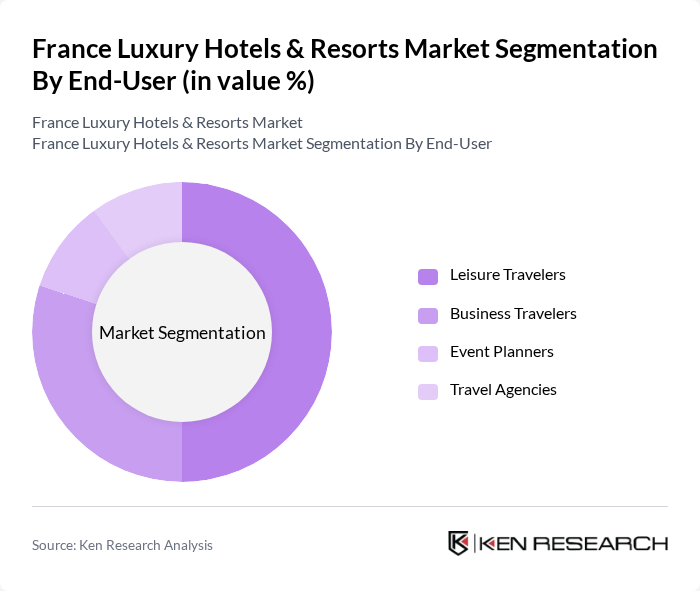

By End-User:The market can also be segmented based on end-users, which include Leisure Travelers, Business Travelers, Event Planners, and Travel Agencies. Leisure travelers typically seek luxury accommodations for vacations, while business travelers prioritize convenience and amenities conducive to work. Event planners often require venues for conferences and gatherings, and travel agencies play a crucial role in facilitating bookings for all types of travelers.

The France Luxury Hotels & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as AccorHotels, Marriott International, Hilton Worldwide, Four Seasons Hotels and Resorts, InterContinental Hotels Group, Hyatt Hotels Corporation, Mandarin Oriental Hotel Group, The Ritz-Carlton Hotel Company, Relais & Châteaux, Leading Hotels of the World, Belmond Ltd., Rosewood Hotels & Resorts, Shangri-La Hotels and Resorts, Kempinski Hotels, Small Luxury Hotels of the World contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury hotel market in France appears promising, driven by evolving consumer preferences and technological advancements. As travelers increasingly seek wellness-oriented experiences, hotels are likely to enhance their wellness offerings, integrating spa services and health-focused amenities. Additionally, the integration of smart technology in hospitality services will streamline operations and improve guest experiences, positioning luxury hotels to meet the demands of a tech-savvy clientele while maintaining high service standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Hotels Boutique Hotels Resorts Serviced Apartments Villas Eco-Resorts Others |

| By End-User | Leisure Travelers Business Travelers Event Planners Travel Agencies |

| By Price Range | Premium Ultra-Premium Budget Luxury |

| By Location | Urban Centers Coastal Areas Countryside |

| By Service Type | Full-Service Hotels Limited-Service Hotels All-Inclusive Resorts |

| By Customer Demographics | Families Couples Solo Travelers |

| By Distribution Channel | Direct Booking Online Travel Agencies Travel Agents Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Managers | 100 | General Managers, Operations Directors |

| Affluent Travelers | 150 | High-net-worth Individuals, Frequent Luxury Travelers |

| Travel Agents Specializing in Luxury | 80 | Luxury Travel Advisors, Agency Owners |

| Hospitality Industry Experts | 50 | Consultants, Market Analysts |

| Luxury Service Providers | 70 | Concierge Managers, Spa Directors |

The France Luxury Hotels & Resorts Market is valued at approximately USD 10 billion, reflecting a significant growth driven by increased international tourism, rising disposable incomes, and a preference for premium experiences among travelers.