Philippines Luxury Hotels & Resorts Market Overview

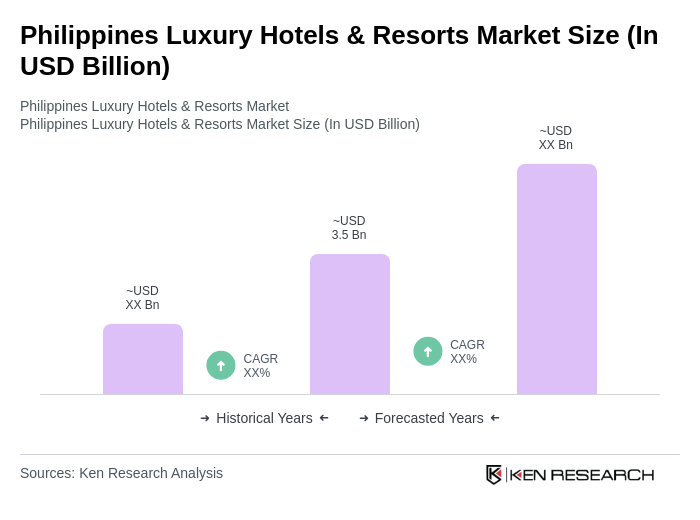

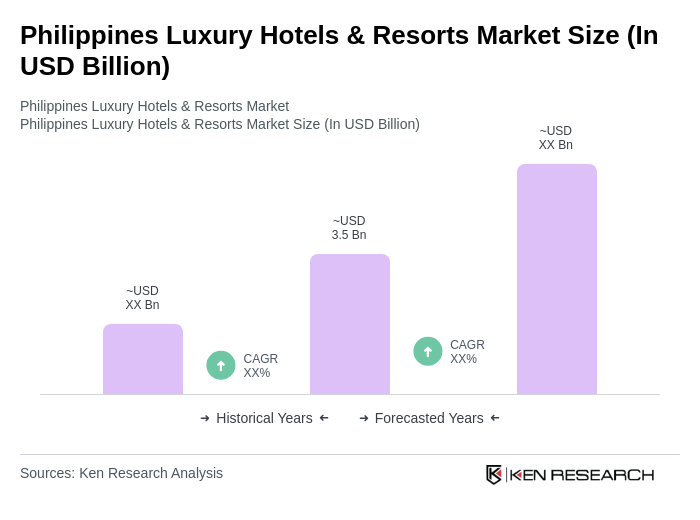

- The Philippines Luxury Hotels & Resorts Market is valued at USD 3.5 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing influx of international tourists, rising disposable incomes, and a growing preference for luxury travel experiences among domestic travelers. The market has seen a significant recovery post-pandemic, with a resurgence in travel demand and investments in high-end accommodations.

- Key cities such as Manila, Cebu, and Davao dominate the luxury hotel market due to their strategic locations, vibrant culture, and accessibility to various tourist attractions. Manila, as the capital, serves as a hub for business and leisure travelers, while Cebu and Davao offer stunning natural landscapes and rich cultural experiences, making them preferred destinations for luxury travelers.

- In 2023, the Philippine government implemented the Tourism Act, which aims to enhance the competitiveness of the tourism sector by promoting sustainable practices and improving infrastructure. This regulation encourages luxury hotels and resorts to adopt eco-friendly initiatives and invest in local communities, thereby boosting the overall appeal of the Philippines as a luxury travel destination.

Philippines Luxury Hotels & Resorts Market Segmentation

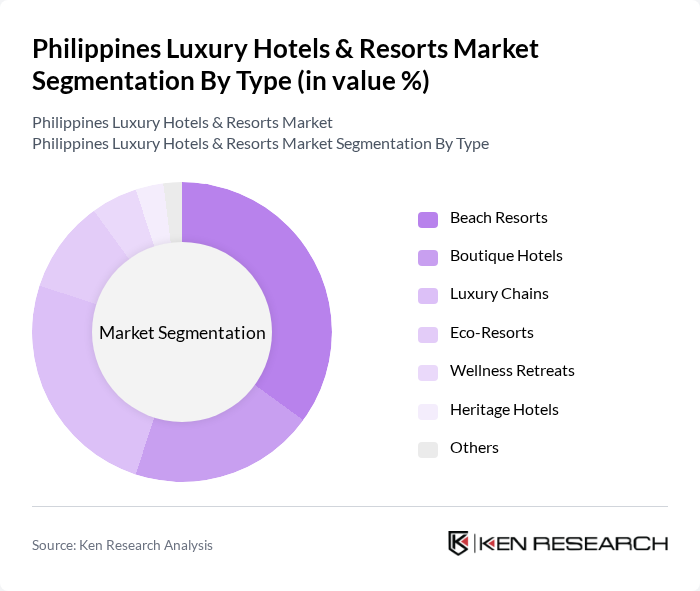

By Type:The luxury hotels and resorts market can be segmented into various types, including Beach Resorts, Boutique Hotels, Luxury Chains, Eco-Resorts, Wellness Retreats, Heritage Hotels, and Others. Among these, Beach Resorts are particularly popular due to the Philippines' stunning coastlines and tropical climate, attracting both local and international tourists seeking relaxation and adventure.

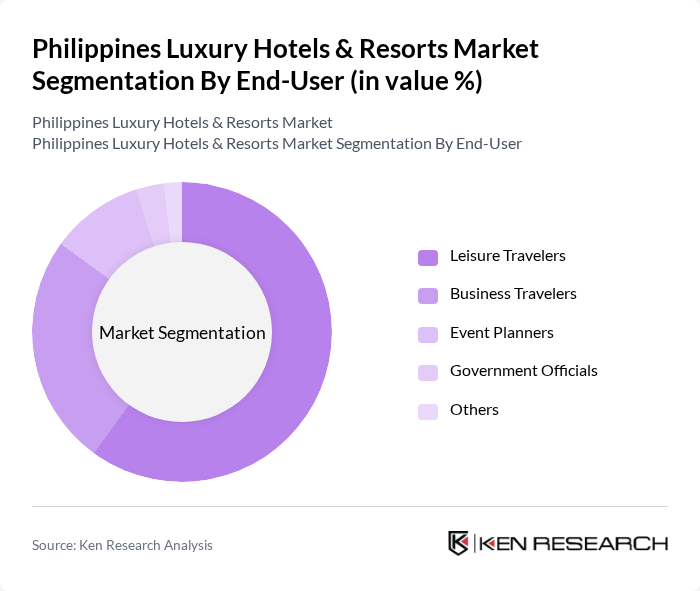

By End-User:The market can also be segmented based on end-users, including Leisure Travelers, Business Travelers, Event Planners, Government Officials, and Others. Leisure Travelers dominate the market, driven by the increasing trend of experiential travel and the desire for unique, luxurious experiences in picturesque settings.

Philippines Luxury Hotels & Resorts Market Competitive Landscape

The Philippines Luxury Hotels & Resorts Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shangri-La Hotels and Resorts, The Peninsula Hotels, Marriott International, Inc., Hilton Worldwide Holdings Inc., AccorHotels, Hyatt Hotels Corporation, Radisson Hotel Group, Dusit International, The Ascott Limited, Crimson Hotels and Resorts, El Nido Resorts, The Bellevue Hotels and Resorts, Discovery Hospitality Corporation, Bluewater Resorts, Movenpick Hotels & Resorts contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Luxury Hotels & Resorts Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The Philippines has seen a significant rise in disposable income, with the World Bank reporting an increase from $3,500 in the past to approximately $4,500 in the future. This growth enables more consumers to afford luxury travel experiences. As the middle class expands, the demand for high-end accommodations is expected to rise, with luxury hotel bookings projected to increase by 15% annually, driven by affluent domestic travelers seeking premium services.

- Rise in International Tourism:The Philippines welcomed over 8 million international tourists recently, a figure projected to grow to 10 million in the future, according to the Department of Tourism. This influx is fueled by the country's rich cultural heritage and natural beauty, attracting luxury travelers. The government aims to enhance tourism infrastructure, which will further boost luxury hotel occupancy rates, expected to reach 75% in major tourist destinations in the future.

- Development of Luxury Infrastructure:The Philippine government has invested over $1 billion in luxury infrastructure projects, including new airports and road networks, enhancing accessibility to remote luxury resorts. In the future, the completion of these projects is anticipated to increase tourist arrivals by 20%, directly benefiting luxury hotels. Additionally, the rise of high-end shopping and dining options in urban areas complements the luxury hotel experience, attracting affluent travelers seeking comprehensive luxury offerings.

Market Challenges

- Economic Fluctuations:The Philippines' economy is projected to grow at a rate of 6% in the future, but fluctuations in global markets can impact luxury spending. Economic uncertainties, such as inflation rates projected to reach 4.5%, may lead to reduced discretionary spending among potential luxury travelers. This volatility can affect hotel occupancy rates and revenue, posing a challenge for luxury hotel operators in maintaining profitability during economic downturns.

- Competition from Alternative Accommodations:The rise of platforms like Airbnb has intensified competition in the luxury segment, with over 1 million listings in the Philippines recently. This trend poses a challenge for traditional luxury hotels, which must differentiate their offerings. With travelers increasingly seeking unique experiences, luxury hotels must innovate to retain market share, as alternative accommodations often provide competitive pricing and personalized experiences that appeal to discerning travelers.

Philippines Luxury Hotels & Resorts Market Future Outlook

The future of the Philippines luxury hotels and resorts market appears promising, driven by increasing disposable incomes and a growing international tourism sector. As the government continues to invest in infrastructure and promote eco-friendly initiatives, luxury accommodations are likely to thrive. Additionally, the integration of technology in hospitality services will enhance guest experiences, making luxury travel more appealing. Overall, the market is poised for growth, with a focus on sustainability and unique offerings shaping its trajectory in the future.

Market Opportunities

- Expansion of Wellness Tourism:The wellness tourism sector in the Philippines is projected to reach $1.5 billion in the future, driven by increasing consumer interest in health and wellness. Luxury hotels can capitalize on this trend by offering specialized wellness packages, including spa treatments and holistic retreats, attracting health-conscious travelers seeking rejuvenation and relaxation.

- Investment in Eco-Friendly Resorts:With a growing emphasis on sustainability, investments in eco-friendly resorts are expected to rise, with over $500 million allocated for green initiatives in the future. Luxury hotels that adopt sustainable practices, such as renewable energy and waste reduction, can attract environmentally conscious travelers, enhancing their market appeal and contributing to long-term profitability.