Region:Asia

Author(s):Shubham

Product Code:KRAB3191

Pages:85

Published On:October 2025

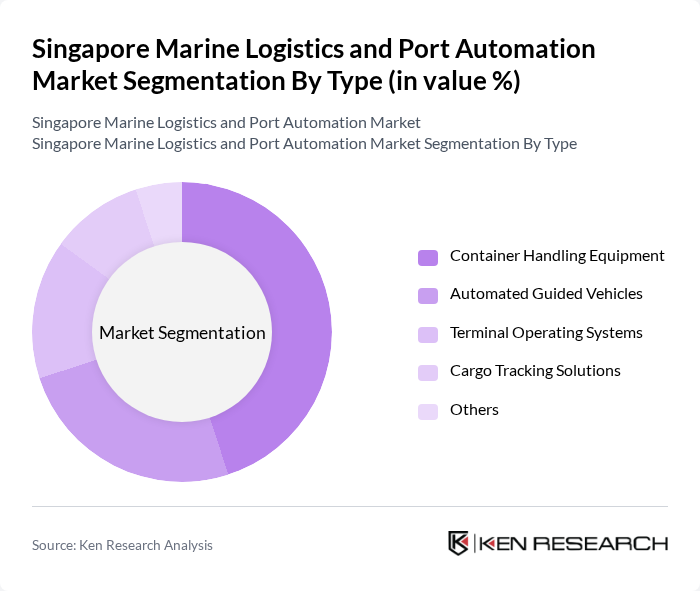

By Type:The market is segmented into various types, including Container Handling Equipment, Automated Guided Vehicles, Terminal Operating Systems, Cargo Tracking Solutions, and Others. Container Handling Equipment is the leading sub-segment, driven by the increasing volume of containerized cargo and the need for efficient handling solutions. Automated Guided Vehicles are gaining traction due to their ability to enhance operational efficiency and reduce labor costs. Terminal Operating Systems are essential for managing port operations, while Cargo Tracking Solutions are crucial for ensuring supply chain transparency.

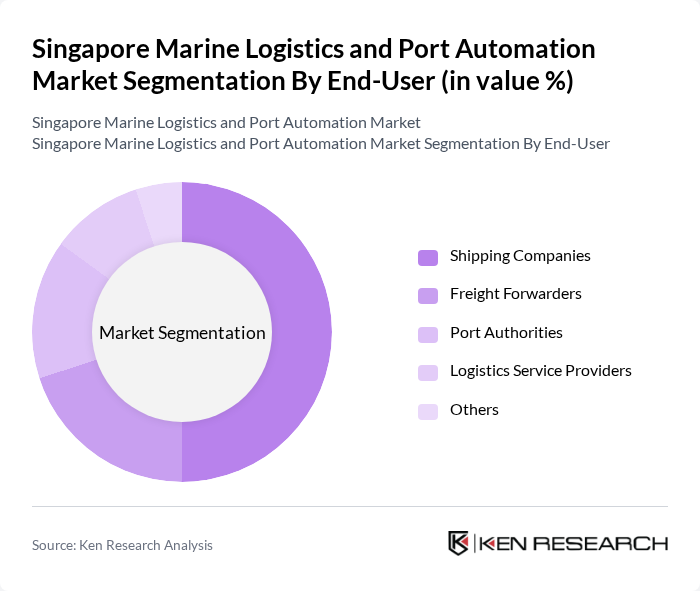

By End-User:The end-user segmentation includes Shipping Companies, Freight Forwarders, Port Authorities, Logistics Service Providers, and Others. Shipping Companies represent the largest segment, as they require advanced logistics solutions to manage their operations efficiently. Freight Forwarders are also significant players, leveraging technology to streamline their services. Port Authorities play a crucial role in regulating and managing port operations, while Logistics Service Providers are increasingly adopting automation to enhance service delivery.

The Singapore Marine Logistics and Port Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as PSA International Pte Ltd, Port of Singapore Authority, Sembcorp Marine Ltd, Jurong Port Pte Ltd, YCH Group, APM Terminals, Kuehne + Nagel International AG, DB Schenker, Nippon Yusen Kabushiki Kaisha (NYK Line), Evergreen Marine Corporation, Hapag-Lloyd AG, CMA CGM Group, Maersk Line, ZIM Integrated Shipping Services, Orient Overseas Container Line (OOCL) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Singapore's marine logistics and port automation market appears promising, driven by technological advancements and increasing global trade. As companies adopt AI and IoT solutions, operational efficiencies are expected to improve significantly. Furthermore, the focus on sustainability will likely lead to the development of green logistics practices. By future, the integration of smart port technologies is projected to enhance cargo handling efficiency by 30%, positioning Singapore as a leader in innovative maritime solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Container Handling Equipment Automated Guided Vehicles Terminal Operating Systems Cargo Tracking Solutions Others |

| By End-User | Shipping Companies Freight Forwarders Port Authorities Logistics Service Providers Others |

| By Application | Container Terminals Bulk Cargo Handling Ro-Ro Operations Warehousing Solutions Others |

| By Distribution Mode | Direct Shipping Third-Party Logistics Intermodal Transport Others |

| By Service Type | Port Management Services Cargo Handling Services Maintenance and Repair Services Others |

| By Technology | Robotics and Automation Data Analytics and AI Blockchain Solutions Others |

| By Investment Source | Private Investments Government Funding Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Port Automation Technologies | 100 | IT Managers, Automation Engineers |

| Marine Logistics Operations | 80 | Logistics Coordinators, Operations Managers |

| Shipping and Freight Services | 90 | Shipping Line Executives, Freight Forwarders |

| Regulatory Compliance in Port Operations | 70 | Compliance Officers, Legal Advisors |

| Supply Chain Innovations | 85 | Supply Chain Analysts, Business Development Managers |

The Singapore Marine Logistics and Port Automation Market is valued at approximately USD 5 billion, reflecting significant growth driven by the demand for efficient shipping solutions and advancements in automation technologies.