Region:Asia

Author(s):Geetanshi

Product Code:KRAB1594

Pages:80

Published On:October 2025

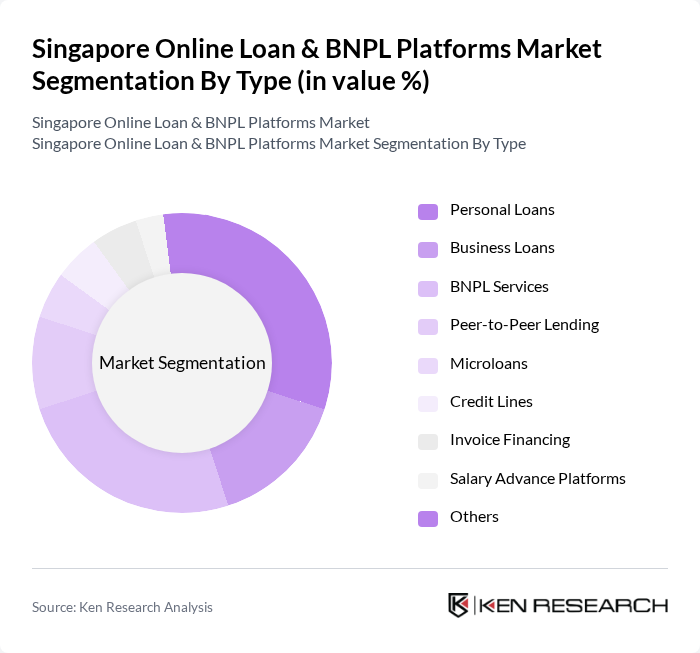

By Type:The market is segmented into various types, including Personal Loans, Business Loans, BNPL Services, Peer-to-Peer Lending, Microloans, Credit Lines, Invoice Financing, Salary Advance Platforms, and Others.Personal LoansandBNPL Servicesare particularly prominent, driven by consumer demand for quick and accessible financing options. The rise of e-commerce and digital retail has further accelerated the popularity of BNPL services, enabling consumers to make purchases without immediate payment and offering merchants higher conversion rates and average order values.

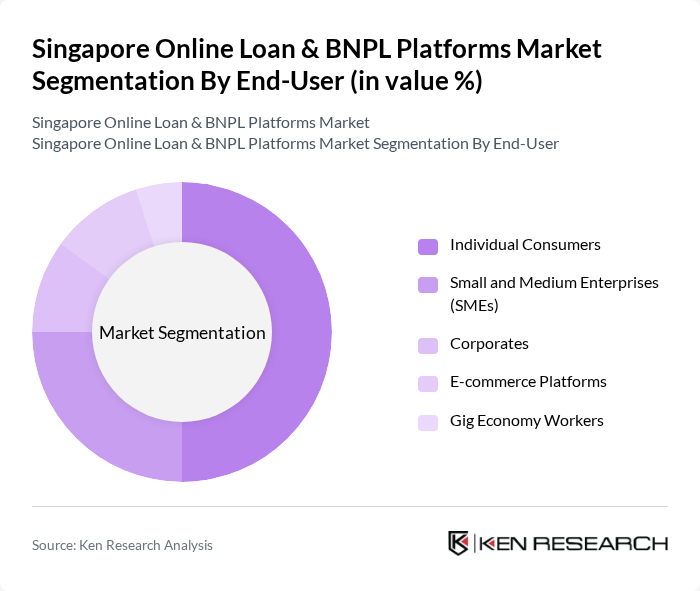

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, E-commerce Platforms, Financial Institutions, Gig Economy Workers, and Others.Individual ConsumersandSMEsare the primary users of online loan and BNPL services, seeking flexible financing solutions for personal and business needs. The growth of e-commerce and the increasing participation of gig economy workers have also led to heightened demand from e-commerce platforms and alternative finance providers, who are integrating BNPL solutions to enhance customer experience and drive sales.

The Singapore Online Loan & BNPL Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as DBS Bank Ltd., Oversea-Chinese Banking Corporation (OCBC Bank), United Overseas Bank (UOB), Grab Financial Group, Razer Fintech, Atome Financial, Kredivo Singapore, Singtel Dash, Hoolah (now part of ShopBack), PayLater by Grab, Funding Societies, MoolahSense, Lendela, Validus Capital, Aspire contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online loan and BNPL market in Singapore appears promising, driven by ongoing technological advancements and a growing consumer base seeking flexible financial solutions. As e-commerce continues to expand, platforms that integrate seamless payment options will likely thrive. Additionally, the increasing focus on sustainable lending practices and responsible borrowing will shape the market landscape, encouraging innovation and collaboration among service providers to meet evolving consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans BNPL Services Peer-to-Peer Lending Microloans Credit Lines Invoice Financing Salary Advance Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates E-commerce Platforms Financial Institutions Gig Economy Workers Others |

| By Loan Amount | Small Loans (Up to SGD 5,000) Medium Loans (SGD 5,001 - SGD 20,000) Large Loans (Above SGD 20,000) Microloans (Below SGD 1,000) Others |

| By Repayment Period | Pay-in-3/Pay-in-4 (Short-term BNPL) Short-term (Up to 6 months) Medium-term (6 months to 2 years) Long-term (Above 2 years) Others |

| By Interest Rate Type | Fixed Interest Rates Variable Interest Rates Promotional/Zero Interest (BNPL) Others |

| By Distribution Channel | Online Platforms Mobile Applications Financial Institutions Third-party Aggregators Embedded Finance (via Merchant/E-commerce) Others |

| By Customer Segment | Millennials Gen Z Working Professionals Retirees Self-employed/Freelancers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Loan Users | 100 | Consumers aged 25-45, Middle-income earners |

| BNPL Service Users | 90 | Young professionals, E-commerce shoppers |

| Financial Advisors | 40 | Certified Financial Planners, Investment Advisors |

| Regulatory Experts | 40 | Compliance Officers, Legal Advisors in Fintech |

| Industry Analysts | 50 | Market Researchers, Economic Analysts |

The Singapore Online Loan & BNPL Platforms Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the increasing adoption of digital financial services and consumer preference for flexible payment options.