Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA4509

Pages:88

Published On:September 2025

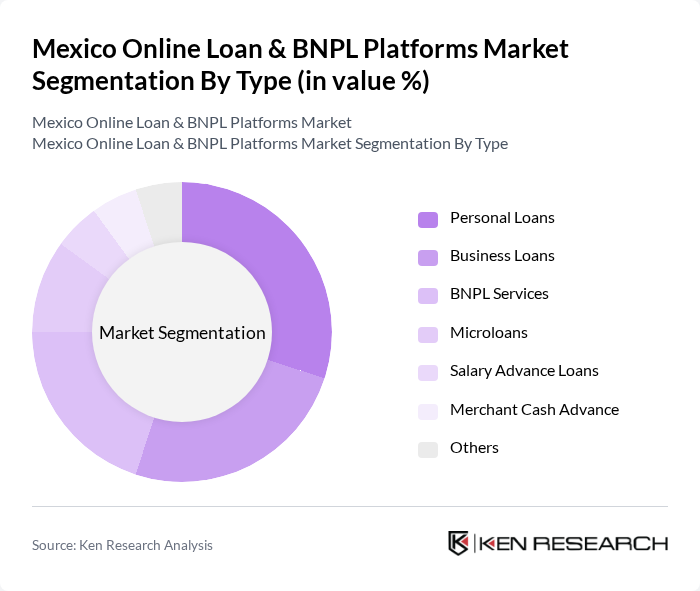

By Type:The market is segmented into personal loans, business loans, BNPL services, microloans, salary advance loans, merchant cash advances, and other specialized financial products. Each segment addresses distinct consumer and business needs, reflecting Mexico’s diverse financial landscape and the growing demand for tailored credit solutions among individuals, SMEs, and micro-entrepreneurs.

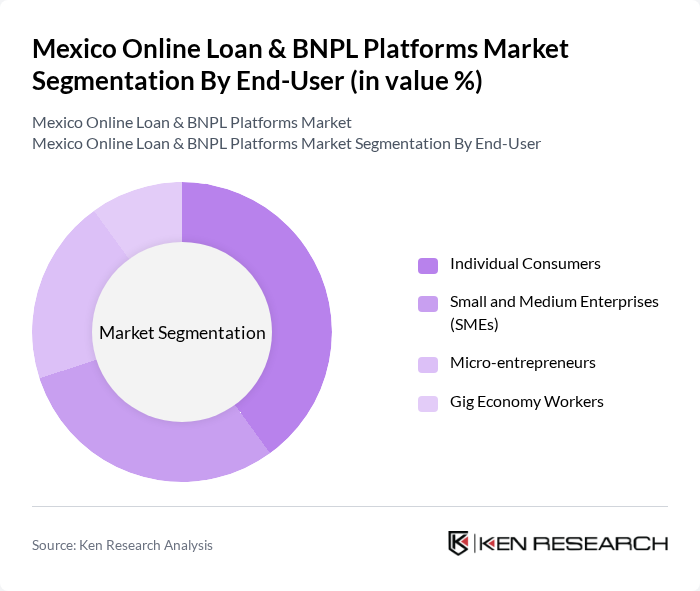

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), micro-entrepreneurs, and gig economy workers. Each group demonstrates unique borrowing behaviors and preferences for online loan products, influenced by their financial needs and access to digital credit solutions.

The Mexico Online Loan & BNPL Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kueski, Konfío, Covalto, Klar, ePesos, Billpocket, Aplazo, Mercado Crédito, CrediJusto, Albo, Baubap, Nubank México, Coppel, OXXO, and Afluenta contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online loan and BNPL market in Mexico appears promising, driven by technological advancements and evolving consumer preferences. As digital-first lending solutions gain traction, companies are expected to enhance their offerings through innovative products and services. Additionally, the integration of artificial intelligence in credit scoring will likely improve risk assessment, enabling lenders to serve a broader customer base while maintaining profitability. This dynamic environment will foster competition and drive further growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans BNPL Services Microloans Salary Advance Loans Merchant Cash Advance Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Micro-entrepreneurs Gig Economy Workers |

| By Application | Emergency Expenses E-commerce Purchases Debt Consolidation Working Capital |

| By Distribution Channel | Online Platforms Mobile Applications Embedded Finance (via Retailers/E-commerce) |

| By Customer Segment | Millennials Gen Z Unbanked/Underbanked |

| By Loan Amount | Micro Loans (< MXN 5,000) Small Loans (MXN 5,000–50,000) Medium Loans (MXN 50,000–250,000) Large Loans (> MXN 250,000) |

| By Credit Score Range | Low Credit Score Medium Credit Score High Credit Score |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Personal Loans | 60 | Consumers aged 18-45, Recent borrowers |

| BNPL Usage in E-commerce | 50 | Online shoppers, E-commerce platform users |

| Financial Literacy and Awareness | 40 | Young professionals, College students |

| Regulatory Impact on Lending | 40 | Financial regulators, Compliance officers |

| Consumer Satisfaction with Loan Services | 45 | Previous users of online loan services, Customer service feedback providers |

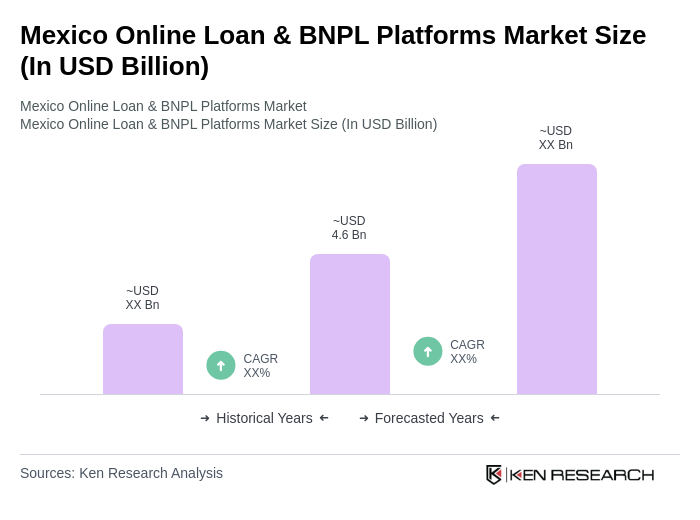

The Mexico Online Loan & BNPL Platforms Market is valued at approximately USD 4.6 billion, reflecting significant growth driven by the increasing adoption of digital financial services and the demand for flexible payment options among consumers.