Region:Asia

Author(s):Geetanshi

Product Code:KRAC0128

Pages:85

Published On:August 2025

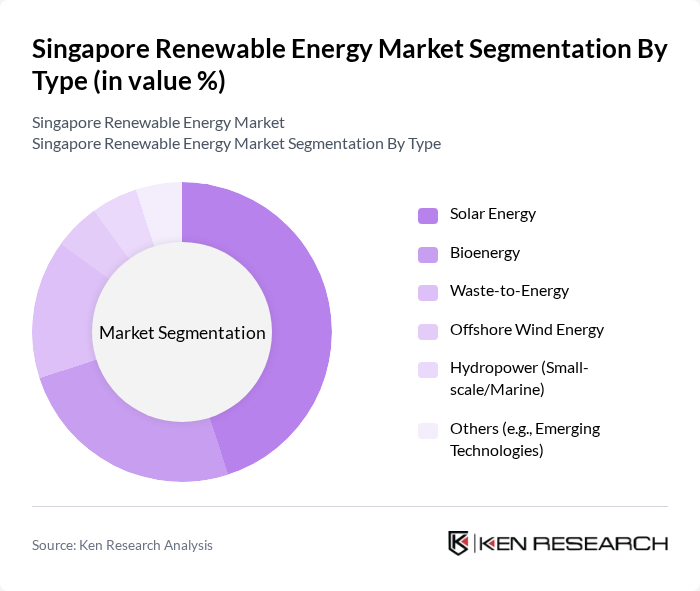

By Type:The market is segmented into various types of renewable energy sources, including solar energy, bioenergy, waste-to-energy, offshore wind energy, hydropower (small-scale/marine), and others such as emerging technologies. Among these,solar energyhas emerged as the dominant segment due to its scalability and decreasing costs, driven by technological advancements and government incentives.Bioenergyandwaste-to-energyalso play significant roles, particularly in urban waste management and energy recovery. Offshore wind and small-scale hydropower remain limited due to geographical constraints, while emerging technologies are being explored for future diversification .

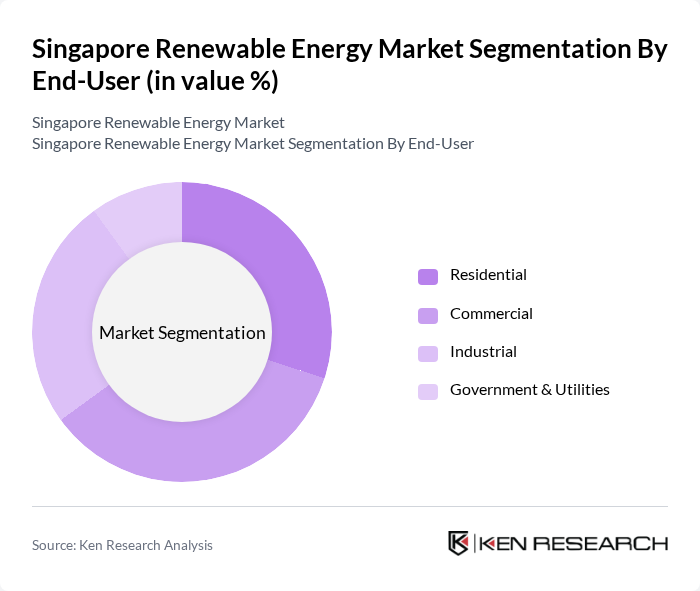

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. Theresidentialsegment is witnessing significant growth as homeowners increasingly adopt solar panels and energy-efficient technologies, supported by government incentives and net metering schemes. Thecommercialsector is also expanding, driven by corporate sustainability goals and energy cost savings.Industrialapplications are growing, particularly in energy-intensive sectors, while government and utilities are actively pushing for greater renewable energy adoption across all sectors through policy and infrastructure investment .

The Singapore Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sunseap Group, Sembcorp Industries Ltd., Keppel Infrastructure Holdings Pte Ltd., PacificLight Power Pte Ltd., YTL PowerSeraya Pte Ltd., ENGIE South East Asia, First Solar, Inc., REC Solar Holdings AS, Vena Energy, TotalEnergies Renewables, EDP Renewables, Siemens Gamesa Renewable Energy, Trina Solar Limited, Canadian Solar Inc., JinkoSolar Holding Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Singapore's renewable energy market appears promising, driven by increasing government support and technological advancements. In future, the focus will likely shift towards enhancing energy efficiency and integrating smart grid technologies. The rise of community solar initiatives will also play a crucial role in democratizing energy access. As the nation strives to meet its sustainability goals, collaboration with international firms will be essential in fostering innovation and expanding the renewable energy landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Energy Bioenergy Waste-to-Energy Offshore Wind Energy Hydropower (Small-scale/Marine) Others (e.g., Emerging Technologies) |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Grid-Connected Systems Off-Grid Systems Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Project Developers | 60 | Project Managers, Business Development Executives |

| Wind Energy Operators | 40 | Operations Managers, Technical Directors |

| Government Energy Policy Makers | 50 | Regulatory Affairs Specialists, Policy Analysts |

| Energy Consultants | 45 | Consultants, Market Analysts |

| Investors in Renewable Energy | 40 | Investment Managers, Financial Analysts |

The Singapore Renewable Energy Market is valued at approximately USD 1.2 billion, driven by government initiatives to increase renewable energy's share in the national energy mix and rising public awareness of sustainability and energy security.