Region:Asia

Author(s):Geetanshi

Product Code:KRAD0132

Pages:96

Published On:August 2025

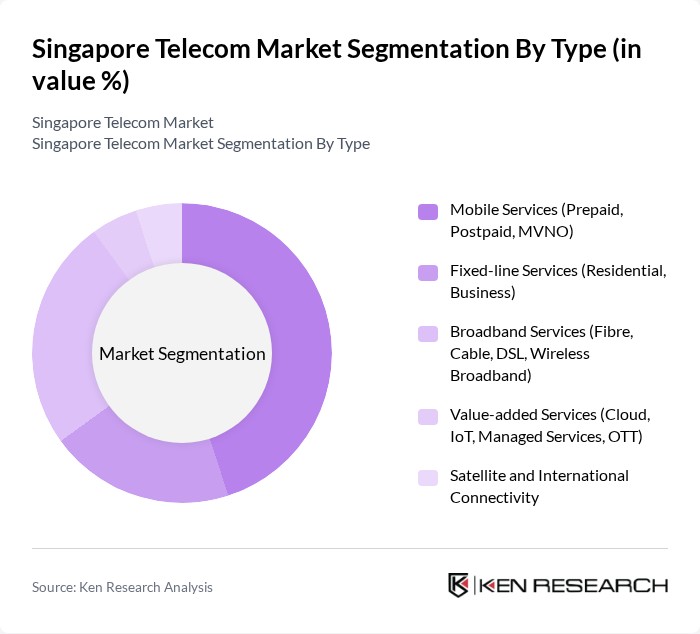

By Type:The Singapore telecom market is segmented by service types including mobile services, fixed-line services, broadband services, value-added services, and satellite and international connectivity. Mobile services, encompassing prepaid, postpaid, and MVNO offerings, are the dominant segment due to near-universal smartphone penetration and the growing demand for high-speed data. The flexibility and range of mobile plans cater to both individual and enterprise users, making mobile the preferred choice for most consumers .

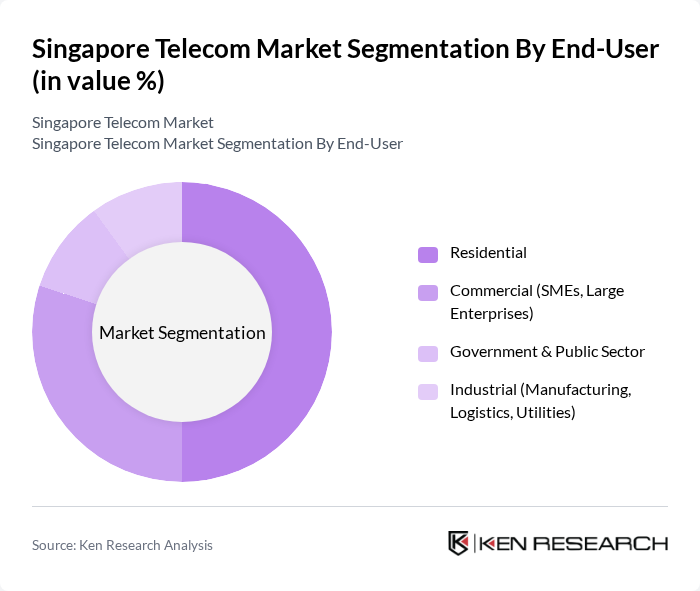

By End-User:The end-user segmentation covers residential, commercial, government & public sector, and industrial users. The residential segment is the largest, propelled by widespread adoption of broadband and mobile services, as well as increased demand for digital entertainment and remote work solutions. Commercial and enterprise users are also significant, reflecting Singapore’s status as a business and technology hub .

The Singapore Telecom Market features a dynamic mix of regional and international players. Leading participants such as Singtel (Singapore Telecommunications Limited), StarHub Ltd, M1 Limited, SIMBA Telecom Pte Ltd (formerly TPG Telecom), MyRepublic Ltd, ViewQwest Pte Ltd, Circles.Life (Liberty Wireless Pte Ltd), NetLink NBN Trust, WhizComms, RedONE Network Pte Ltd, Zero1 Pte Ltd, Vivifi (Parity Media Pte Ltd), Changi Mobile (Changi Travel Services Pte Ltd), Grid Mobile (Enabling Asia Tech Pte Ltd), and SingNet Pte Ltd are central to market innovation, service diversification, and the expansion of digital infrastructure .

The Singapore telecom market is poised for continued evolution, driven by advancements in technology and changing consumer preferences. The rollout of 5G networks is expected to enhance connectivity and enable new applications, particularly in IoT and smart city initiatives. Additionally, the increasing focus on digital services and cybersecurity will shape the competitive landscape, prompting telecom providers to innovate and adapt. As the market matures, strategic partnerships and investments in emerging technologies will be crucial for sustaining growth and addressing evolving consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services (Prepaid, Postpaid, MVNO) Fixed-line Services (Residential, Business) Broadband Services (Fibre, Cable, DSL, Wireless Broadband) Value-added Services (Cloud, IoT, Managed Services, OTT) Satellite and International Connectivity |

| By End-User | Residential Commercial (SMEs, Large Enterprises) Government & Public Sector Industrial (Manufacturing, Logistics, Utilities) |

| By Application | Voice Communication Data Communication Video Communication & Streaming IoT & M2M Applications |

| By Distribution Channel | Direct Sales (Corporate, Government Contracts) Retail Outlets (Flagship, Multi-brand) Online Platforms (Web, App-based) |

| By Pricing Model | Subscription-based Pay-as-you-go Bundled Packages (Quad-play, Triple-play) |

| By Service Tier | Premium Services (Enterprise, Dedicated) Standard Services Basic Services |

| By Policy Support | Subsidies for infrastructure development Tax incentives for telecom investments Regulatory support for new technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-65, diverse income brackets |

| Broadband Subscribers | 90 | Household decision-makers, IT professionals |

| Enterprise Telecom Solutions | 60 | IT Managers, Procurement Officers in SMEs |

| 5G Technology Adoption | 50 | Tech-savvy consumers, early adopters |

| Telecom Infrastructure Providers | 40 | Executives from telecom equipment manufacturers |

The Singapore Telecom Market is valued at approximately USD 2.8 billion, driven by the increasing demand for mobile and broadband services, rapid adoption of 5G technology, and significant investments in digital infrastructure.