Region:Africa

Author(s):Geetanshi

Product Code:KRAB5711

Pages:87

Published On:October 2025

By Type:The market is segmented into various types of financing options, including New Car Financing, Used Car Financing, Auto Leasing, Personal Loans for Vehicle Purchase, Fleet Financing, Balloon Payment Financing, Rent-to-Buy and Subscription Models, and Others. Among these, New Car Financing remains the leading sub-segment, driven by consumer preferences for the latest models, technological advancements, and the availability of attractive financing packages. However, Used Car Financing is experiencing accelerated growth due to affordability concerns and tailored risk models from lenders, reflecting a shift in consumer behavior toward value-driven purchases .

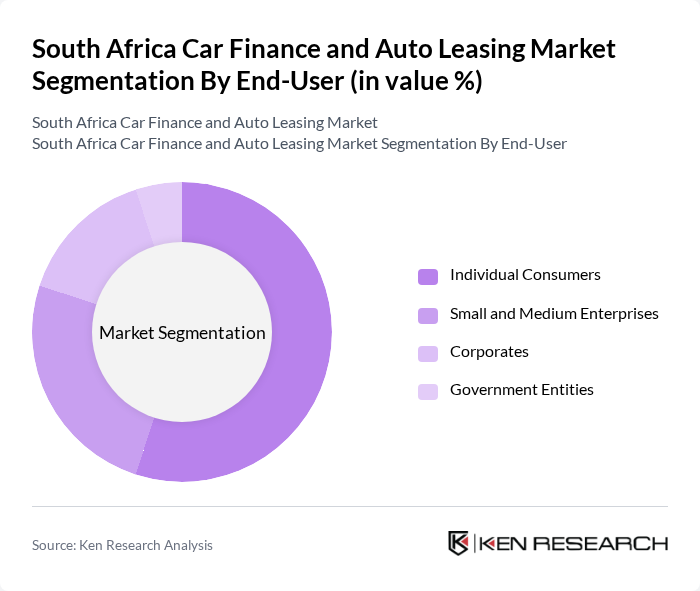

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Consumers represent the largest segment, driven by the growing trend of personal vehicle ownership, increasing digital access to financing, and tailored loan products. SMEs are showing notable growth as they seek flexible financing for operational vehicles, while Corporates and Government Entities contribute through fleet and specialized leasing arrangements .

The South Africa Car Finance and Auto Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABSA Group Limited, Standard Bank Group, Nedbank Limited, FirstRand Limited (including WesBank), Investec Bank Limited, WesBank (a division of FirstRand), MFC (a division of Nedbank), Toyota Financial Services South Africa, Volkswagen Financial Services South Africa, Mercedes-Benz Financial Services South Africa, BMW Financial Services South Africa, Ford Credit South Africa, Renault Financial Services South Africa, Hyundai Financial Services South Africa, Kia Finance South Africa, SA Taxi Finance, Motus Financial Services, LiquidCapital, Bidvest Bank Limited, Alphera Financial Services South Africa contribute to innovation, geographic expansion, and service delivery in this space .

The South African car finance and auto leasing market is poised for transformation, driven by technological advancements and changing consumer preferences. The increasing adoption of digital financing platforms is expected to streamline the application process, making it more accessible for consumers. Additionally, the shift towards electric vehicles will create new financing opportunities, as consumers seek sustainable options. As the market adapts to these trends, it is likely to witness enhanced competition and innovation, ultimately benefiting consumers and financial institutions alike.

| Segment | Sub-Segments |

|---|---|

| By Type | New Car Financing Used Car Financing Auto Leasing Personal Loans for Vehicle Purchase Fleet Financing Balloon Payment Financing Rent-to-Buy and Subscription Models Others |

| By End-User | Individual Consumers Small and Medium Enterprises Corporates Government Entities |

| By Sales Channel | Direct Sales Online Platforms Dealerships Financial Institutions Digital Lending Platforms |

| By Financing Type | Secured Loans Unsecured Loans Lease-to-Own Operating Lease |

| By Vehicle Type | Passenger Cars Commercial Vehicles SUVs Electric and Hybrid Vehicles |

| By Payment Structure | Fixed Payments Variable Payments Deferred Payments |

| By Duration | Short-Term Financing (up to 36 months) Medium-Term Financing (37–60 months) Long-Term Financing (over 60 months) |

| By Financial Institution Type | Banks Non-Banking Financial Companies (NBFCs) Captive Finance Companies Fintech Lenders |

| By Region | Gauteng Western Cape KwaZulu-Natal Rest of South Africa |

| By Consumer Age Group | Gen Z (born 1995–2010) Millennials (born 1980–1994) Gen X and Older |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Financing Options | 100 | Financial Advisors, Loan Officers |

| Auto Leasing Trends | 80 | Leasing Managers, Fleet Operators |

| Consumer Preferences in Car Finance | 120 | Car Buyers, Lease Customers |

| Impact of Economic Factors on Financing | 70 | Economists, Financial Analysts |

| Regulatory Influences on Auto Financing | 60 | Policy Makers, Regulatory Experts |

The South Africa Car Finance and Auto Leasing Market is valued at approximately USD 5.1 billion, supported by total loan disbursals of ZAR 97 billion, indicating strong demand for vehicle financing and leasing solutions.