Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB5825

Pages:80

Published On:October 2025

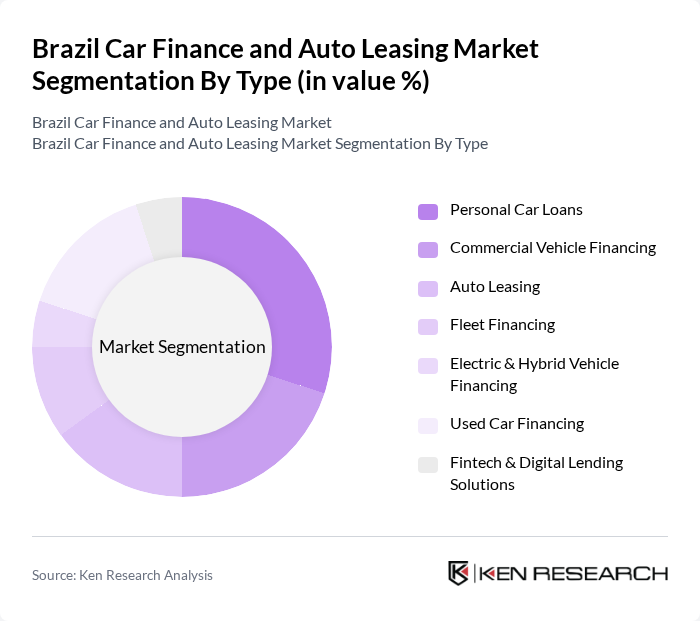

By Type:The market is segmented into various types, including Personal Car Loans, Commercial Vehicle Financing, Auto Leasing, Fleet Financing, Electric & Hybrid Vehicle Financing, Used Car Financing, and Fintech & Digital Lending Solutions. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of car financing options available in Brazil.

The Personal Car Loans segment is currently dominating the market due to the increasing trend of individual ownership among consumers. This segment benefits from competitive interest rates and flexible repayment options, making it an attractive choice for many. Additionally, the rise in disposable income and the growing preference for personal vehicles over public transport have significantly contributed to the growth of this segment. The convenience and accessibility of personal car loans have made them a preferred financing option for many Brazilians.

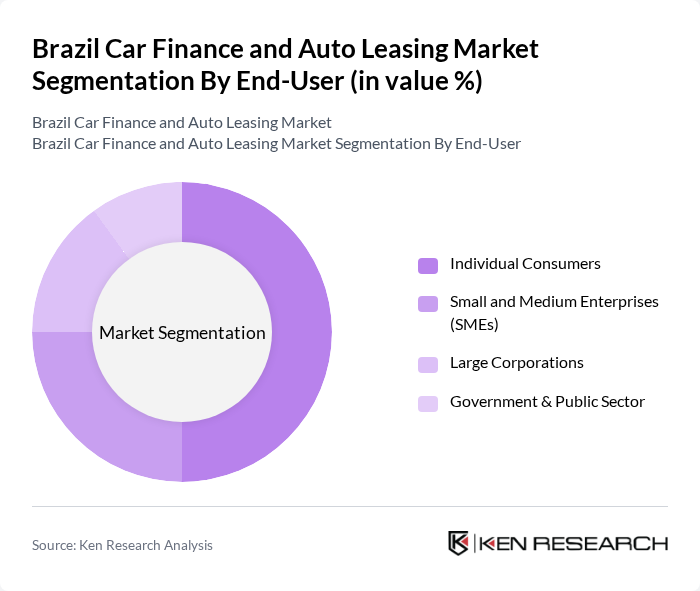

By End-User:The market is segmented by end-user into Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government & Public Sector. Each segment has distinct financing needs and preferences, influencing the overall dynamics of the car finance and leasing market in Brazil.

The Individual Consumers segment is the largest in the market, driven by the increasing number of people seeking personal vehicles for convenience and mobility. This segment is characterized by a diverse range of financing options tailored to meet the needs of various income groups. The growing trend of urbanization and the desire for personal transportation solutions have significantly boosted the demand for car financing among individual consumers, making it the leading segment in the market.

The Brazil Car Finance and Auto Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco do Brasil S.A., Banco Bradesco S.A., Itaú Unibanco Holding S.A., Banco Santander (Brasil) S.A., Volkswagen Financial Services Brasil Ltda., GM Financial do Brasil S.A., Banco PAN S.A., BV Financeira S.A. (Banco Votorantim), Porto Seguro Bank S.A., Caixa Econômica Federal, Banco Safra S.A., Banco Original S.A., Banco Inter S.A., Banco BMG S.A., Banco do Nordeste do Brasil S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Brazil car finance and auto leasing market appears promising, driven by technological advancements and evolving consumer preferences. The integration of digital financing platforms is expected to streamline the loan application process, enhancing customer experience. Additionally, the increasing focus on sustainability will likely boost demand for electric and hybrid vehicles, supported by government incentives. As these trends continue to develop, the market is poised for significant transformation, creating new opportunities for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Loans Commercial Vehicle Financing Auto Leasing Fleet Financing Electric & Hybrid Vehicle Financing Used Car Financing Fintech & Digital Lending Solutions |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government & Public Sector |

| By Sales Channel | Direct Sales (Bank Branches & Captive Finance) Online Platforms & Fintechs Dealership Financing Third-Party Financial Institutions |

| By Financing Type | Secured Loans Unsecured Loans Lease-to-Own Operating Lease |

| By Vehicle Type | Passenger Cars (Sedans, Hatchbacks, SUVs) Light Commercial Vehicles Trucks & Heavy Vehicles Vans & Utility Vehicles |

| By Duration of Financing | Short-term Financing (<24 months) Medium-term Financing (24–60 months) Long-term Financing (>60 months) |

| By Region | North Region Northeast Region Central-West Region Southeast Region South Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 120 | Car Buyers, Financial Advisors |

| Auto Leasing Trends | 80 | Leasing Managers, Fleet Operators |

| Banking Sector Insights | 60 | Bank Managers, Loan Officers |

| Dealership Financing Practices | 50 | Dealership Owners, Sales Managers |

| Consumer Preferences in Auto Financing | 100 | Recent Car Buyers, Financial Planners |

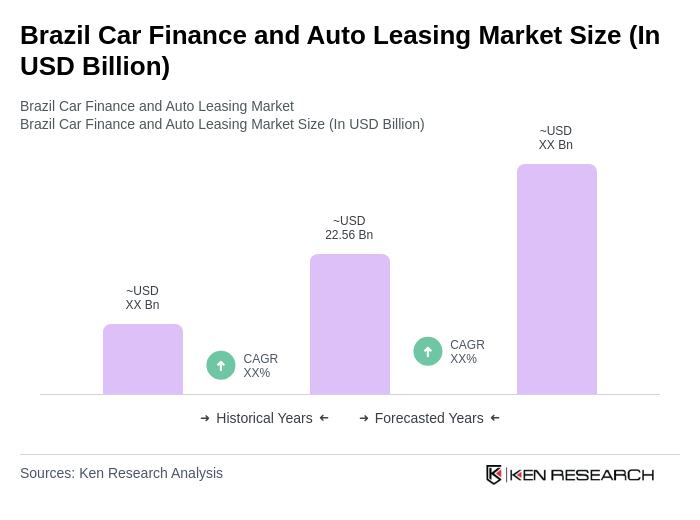

The Brazil Car Finance and Auto Leasing Market is valued at approximately USD 22.56 billion, driven by increasing consumer demand for personal vehicles and favorable financing options provided by financial institutions.