Region:Africa

Author(s):Rebecca

Product Code:KRAB2872

Pages:87

Published On:October 2025

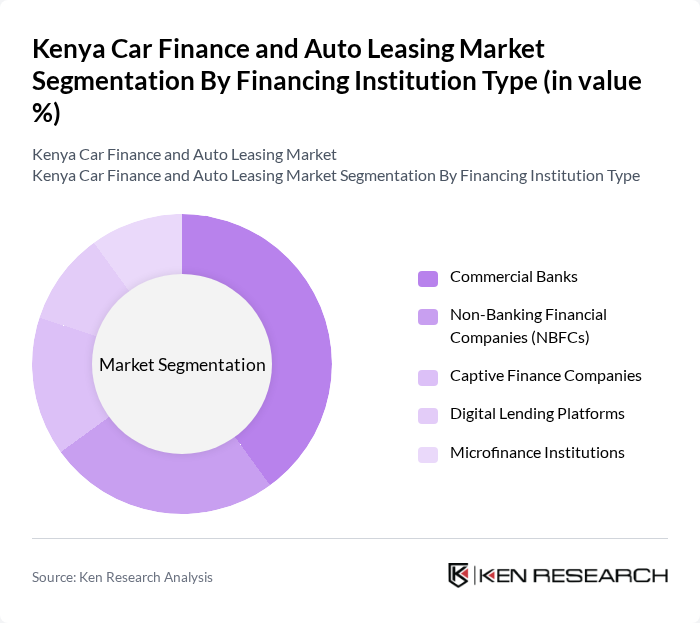

By Financing Institution Type:The financing institution type segment includes various entities that provide car financing solutions to consumers. The major subsegments are Commercial Banks, Non-Banking Financial Companies (NBFCs), Captive Finance Companies, Digital Lending Platforms, and Microfinance Institutions. Each of these plays a crucial role in catering to different consumer needs and preferences. Commercial Banks and NBFCs dominate the market due to their extensive branch networks, established trust, and ability to offer competitive interest rates. Digital Lending Platforms are rapidly expanding, leveraging mobile technology to reach underserved and first-time borrowers, while Captive Finance Companies and Microfinance Institutions focus on niche segments such as new vehicle sales and informal sector customers.

The Commercial Banks subsegment dominates the financing institution type segment due to their established presence, extensive branch networks, and competitive interest rates. They offer a wide range of financing products tailored to both individual and corporate clients, making them the preferred choice for many consumers. Additionally, the trust and reliability associated with banks contribute to their market leadership, as consumers often seek secure and well-regulated financing options. NBFCs and Digital Lending Platforms are gaining traction, especially among younger and informal sector borrowers, due to their flexible product offerings and digital accessibility.

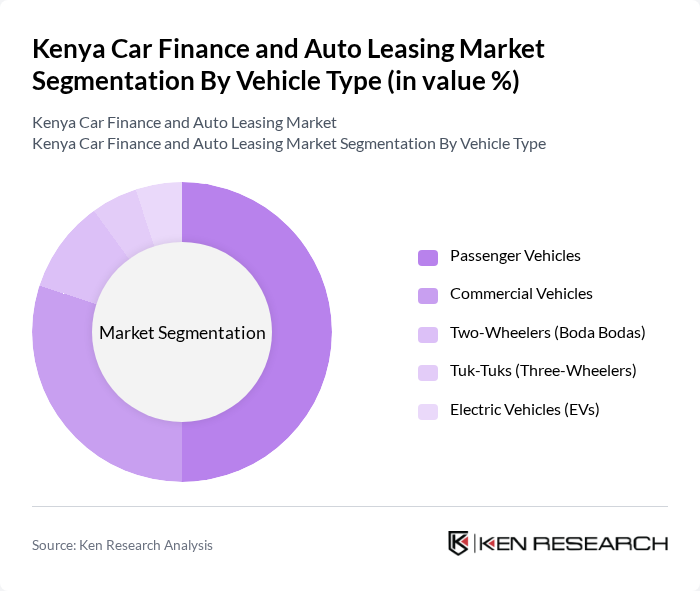

By Vehicle Type:The vehicle type segment encompasses various categories of vehicles financed through loans or leases. The subsegments include Passenger Vehicles, Commercial Vehicles, Two-Wheelers (Boda Bodas), Tuk-Tuks (Three-Wheelers), and Electric Vehicles (EVs). Each category serves distinct consumer needs and preferences, reflecting the diverse automotive landscape in Kenya. Used passenger vehicles account for the largest share, driven by affordability and a strong preference for pre-owned imports. Commercial vehicles are supported by the growth of logistics, e-commerce, and informal transport services, while two-wheelers and tuk-tuks are popular among gig economy workers and small business owners. Electric vehicles are a fast-growing niche, supported by recent regulatory incentives and rising consumer awareness of sustainability.

Passenger Vehicles are the leading subsegment in the vehicle type category, driven by the increasing demand for personal transportation among the growing middle class. The rise in disposable incomes and urbanization has led to a surge in car ownership, making passenger vehicles a popular choice for financing. The availability of various financing options tailored for personal vehicles has further solidified this subsegment's dominance in the market. Commercial vehicles and two-wheelers are also experiencing strong growth, fueled by the expansion of logistics, ride-hailing, and informal transport services. Electric vehicles are emerging as a key trend, supported by government incentives and evolving consumer preferences.

The Kenya Car Finance and Auto Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as KCB Bank Kenya, Equity Bank Kenya, NCBA Bank Kenya, Cooperative Bank of Kenya, Stanbic Bank Kenya, Watu Credit Limited, Mogo Kenya, Toyota Kenya Finance, CFAO Motors Kenya, Simba Corporation, Car & General (K) Ltd, Branch International Kenya, Isuzu East Africa, General Motors East Africa, Peach Cars Kenya contribute to innovation, geographic expansion, and service delivery in this space.

The Kenya car finance and auto leasing market is poised for significant transformation, driven by technological advancements and changing consumer preferences. The shift towards digital financing solutions is expected to streamline the application process, making it more accessible. Additionally, the increasing focus on sustainability will likely drive demand for electric vehicles, prompting financial institutions to develop tailored financing products. As urbanization continues, the market will adapt to meet the evolving needs of consumers seeking flexible and innovative mobility solutions.

| Segment | Sub-Segments |

|---|---|

| By Financing Institution Type | Commercial Banks Non-Banking Financial Companies (NBFCs) Captive Finance Companies Digital Lending Platforms Microfinance Institutions |

| By Vehicle Type | Passenger Vehicles Commercial Vehicles Two-Wheelers (Boda Bodas) Tuk-Tuks (Three-Wheelers) Electric Vehicles (EVs) |

| By Loan Tenure | Less than 12 Months 24 Months 36 Months 60 Months |

| By Vehicle Condition | New Vehicles Used Vehicles |

| By Borrower Type | Salaried Individuals Self-Employed/Informal Sector SMEs and Fleet Operators Gig Economy Workers Ride-Hailing Drivers |

| By Market Structure | Bank-Owned Multi-Finance Captive Companies |

| By Region | Nairobi Mombasa Kisumu Nakuru Eldoret Other Regions (Meru, Nyeri, Thika, Machakos) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Car Financing Options | 100 | Financial Advisors, Loan Officers |

| Auto Leasing Trends | 60 | Leasing Managers, Fleet Operators |

| Consumer Preferences in Vehicle Financing | 80 | Car Buyers, Financial Planners |

| Impact of Economic Factors on Car Financing | 50 | Economists, Market Analysts |

| Regulatory Environment and Its Effects | 40 | Policy Makers, Compliance Officers |

The Kenya Car Finance and Auto Leasing Market is valued at approximately USD 1.9 billion, driven by factors such as urbanization, rising disposable incomes, and a growing middle class seeking affordable vehicle financing options.