Region:Asia

Author(s):Geetanshi

Product Code:KRAB5754

Pages:98

Published On:October 2025

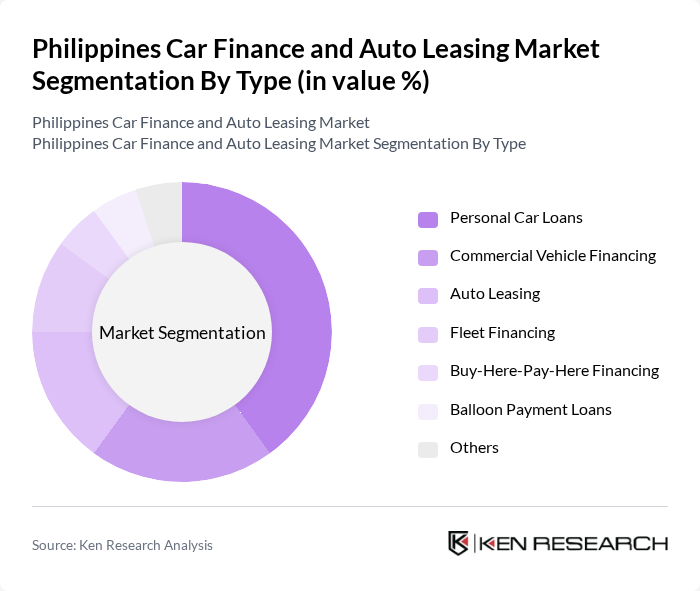

By Type:The market is segmented into various types of financing options, including Personal Car Loans, Commercial Vehicle Financing, Auto Leasing, Fleet Financing, Buy-Here-Pay-Here Financing, Balloon Payment Loans, and Others. Personal Car Loans dominate the market due to the increasing number of individual consumers seeking to finance their vehicle purchases. The convenience and flexibility offered by these loans make them a preferred choice among Filipinos, with passenger cars accounting for approximately 45% of the vehicle financing market.

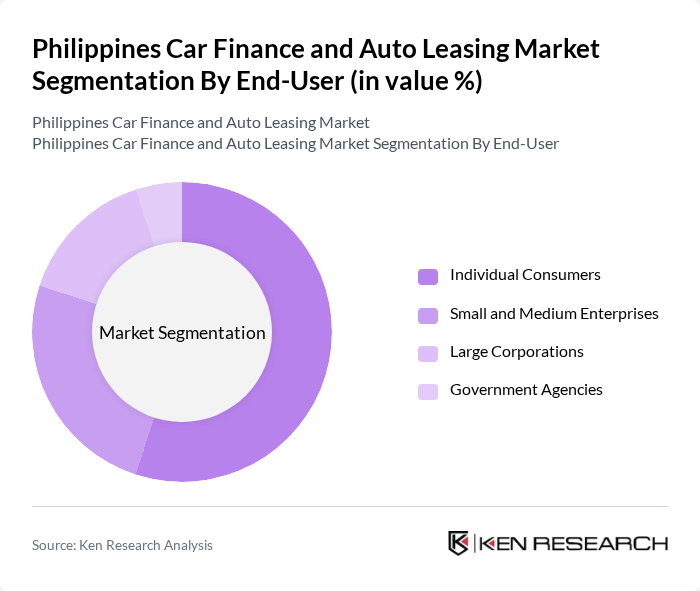

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Agencies. Individual Consumers represent the largest segment, driven by the growing trend of personal vehicle ownership among Filipinos and the expanding middle class seeking convenient financing options. SMEs are also increasingly seeking financing options to expand their operations, contributing to the overall growth of the market.

The Philippines Car Finance and Auto Leasing Market is characterized by a dynamic mix of regional and international players. Leading participants such as BDO Unibank, Metrobank, RCBC, EastWest Bank, Union Bank of the Philippines, Security Bank Corporation, Philippine National Bank, Land Bank of the Philippines, Toyota Financial Services Philippines, Honda Financial Services, Ford Credit Philippines, Nissan Finance Philippines, Mitsubishi Motors Philippines Corporation, Isuzu Philippines Corporation, Hyundai Asia Resources, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines car finance and auto leasing market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As digital financing solutions gain traction, more consumers will access streamlined loan processes. Additionally, the rise of electric vehicles will create new financing opportunities, encouraging sustainable practices. With urbanization continuing to reshape transportation needs, the market is expected to adapt, fostering innovation and enhancing customer experiences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Car Loans Commercial Vehicle Financing Auto Leasing Fleet Financing Buy-Here-Pay-Here Financing Balloon Payment Loans Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Government Agencies |

| By Sales Channel | Direct Sales Online Platforms Dealerships Financial Institutions |

| By Financing Type | Hire Purchase Personal Loans Lease-to-Own Secured Loans Unsecured Loans |

| By Vehicle Type | Passenger Cars Commercial Vehicles Two-Wheelers Electric Vehicles Luxury Vehicles |

| By Duration | Short-term Financing Long-term Financing |

| By Policy Support | Government Subsidies Tax Exemptions Incentives for Electric Vehicles Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Car Financing | 100 | Car Buyers, Financial Advisors |

| Auto Leasing Preferences | 60 | Leasing Managers, Corporate Fleet Managers |

| Dealership Financing Practices | 50 | Dealership Owners, Sales Managers |

| Impact of Digital Financing Solutions | 40 | Tech-savvy Consumers, Fintech Executives |

| Regulatory Impact on Financing | 40 | Policy Makers, Regulatory Affairs Specialists |

The Philippines Car Finance and Auto Leasing Market is valued at approximately USD 3.7 billion, reflecting a significant growth driven by increasing consumer demand for personal vehicles and favorable financing options from financial institutions.