Region:Africa

Author(s):Rebecca

Product Code:KRAA0332

Pages:89

Published On:August 2025

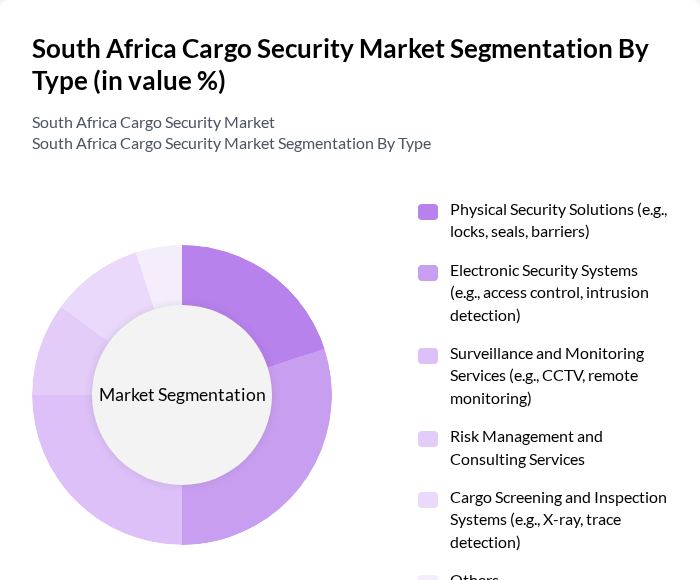

By Type:The cargo security market is segmented into physical security solutions, electronic security systems, surveillance and monitoring services, risk management and consulting services, cargo screening and inspection systems, and others. Electronic security systems, including access control and intrusion detection, are gaining traction due to the increasing adoption of digital technology and automation in logistics and transportation, which enhances the effectiveness and efficiency of cargo security measures .

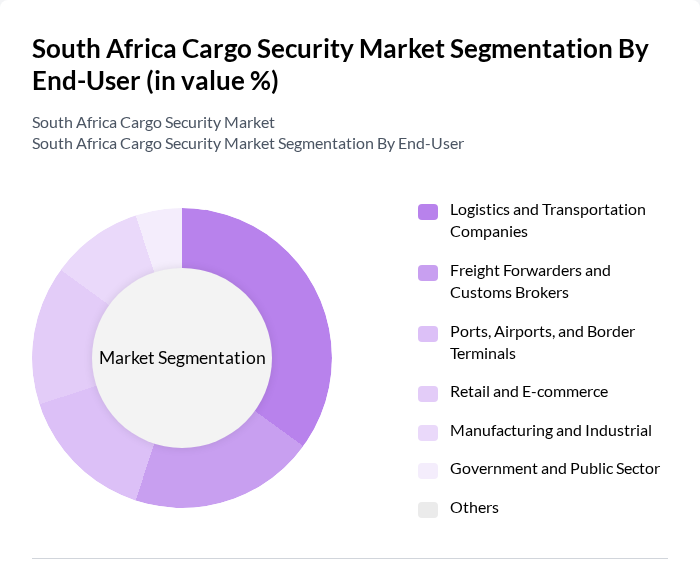

By End-User:End-user segmentation includes logistics and transportation companies, freight forwarders and customs brokers, ports, airports, and border terminals, retail and e-commerce, manufacturing and industrial sectors, government and public sector, and others. Logistics and transportation companies are the leading end-users, driven by the need for secure and efficient movement of goods across multiple channels and the increasing complexity of supply chains .

The South Africa Cargo Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Fidelity Services Group, Bidvest Protea Coin, G4S Secure Solutions South Africa, ADT South Africa (a brand of Fidelity ADT), Control Risks South Africa, Secure Logistics (South Africa), Securitas South Africa, Transnet Freight Rail, Cargo Security Solutions (Pty) Ltd, Barloworld Logistics, Ctrack South Africa, TAPA EMEA (Transported Asset Protection Association, South Africa Chapter), South African Security Association (SASA), MHS (Material Handling Solutions), CargoWise (WiseTech Global, South Africa) contribute to innovation, geographic expansion, and service delivery in this space.

The South Africa cargo security market is poised for significant evolution, driven by technological advancements and increasing awareness of security needs. As businesses recognize the importance of safeguarding their assets, the integration of IoT and data analytics will become more prevalent. Additionally, partnerships with law enforcement agencies are expected to strengthen, enhancing collaborative efforts to combat cargo theft. The focus on sustainability will also shape security practices, leading to innovative solutions that align with environmental goals while ensuring safety.

| Segment | Sub-Segments |

|---|---|

| By Type | Physical Security Solutions (e.g., locks, seals, barriers) Electronic Security Systems (e.g., access control, intrusion detection) Surveillance and Monitoring Services (e.g., CCTV, remote monitoring) Risk Management and Consulting Services Cargo Screening and Inspection Systems (e.g., X-ray, trace detection) Others |

| By End-User | Logistics and Transportation Companies Freight Forwarders and Customs Brokers Ports, Airports, and Border Terminals Retail and E-commerce Manufacturing and Industrial Government and Public Sector Others |

| By Cargo Type | Perishable Goods Electronics and High-Value Goods Pharmaceuticals and Medical Supplies Mining and Raw Materials Automotive and Machinery Others |

| By Security Technology | GPS Tracking and Telematics RFID and Barcode Systems Biometric Access Control Alarm and Intrusion Detection Systems X-ray and Non-Intrusive Inspection Video Surveillance (CCTV, AI-enabled cameras) Others |

| By Service Type | Security Consulting and Risk Assessment Installation and Integration Services Maintenance and Support Services Monitoring and Response Services Training and Compliance Services Others |

| By Distribution Channel | Direct Sales Distributors and Resellers Online Sales System Integrators Others |

| By Policy Support | Government Grants Tax Incentives Subsidies for Security Technology Regulatory Mandates and Compliance Requirements Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics and Freight Companies | 100 | Logistics Managers, Operations Directors |

| Security Technology Providers | 60 | Product Managers, Sales Executives |

| Government and Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Insurance Companies Specializing in Cargo | 50 | Underwriters, Risk Assessment Analysts |

| Transport and Logistics Associations | 40 | Association Leaders, Industry Analysts |

The South Africa Cargo Security Market is valued at approximately USD 150 million, driven by the increasing need for secure transportation of goods, rising cargo theft incidents, and the growth of e-commerce requiring enhanced security measures throughout the supply chain.