Region:Africa

Author(s):Shubham

Product Code:KRAB1187

Pages:91

Published On:October 2025

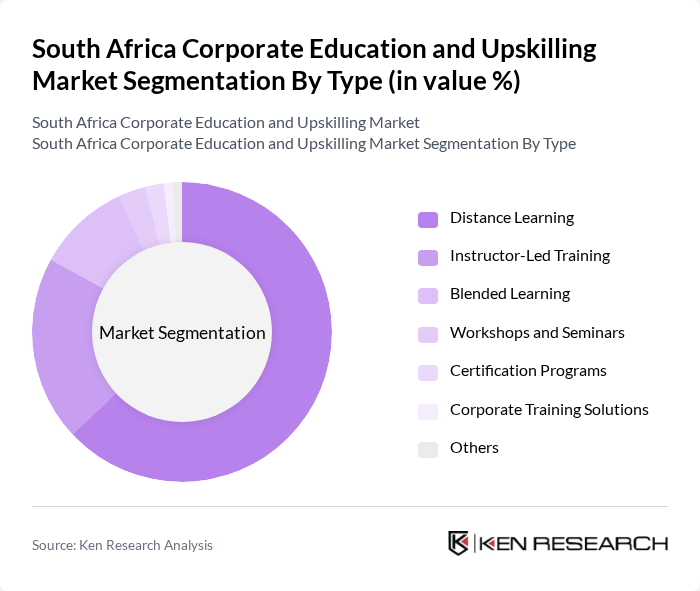

By Type:The market is segmented into various types of educational offerings, including Distance Learning, Instructor-Led Training, Blended Learning, Workshops and Seminars, Certification Programs, Corporate Training Solutions, and Others. Among these, Distance Learning has gained significant traction due to its flexibility, scalability, and accessibility, enabling employees to learn at their own pace and from remote locations. Instructor-Led Training remains popular for its interactive and personalized approach, while Certification Programs are increasingly sought after for their role in validating professional skills and supporting career advancement. The adoption of blended learning models, which combine online and in-person elements, is also rising as organizations seek to maximize training effectiveness .

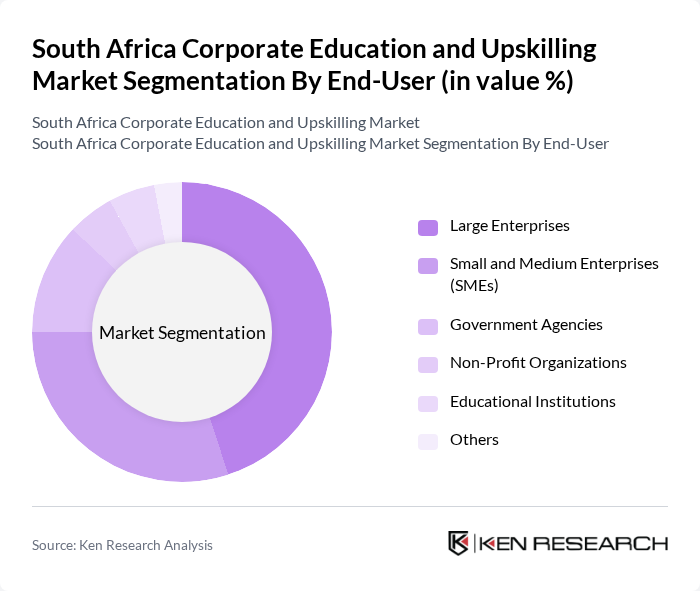

By End-User:The end-user segmentation includes Large Enterprises, Small and Medium Enterprises (SMEs), Government Agencies, Non-Profit Organizations, Educational Institutions, and Others. Large Enterprises dominate the market due to their substantial training budgets, advanced digital infrastructure, and the need for comprehensive employee development programs. SMEs are increasingly adopting digital learning platforms to upskill their workforce cost-effectively, while Government Agencies and Non-Profit Organizations focus on training initiatives to enhance public service delivery and capacity building. Educational Institutions are also expanding their corporate training offerings to serve the needs of working professionals .

The South Africa Corporate Education and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as University of Cape Town (UCT) Graduate School of Business, Wits Business School (University of the Witwatersrand), GetSmarter (a 2U, Inc. brand), Udemy Business, Coursera Inc., Skillshare, DVT Academy, The Knowledge Academy South Africa, Learnfast Training Solutions, Mindset Learn, The Training Room Online (TTRO), Inscape Education Group, USB-ED (University of Stellenbosch Business School Executive Development), CPUT (Cape Peninsula University of Technology) Corporate Training, The Institute of People Development (IPD) contribute to innovation, geographic expansion, and service delivery in this space.

The South African corporate education and upskilling market is poised for significant transformation, driven by technological advancements and evolving workforce needs. As organizations increasingly prioritize employee development, the integration of artificial intelligence and personalized learning experiences will become essential. Furthermore, the emphasis on soft skills and micro-credentialing will reshape training methodologies, ensuring that employees are equipped with both technical and interpersonal skills necessary for future job markets. This dynamic landscape presents opportunities for innovative training solutions and partnerships.

| Segment | Sub-Segments |

|---|---|

| By Type | Distance Learning Instructor-Led Training Blended Learning Workshops and Seminars Certification Programs Corporate Training Solutions Others |

| By End-User | Large Enterprises Small and Medium Enterprises (SMEs) Government Agencies Non-Profit Organizations Educational Institutions Others |

| By Industry | Information Technology Finance and Banking Healthcare Manufacturing Retail Telecommunications Others |

| By Delivery Mode | Virtual Learning Face-to-Face Learning Hybrid Learning Mobile Learning Others |

| By Duration | Short Courses Long-Term Programs Workshops Bootcamps Others |

| By Certification Type | Professional Certifications Academic Certifications Industry-Specific Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Corporate Packages Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 120 | HR Managers, Training Coordinators |

| Upskilling Initiatives in Tech Sector | 90 | IT Managers, Learning and Development Specialists |

| Leadership Development Programs | 60 | Executive Coaches, Senior Executives |

| Soft Skills Training | 50 | Training Facilitators, Corporate Trainers |

| Sector-Specific Upskilling | 55 | Industry Experts, Sector Analysts |

The South Africa Corporate Education and Upskilling Market is valued at approximately USD 980 million, reflecting a significant investment in employee training and development driven by the demand for skilled labor and the adoption of digital learning platforms.