Region:Africa

Author(s):Geetanshi

Product Code:KRAA5024

Pages:87

Published On:September 2025

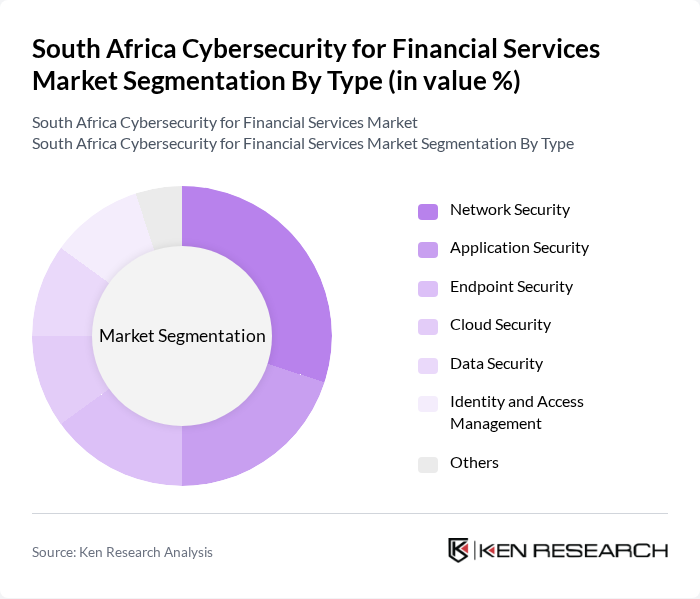

By Type:The market is segmented into various types of cybersecurity solutions, including Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, and Others. Among these, Network Security is the leading sub-segment, driven by the increasing need to protect networks from unauthorized access and cyber threats. Financial institutions are prioritizing investments in network security to safeguard their infrastructure and customer data.

By End-User:The end-user segmentation includes Banks, Insurance Companies, Investment Firms, Payment Processors, and Others. The banking sector is the dominant end-user, as banks are heavily targeted by cybercriminals due to the sensitive nature of their operations. As a result, they are investing significantly in cybersecurity measures to protect their assets and customer information.

The South Africa Cybersecurity for Financial Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Palo Alto Networks, Check Point Software Technologies, Fortinet, IBM Security, Cisco Systems, McAfee, Trend Micro, Symantec, Kaspersky Lab, Sophos, CrowdStrike, FireEye, RSA Security, CyberArk, Proofpoint contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African cybersecurity market for financial services is poised for significant evolution, driven by technological advancements and regulatory pressures. As institutions increasingly adopt AI and machine learning for threat detection, the demand for innovative cybersecurity solutions will rise. Additionally, the integration of cybersecurity into overall business strategies will become essential, ensuring that financial services can effectively navigate the complex landscape of cyber threats while maintaining compliance with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Others |

| By End-User | Banks Insurance Companies Investment Firms Payment Processors Others |

| By Compliance Requirement | PCI DSS GDPR ISO 27001 Others |

| By Service Model | Managed Security Services Professional Services Consulting Services Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Industry Vertical | Banking Insurance Retail Healthcare Others |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector Cybersecurity Practices | 150 | IT Security Managers, Risk Assessment Officers |

| Insurance Companies' Cyber Threat Responses | 100 | Compliance Officers, Cybersecurity Analysts |

| Fintech Startups' Security Solutions | 80 | Founders, CTOs, Product Managers |

| Investment Firms' Data Protection Strategies | 70 | Data Protection Officers, IT Directors |

| Regulatory Compliance in Financial Services | 60 | Legal Advisors, Compliance Managers |

The South Africa Cybersecurity for Financial Services Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing cyber threats, regulatory compliance, and the adoption of digital banking services.