Region:Africa

Author(s):Rebecca

Product Code:KRAA5342

Pages:86

Published On:September 2025

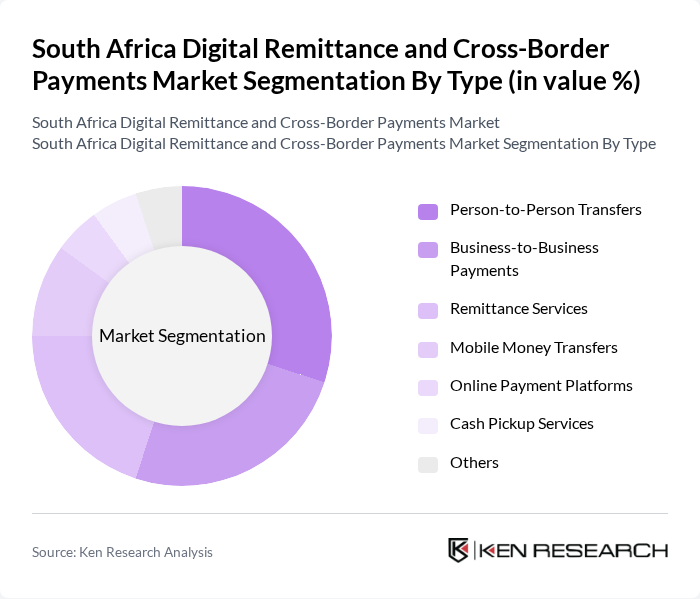

By Type:The market is segmented into various types, including Person-to-Person Transfers, Business-to-Business Payments, Remittance Services, Mobile Money Transfers, Online Payment Platforms, Cash Pickup Services, and Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth.

The Person-to-Person Transfers segment is currently dominating the market due to the high volume of remittances sent by migrant workers to their families. This segment benefits from the ease of use and accessibility of digital platforms, which allow users to send money quickly and securely. The increasing smartphone penetration and internet access further enhance the appeal of this segment, making it a preferred choice for many consumers.

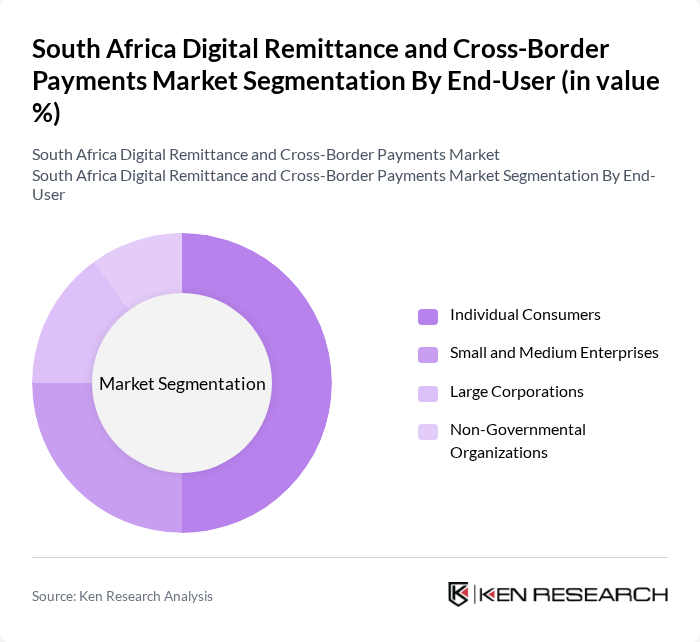

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises, Large Corporations, and Non-Governmental Organizations. Each segment has unique requirements and transaction patterns that influence their participation in the digital remittance and cross-border payments market.

The Individual Consumers segment leads the market, driven by the high volume of remittances sent by individuals, particularly migrant workers. This segment's growth is supported by the increasing adoption of digital payment solutions, which offer convenience and lower transaction costs compared to traditional methods. The need for quick and reliable remittance services further solidifies the dominance of this segment.

The South Africa Digital Remittance and Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayFast, SendMoney, WorldRemit, Remitly, TransferWise, Xoom, MoneyGram, Western Union, FNB (First National Bank), Standard Bank, Absa Bank, Capitec Bank, MTN Mobile Money, Vodacom M-Pesa, PayPal contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital remittance and cross-border payments market is poised for significant transformation driven by technological advancements and evolving consumer preferences. As mobile wallet services gain traction, the integration of AI for fraud detection will enhance security and user trust. Additionally, the adoption of blockchain technology is expected to streamline transactions, reducing costs and improving efficiency. These trends indicate a robust future for digital remittance services, catering to the growing demand for faster, safer, and more affordable payment solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business-to-Business Payments Remittance Services Mobile Money Transfers Online Payment Platforms Cash Pickup Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Non-Governmental Organizations |

| By Payment Method | Bank Transfers Credit/Debit Cards E-Wallets Cash Payments |

| By Transaction Size | Low-Value Transactions Medium-Value Transactions High-Value Transactions |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions |

| By Geographic Reach | Domestic Transfers Regional Transfers International Transfers |

| By Customer Segment | Migrant Workers Students Abroad Expatriates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Users | 150 | Individuals using digital remittance services |

| Small Business Owners | 100 | Owners of businesses engaged in cross-border transactions |

| Fintech Executives | 80 | CEOs, CTOs, and Product Managers from fintech companies |

| Regulatory Authorities | 50 | Officials from the Financial Sector Conduct Authority |

| Financial Analysts | 70 | Analysts specializing in remittance and payment systems |

The South Africa Digital Remittance and Cross-Border Payments Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by increasing migrant remittances, digital payment platforms, and mobile money solutions.