Region:North America

Author(s):Dev

Product Code:KRAB3096

Pages:94

Published On:October 2025

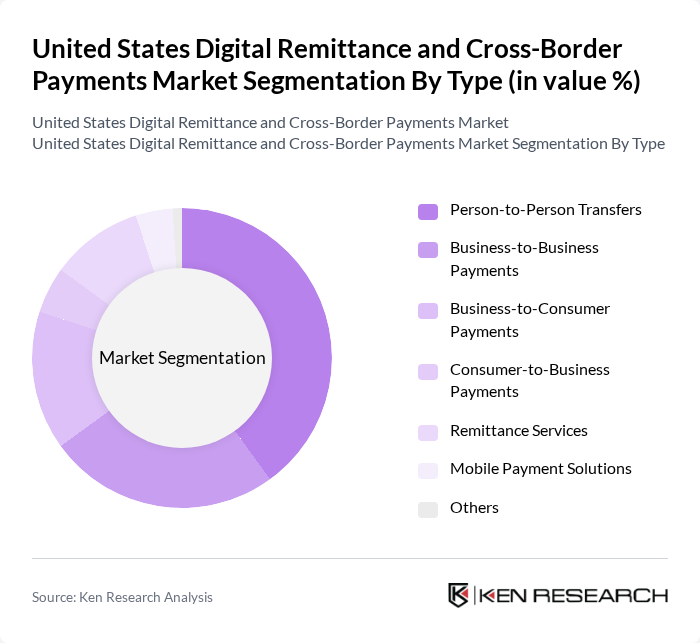

By Type:The market is segmented into various types, including Person-to-Person Transfers, Business-to-Business Payments, Business-to-Consumer Payments, Consumer-to-Business Payments, Remittance Services, Mobile Payment Solutions, and Others. Among these, Person-to-Person Transfers dominate the market due to the increasing need for individuals to send money to family and friends across borders quickly and efficiently. The convenience of mobile apps and online platforms has further fueled this segment's growth.

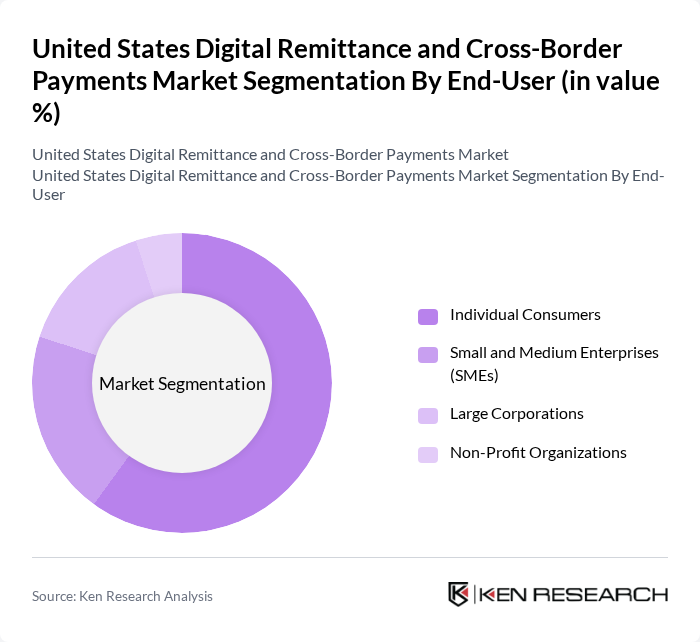

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Profit Organizations. Individual Consumers represent the largest segment, driven by the growing trend of personal remittances and the increasing reliance on digital platforms for sending money. The ease of use and accessibility of these services make them particularly appealing to everyday users.

The United States Digital Remittance and Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Western Union Company, MoneyGram International, Inc., TransferWise Ltd., Remitly, Inc., Xoom Corporation, Revolut Ltd., Venmo, LLC, Zelle, WorldRemit Ltd., OFX Group Ltd., Skrill Limited, Ria Money Transfer, Payoneer Inc., Cash App contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital remittance and cross-border payments market in the United States appears promising, driven by technological advancements and evolving consumer preferences. As mobile wallet adoption continues to rise, with over 75% of smartphone users expected to utilize these services in the future, the market will likely see increased transaction volumes. Additionally, the integration of artificial intelligence in payment processing is anticipated to enhance efficiency and security, further attracting users to digital platforms.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business-to-Business Payments Business-to-Consumer Payments Consumer-to-Business Payments Remittance Services Mobile Payment Solutions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Profit Organizations |

| By Payment Method | Bank Transfers Credit/Debit Cards E-Wallets Cryptocurrency |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Geographic Focus | Domestic Transfers International Transfers |

| By Customer Segment | Retail Customers Corporate Customers Government Entities |

| By Service Type | Standard Services Premium Services Subscription Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Services | 150 | Individual Users, Financial Advisors |

| SME Cross-Border Transactions | 100 | Business Owners, Finance Managers |

| Digital Payment Platforms | 80 | Product Managers, Marketing Directors |

| Regulatory Compliance Insights | 60 | Compliance Officers, Legal Advisors |

| Consumer Behavior in Remittance | 90 | End-Users, Market Researchers |

The United States Digital Remittance and Cross-Border Payments Market is valued at approximately USD 150 billion, reflecting significant growth driven by increasing immigration and the adoption of digital payment solutions that offer convenience and lower transaction costs.