Region:Europe

Author(s):Geetanshi

Product Code:KRAB5750

Pages:89

Published On:October 2025

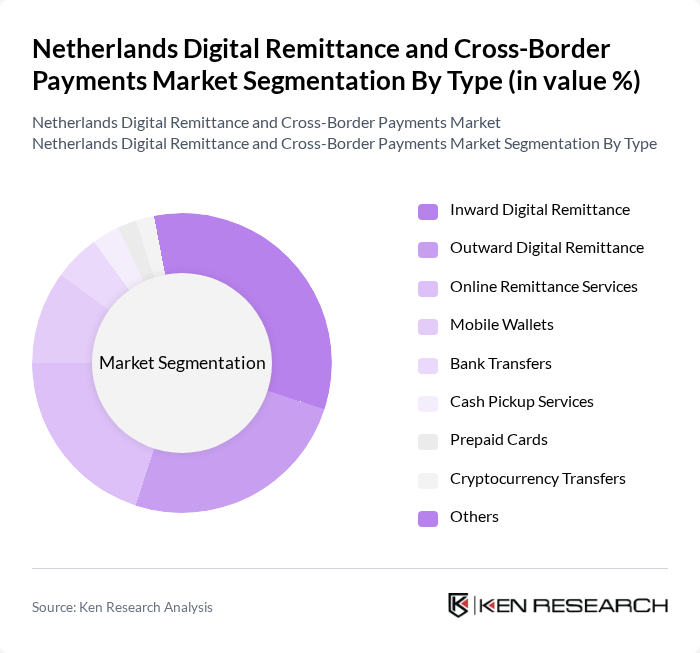

By Type:The market is segmented into various types of digital remittance and cross-border payment services, including Inward Digital Remittance, Outward Digital Remittance, Online Remittance Services, Mobile Wallets, Bank Transfers, Cash Pickup Services, Prepaid Cards, Cryptocurrency Transfers, and Others. Each of these subsegments addresses different consumer needs, with a notable shift toward mobile wallets and online services as digital adoption accelerates. Cryptocurrency transfers are emerging as a niche but rapidly growing segment, driven by demand for faster, lower-cost cross-border transactions.

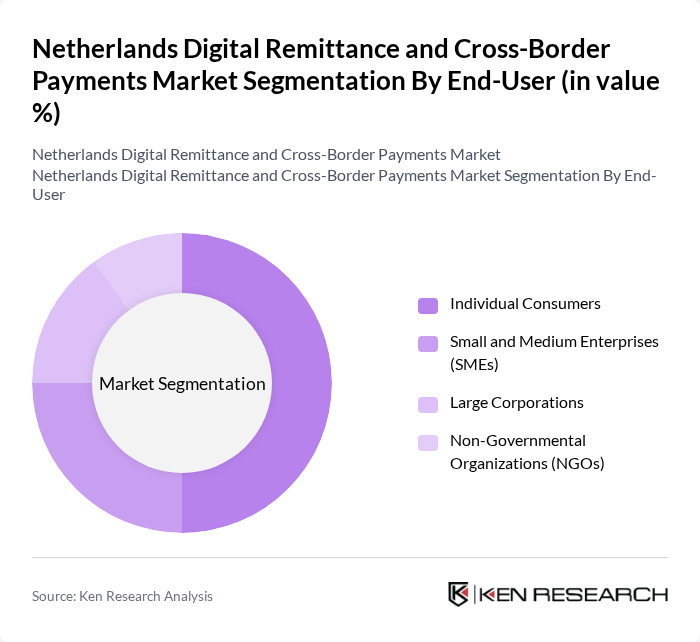

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual consumers represent the largest segment, reflecting the strong demand for personal remittance and family support transfers. SMEs and large corporations increasingly leverage digital cross-border payment platforms for operational efficiency and international trade, while NGOs use these services for international aid disbursement and project funding.

The Netherlands Digital Remittance and Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wise Ltd. (formerly TransferWise), PayPal Holdings, Inc. (including Xoom), Western Union Company, MoneyGram International, Inc., Revolut Ltd., Remitly, Inc., WorldRemit Ltd., Skrill Limited (Paysafe Group), OFX Group Ltd., N26 GmbH, Azimo Ltd. (now part of Papaya Global), Payoneer Inc., ING Group N.V., bunq B.V., and Rabobank Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands digital remittance and cross-border payments market appears promising, driven by ongoing technological innovations and increasing consumer demand for efficient payment solutions. As mobile payment adoption continues to rise, service providers are likely to enhance their offerings, focusing on user experience and security. Additionally, partnerships with financial institutions will facilitate broader access to remittance services, particularly for underserved populations, fostering financial inclusion and expanding market reach in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Inward Digital Remittance Outward Digital Remittance Online Remittance Services Mobile Wallets Bank Transfers Cash Pickup Services Prepaid Cards Cryptocurrency Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Credit/Debit Cards Bank Transfers E-wallets Cash |

| By Transaction Size | Small Transactions (<€500) Medium Transactions (€500–€5,000) Large Transactions (>€5,000) |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions |

| By Geographic Reach | Domestic Transfers International Transfers |

| By Customer Segment | Expatriates Students Abroad Migrant Workers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Services | 120 | End-users, Financial Service Users |

| Business-to-Business Cross-Border Payments | 100 | Finance Managers, CFOs of SMEs |

| Digital Wallet Adoption | 80 | Tech-savvy Consumers, E-commerce Users |

| Regulatory Compliance Insights | 60 | Compliance Officers, Legal Advisors |

| Payment Processing Technology | 70 | IT Managers, Payment Solution Architects |

The Netherlands Digital Remittance and Cross-Border Payments Market is valued at approximately USD 1.1 billion, reflecting its significant role within the broader European digital remittance market, which is estimated at USD 6.5 billion.