Region:Africa

Author(s):Geetanshi

Product Code:KRAB3355

Pages:87

Published On:October 2025

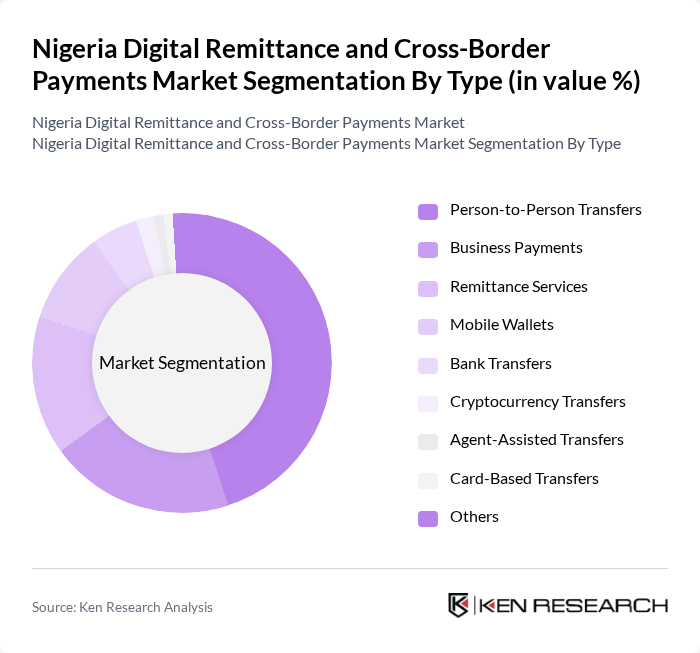

By Type:The market is segmented into Person-to-Person Transfers, Business Payments, Remittance Services, Mobile Wallets, Bank Transfers, Cryptocurrency Transfers, Agent-Assisted Transfers, Card-Based Transfers, and Others. Person-to-Person Transfers dominate the market, driven by the high volume of remittances sent by individuals to family and friends. The convenience, speed, and increasing adoption of mobile and digital channels make these transfers the preferred choice for most users. Mobile-based remittance transactions now account for a significant share of total transfers, reflecting the shift toward digital-first solutions .

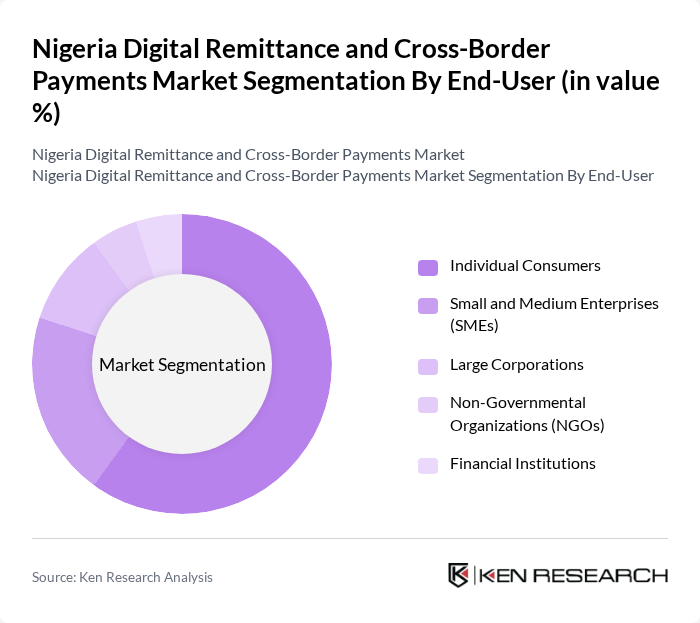

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Non-Governmental Organizations (NGOs), and Financial Institutions. Individual Consumers represent the largest segment, reflecting the centrality of personal remittances and the accelerating adoption of digital payments among the Nigerian population. The reliance on remittances for daily expenses, education, and investments continues to drive this segment’s dominance .

The Nigeria Digital Remittance and Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Flutterwave, Paystack, Interswitch, WorldRemit, Western Union, MoneyGram, Sendwave, Remitly, Chipper Cash, Kuda Bank, GTBank, Zenith Bank, Access Bank, First Bank of Nigeria, Ecobank, Wise (formerly TransferWise), Opay, Paga, UBA (United Bank for Africa), and Fidelity Bank contribute to innovation, geographic expansion, and service delivery in this space .

The future of Nigeria's digital remittance and cross-border payments market appears promising, driven by technological advancements and increasing consumer adoption. As mobile penetration continues to rise, more users will likely engage with digital payment platforms. Additionally, the integration of blockchain technology is expected to enhance transaction efficiency and security. With ongoing government support for financial inclusion, the market is poised for significant growth, addressing existing challenges while capitalizing on emerging opportunities in underserved regions.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business Payments Remittance Services Mobile Wallets Bank Transfers Cryptocurrency Transfers Agent-Assisted Transfers Card-Based Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) Financial Institutions |

| By Payment Method | Bank Transfers Mobile Payments Cash Payments Online Payment Platforms Cryptocurrency Payments |

| By Transaction Size | Micro Transactions (Below $100) Small Transactions ($100–$500) Medium Transactions ($500–$5,000) Large Transactions (Above $5,000) |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions Occasional Transactions |

| By Geographic Reach | Domestic Transfers International Transfers Intra-African Transfers |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Remittance Users | 100 | Expatriates, Migrant Workers |

| Fintech Service Providers | 50 | Product Managers, Business Development Executives |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Traditional Banking Sector | 60 | Branch Managers, Retail Banking Executives |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Financial Educators |

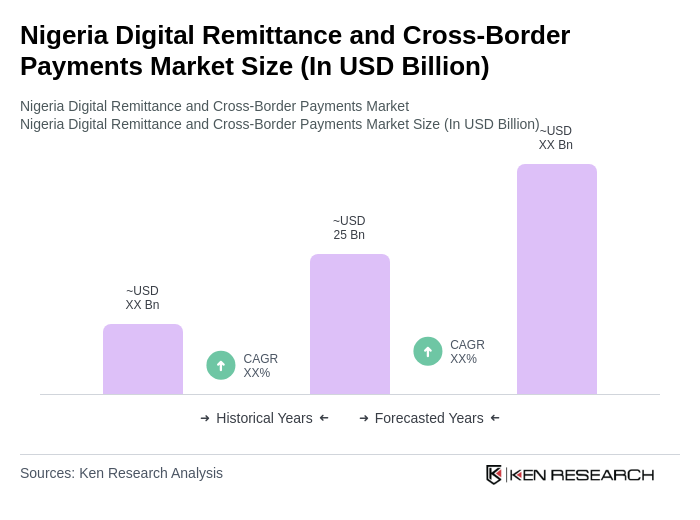

The Nigeria Digital Remittance and Cross-Border Payments Market is valued at approximately USD 25 billion, driven by the increasing number of Nigerians living abroad and the rapid growth of digital payment platforms and mobile wallets.