Region:Africa

Author(s):Rebecca

Product Code:KRAA4595

Pages:83

Published On:September 2025

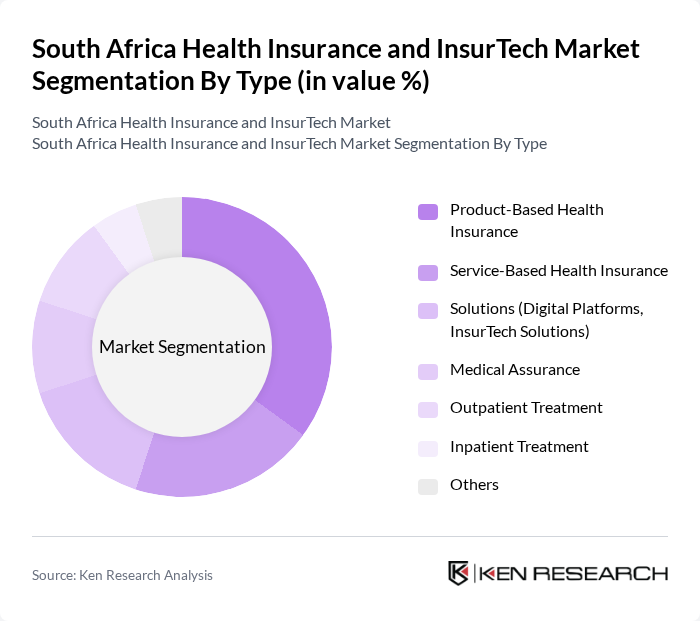

By Type:The market is segmented into Product-Based Health Insurance, Service-Based Health Insurance, Solutions (Digital Platforms, InsurTech Solutions), Medical Assurance, Outpatient Treatment, Inpatient Treatment, and Others. Product-Based Health Insurance remains the leading segment, attributed to its comprehensive coverage and consumer preference for tailored health plans. The trend toward personalized and modular health insurance products continues to drive this segment’s growth, supported by digital distribution channels and increased consumer engagement with online platforms .

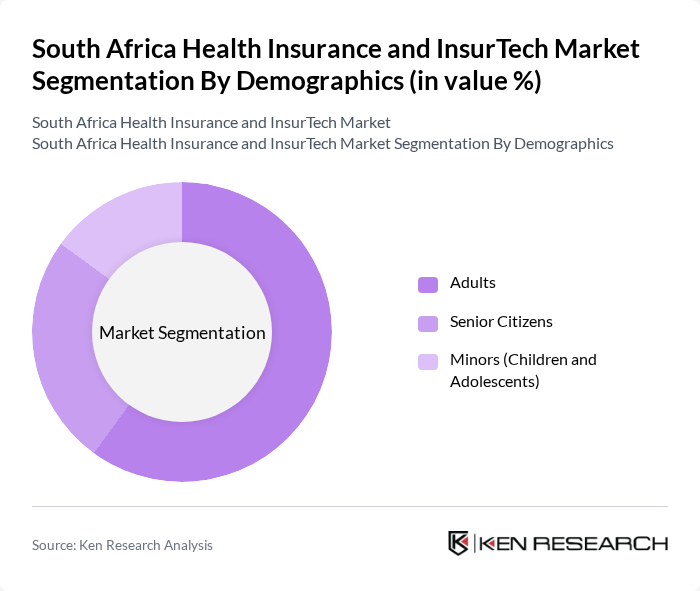

By Demographics:The demographic segmentation includes Adults, Senior Citizens, and Minors (Children and Adolescents). The Adults segment is the largest contributor to the market, driven by a growing base of working professionals seeking health insurance for themselves and their families. Heightened awareness of health risks, financial security needs, and employer-sponsored group health plans are key factors influencing this trend .

The South Africa Health Insurance and InsurTech Market is characterized by a dynamic mix of regional and international players. Leading participants such as Discovery Health, Momentum Health, Medscheme, Netcare, Sanlam, Old Mutual, Hollard, Liberty Health, Fedhealth, Profmed, Government Employees Medical Scheme (GEMS), Health Squared, BrightRock, Simply, Telesure Investment Holdings, Now Health International, International Medical Group, Inc., MAPFRE South Africa, Zurich Insurance Group AG, and Allianz SE contribute to innovation, geographic expansion, and service delivery in this space .

The South African health insurance and InsurTech market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As digital health solutions gain traction, insurers are expected to leverage data analytics and artificial intelligence to enhance service delivery and personalize health plans. Additionally, the push for universal health coverage will likely create new regulatory frameworks, fostering innovation and collaboration between traditional insurers and tech startups, ultimately improving healthcare access and affordability for consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Product-Based Health Insurance Service-Based Health Insurance Solutions (Digital Platforms, InsurTech Solutions) Medical Assurance Outpatient Treatment Inpatient Treatment Others |

| By Demographics | Adults Senior Citizens Minors (Children and Adolescents) |

| By Health Insurance Plan | Health Maintenance Organization (HMO) Preferred Provider Organization (PPO) Indemnity Health Insurance Health Savings Account (HSA) Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs) Exclusive Provider Organization (EPO) Point of Service (POS) Others |

| By Service Provider | Private Health Insurance Providers Public Health Insurance Providers |

| By Level of Coverage | Platinum Gold Silver Bronze |

| By Coverage Type | Term Coverage Lifetime Coverage |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents Hospitals Clinics E-Commerce Financial Institutions |

| By End User | Individuals Corporates Government Entities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Providers | 60 | CEOs, Product Managers, Compliance Officers |

| InsurTech Startups | 40 | Founders, CTOs, Business Development Managers |

| Healthcare Professionals | 80 | Doctors, Nurses, Hospital Administrators |

| Consumers of Health Insurance | 150 | Policyholders, Potential Buyers, Healthcare Advocates |

| Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Managers |

The South Africa Health Insurance and InsurTech Market is valued at approximately USD 30 billion, reflecting significant growth driven by rising healthcare costs, a growing middle class, and increased consumer awareness regarding health insurance benefits.