South Africa Online Classifieds & Portals Market Overview

- The South Africa Online Classifieds & Portals Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet and mobile devices, along with a shift in consumer behavior towards online shopping and services. The rise of e-commerce and digital platforms has significantly contributed to the expansion of this market, as more users seek convenient ways to buy and sell goods and services online.

- Key cities dominating the South African online classifieds market include Johannesburg, Cape Town, and Durban. These urban centers are characterized by high population density, robust internet connectivity, and a diverse economic landscape, which fosters a vibrant online marketplace. The concentration of businesses and consumers in these areas enhances the visibility and accessibility of online classifieds, making them the preferred choice for both buyers and sellers.

- In 2023, the South African government implemented regulations aimed at enhancing consumer protection in online transactions. This includes the introduction of the Consumer Protection Act, which mandates that online platforms must ensure transparency in pricing, provide clear information about products and services, and protect consumer rights. Such regulations are designed to build trust in online marketplaces and promote fair trading practices.

South Africa Online Classifieds & Portals Market Segmentation

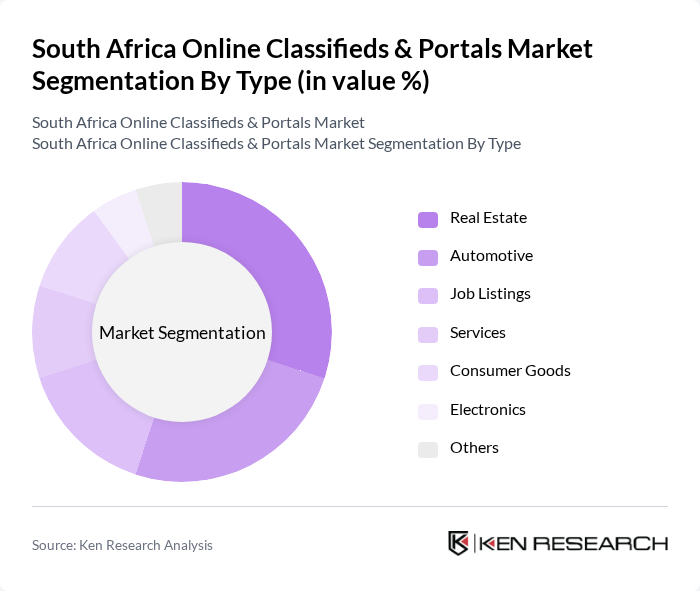

By Type:The market is segmented into various types, including Real Estate, Automotive, Job Listings, Services, Consumer Goods, Electronics, and Others. Each of these segments caters to different consumer needs and preferences, with varying levels of demand and competition. The Real Estate segment is particularly prominent due to the ongoing housing demand, while the Automotive segment benefits from a growing interest in second-hand vehicles.

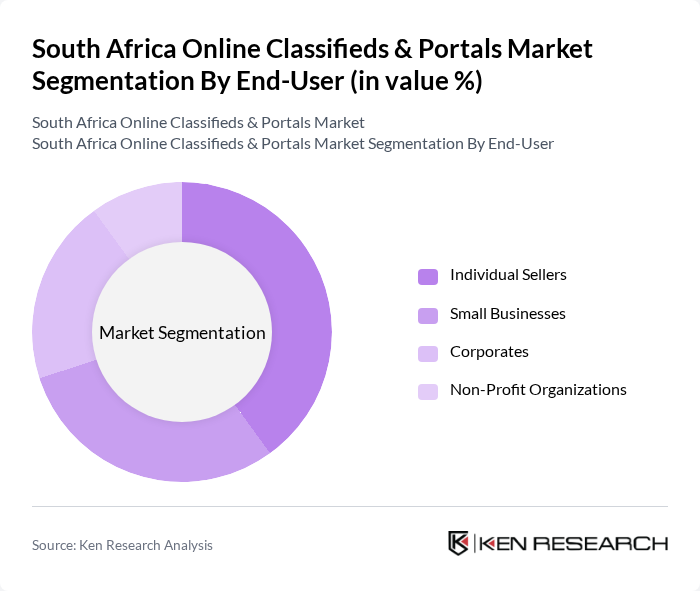

By End-User:The end-user segmentation includes Individual Sellers, Small Businesses, Corporates, and Non-Profit Organizations. Each group utilizes online classifieds differently, with individual sellers often seeking to declutter or monetize personal items, while small businesses leverage these platforms for cost-effective advertising and customer outreach. Corporates may use classifieds for recruitment and service offerings, while non-profits often seek to promote their causes and events.

South Africa Online Classifieds & Portals Market Competitive Landscape

The South Africa Online Classifieds & Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gumtree South Africa, OLX South Africa, Property24, Cars.co.za, Junk Mail, Bidorbuy, Ananzi, Locanto, Classifieds.co.za, MyBroadband, AutoTrader South Africa, Finders Keepers, SA Property, Freeads, The Classifieds contribute to innovation, geographic expansion, and service delivery in this space.

South Africa Online Classifieds & Portals Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, South Africa's internet penetration rate is projected to reach 66%, with approximately 39 million users accessing the web. This growth is driven by improved infrastructure and affordable data plans, which have decreased the average cost of mobile data to around R0.30 per MB. Enhanced connectivity facilitates the use of online classifieds, allowing businesses and consumers to engage more effectively in digital marketplaces, thus driving market growth.

- Rise of Mobile Commerce:Mobile commerce in South Africa is expected to account for R50 billion in transactions by future, reflecting a significant shift towards mobile platforms for buying and selling goods. With over 80% of internet users accessing the web via smartphones, online classifieds are increasingly optimized for mobile use. This trend is further supported by the growing availability of mobile payment solutions, which enhance transaction convenience and security for users.

- Demand for Cost-Effective Advertising Solutions:In future, small and medium enterprises (SMEs) in South Africa are projected to spend R10 billion on online advertising, driven by the need for cost-effective marketing strategies. Online classifieds offer a budget-friendly alternative to traditional advertising, allowing businesses to reach targeted audiences without incurring high costs. This demand is particularly strong among SMEs, which represent 98% of all businesses in the country, highlighting the importance of digital platforms for their growth.

Market Challenges

- Intense Competition:The South African online classifieds market is characterized by fierce competition, with over 50 active platforms vying for market share. Major players like Gumtree and OLX dominate, but new entrants continue to emerge, intensifying the battle for user attention. This competition pressures companies to innovate continuously and improve service offerings, which can strain resources and impact profitability, particularly for smaller platforms.

- Trust and Safety Concerns:Trust issues remain a significant challenge in the online classifieds market, with reports indicating that 30% of users express concerns about scams and fraudulent listings. The lack of robust verification processes can deter potential users from engaging with platforms. Addressing these concerns is crucial for market growth, as enhancing user trust through improved safety measures can lead to increased participation and transaction volumes.

South Africa Online Classifieds & Portals Market Future Outlook

The South African online classifieds market is poised for continued evolution, driven by technological advancements and changing consumer behaviors. As mobile commerce expands, platforms will increasingly integrate features like AI-driven recommendations and enhanced user interfaces to improve engagement. Additionally, the rise of social media will further influence how classifieds are marketed, with platforms leveraging these channels to reach broader audiences. Overall, the market is expected to adapt dynamically to meet the needs of a digitally savvy population.

Market Opportunities

- Expansion into Rural Areas:With approximately 30% of South Africa's population residing in rural areas, there is a significant opportunity for online classifieds to penetrate these markets. By tailoring services to meet local needs and improving internet access, platforms can tap into a largely underserved demographic, potentially increasing user bases and transaction volumes.

- Integration of AI and Machine Learning:The integration of AI and machine learning technologies presents a transformative opportunity for online classifieds. By utilizing these technologies, platforms can enhance user experience through personalized recommendations and improved search functionalities. This innovation can lead to higher user engagement and satisfaction, ultimately driving growth in transaction volumes and platform loyalty.