Region:Europe

Author(s):Shubham

Product Code:KRAB1077

Pages:98

Published On:October 2025

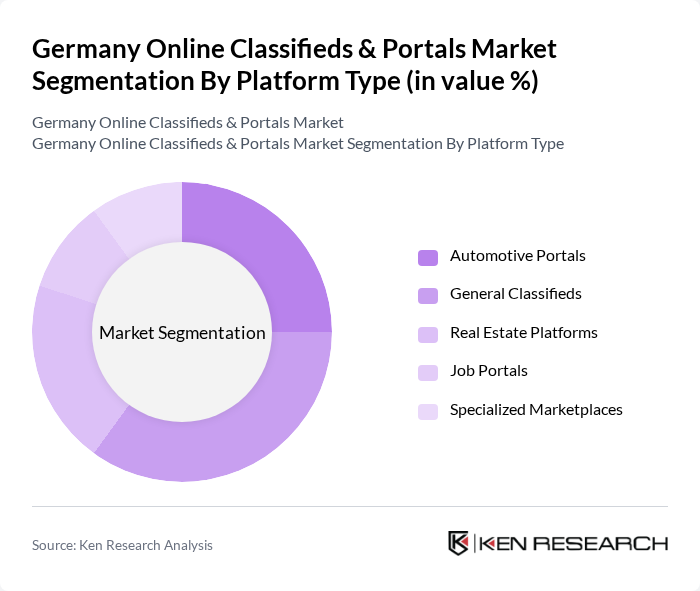

By Platform Type:The market is segmented into various platform types, including Automotive Portals, General Classifieds, Real Estate Platforms, Job Portals, and Specialized Marketplaces. Among these, General Classifieds have emerged as the dominant segment due to their broad appeal and versatility, catering to a wide range of consumer needs from furniture to electronics. Automotive Portals also hold significant market share, driven by the high demand for used vehicles in Germany and the country's strong automotive culture.

By Revenue Model:The revenue model for the market includes Listing Fees, Premium Subscriptions, Transaction Commissions, Advertising Revenue, and Lead Generation Fees. The dominant revenue model is Advertising Revenue, as many platforms leverage their user base to generate income through targeted ads. This model is particularly effective in General Classifieds and Automotive Portals, where high traffic translates to substantial advertising opportunities. The German online advertising market's robust growth, with revenues reaching USD 18.2 billion, supports this revenue model's dominance.

The Germany Online Classifieds & Portals Market is characterized by a dynamic mix of regional and international players. Leading participants such as eBay Kleinanzeigen GmbH, Immowelt AG, AutoScout24 Deutschland GmbH, Quoka GmbH, markt.de, Kleinanzeigen.de (Adevinta), Facebook Marketplace, Shpock, Local24, Jobbörse der Bundesagentur für Arbeit, Meinestadt.de, Vinted GmbH, mobile.de GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany online classifieds and portals market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance user experience, enabling personalized recommendations and streamlined transactions. Additionally, the growing emphasis on sustainability will likely influence listings, as consumers increasingly seek eco-friendly options. These trends indicate a dynamic market landscape, poised for innovation and adaptation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Platform Type | Automotive Portals General Classifieds Real Estate Platforms Job Portals Specialized Marketplaces |

| By Revenue Model | Listing Fees Premium Subscriptions Transaction Commissions Advertising Revenue Lead Generation Fees |

| By User Type | Private Sellers Professional Dealers Commercial Enterprises Service Providers |

| By Device Access | Desktop/Web Mobile Applications Responsive Web |

| By Geographic Reach | National Platforms Regional Platforms Local Marketplaces |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Real Estate Listings | 100 | Real Estate Agents, Property Managers |

| Automotive Sales | 80 | Car Dealership Owners, Automotive Sales Managers |

| Job Listings | 90 | HR Managers, Recruitment Consultants |

| Consumer Goods Sales | 60 | Small Business Owners, E-commerce Managers |

| Service Offerings | 50 | Service Providers, Freelancers |

The Germany Online Classifieds & Portals Market is valued at approximately USD 4.8 billion, driven by increased internet penetration, mobile commerce growth, and digitalization trends among consumers and businesses.