Region:Africa

Author(s):Dev

Product Code:KRAB0386

Pages:85

Published On:August 2025

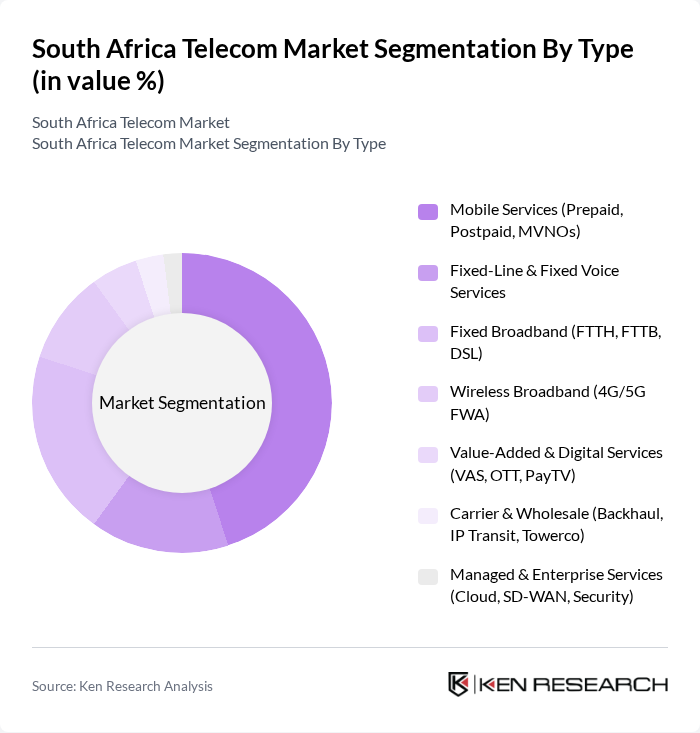

By Type:The telecom market can be segmented into various types, including mobile services, fixed-line services, broadband services, and value-added services. Among these, mobile services, particularly prepaid and postpaid offerings, dominate the market due to the widespread adoption of smartphones and the increasing reliance on mobile internet. The demand for fixed broadband services is also growing, driven by the need for high-speed internet in both residential and business sectors.

By End-User:The telecom market is segmented by end-users, including residential, small and medium enterprises (SMEs), large enterprises, and the public sector. The residential segment is the largest, driven by the increasing demand for internet and mobile services among households. SMEs are also significant contributors, as they seek reliable communication solutions to enhance their operations and customer engagement.

The South Africa Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vodacom Group Limited, MTN South Africa (MTN Group Limited), Telkom SA SOC Limited (including Openserve), Cell C Limited, Rain Networks (rain Mobile; rain One), Liquid Intelligent Technologies (formerly Liquid Telecom), Dark Fibre Africa (DFA) – a Maziv company, Neotel (historical; assets integrated into Liquid Intelligent Technologies), Vox Telecommunications (Vox), Comsol Networks (Fixed Wireless/5G FWA), South African Post Office (Postbank Mobile MVNO programs), FNB Connect (First National Bank MVNO), Afrihost, Axxess, Herotel (formerly WIRUlink and others; fixed wireless and fiber) contribute to innovation, geographic expansion, and service delivery in this space.

The South African telecom market is poised for transformative growth, driven by technological advancements and increasing digital adoption. The expansion of 5G networks will enhance connectivity, enabling new applications in IoT and smart cities. Additionally, the government's focus on digital inclusion will likely foster greater access to services in underserved areas. As competition intensifies, telecom providers will need to innovate continuously, leveraging AI and data analytics to improve customer experiences and operational efficiencies, ensuring sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Services (Prepaid, Postpaid, MVNOs) Fixed-Line & Fixed Voice Services Fixed Broadband (FTTH, FTTB, DSL) Wireless Broadband (4G/5G FWA) Value-Added & Digital Services (VAS, OTT, PayTV) Carrier & Wholesale (Backhaul, IP Transit, Towerco) Managed & Enterprise Services (Cloud, SD-WAN, Security) |

| By End-User | Residential Small and Medium Enterprises (SMEs) Large Enterprises Public Sector (Government, SOEs, Utilities) |

| By Application | Voice (Mobile and Fixed) Data (Mobile Data, Fixed Broadband) Video & Content (IPTV, Streaming, PayTV) Messaging & CPaaS |

| By Distribution Channel | Direct (Operator-Owned Stores, Enterprise Sales) Indirect Retail (Franchise, Multibrand Outlets) Online & App-Based Channels |

| By Pricing Model | Prepaid / Pay-As-You-Go Postpaid Subscription Bundled Converged Offers (Mobile + Fiber + Content) |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Enterprises |

| By Policy Support | Spectrum Assignments (IMT700/800/2600/3500) Universal Service & Access (USAASA/USAF) Programs Infrastructure Sharing & Open-Access Fiber |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Providers | 120 | Marketing Directors, Product Managers |

| Fixed-line Telecommunications | 90 | Operations Managers, Customer Experience Leads |

| Broadband Internet Services | 110 | Network Engineers, Sales Executives |

| Telecom Infrastructure Providers | 80 | Technical Directors, Business Development Managers |

| Consumer Insights on Telecom Services | 140 | End-users, Customer Service Representatives |

The South Africa Telecom Market is valued at approximately USD 10.4 billion, driven by increasing demand for mobile and internet services, smartphone penetration, and the expansion of 4G and 5G networks, which enhance connectivity for consumers and businesses.