Region:Asia

Author(s):Rebecca

Product Code:KRAB5893

Pages:82

Published On:October 2025

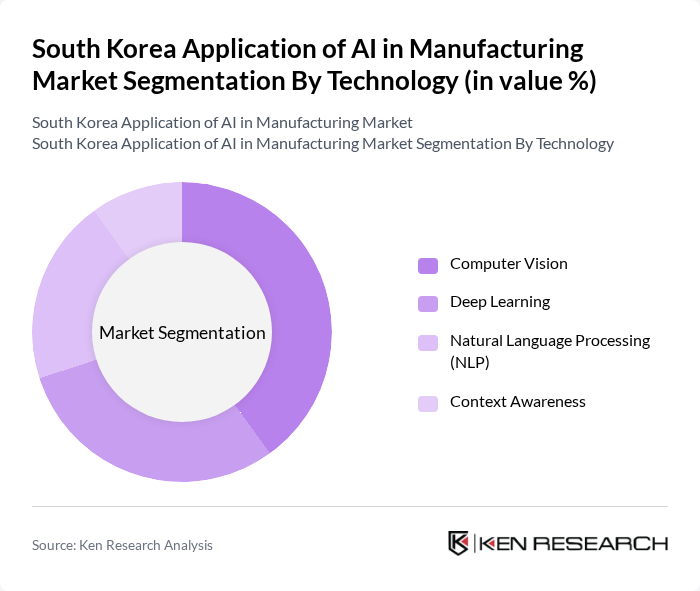

By Technology:The technology segment includes various sub-segments such as Computer Vision, Deep Learning, Natural Language Processing (NLP), and Context Awareness. Among these, Computer Vision is leading the market due to its extensive applications in quality control, defect detection, and automation in manufacturing processes. The increasing need for precision and efficiency in production lines drives the demand for Computer Vision technologies, making it a preferred choice for manufacturers looking to enhance operational capabilities. The adoption of AI-powered visual inspection systems and real-time monitoring further strengthens this segment's leadership .

By Offering:The offering segment encompasses Hardware, Software, AI Platform, and AI Solution. The Software sub-segment is currently dominating the market, driven by the increasing need for advanced analytics, machine learning algorithms, and user-friendly interfaces that facilitate the integration of AI into existing manufacturing systems. As manufacturers seek to leverage data for better decision-making, the demand for sophisticated software solutions continues to rise. The proliferation of cloud-based AI platforms and modular AI solutions is further accelerating software adoption in the manufacturing sector .

The South Korea Application of AI in Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Electronics, SK hynix, LG Electronics, Hyundai Motor Company, Kia Corporation, POSCO, Naver Corporation, Kakao Corp, Hanwha Group, Doosan Group, KT Corporation, CJ Corporation, GS Group, Amorepacific Corporation, Lotte Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in South Korea's manufacturing sector looks promising, with ongoing advancements in technology and increasing integration of AI solutions. As companies continue to embrace smart factory concepts, the focus will shift towards enhancing operational efficiency and sustainability. The collaboration between traditional manufacturers and tech startups is expected to foster innovation, leading to the development of tailored AI solutions that address specific industry needs, ultimately driving growth and competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Technology | Computer Vision Deep Learning Natural Language Processing (NLP) Context Awareness |

| By Offering | Hardware Software AI Platform AI Solution |

| By End-User | Automotive Electronics Aerospace Pharmaceuticals Food and Beverage Others |

| By Application | Predictive Maintenance Quality Control Production Planning Supply Chain Optimization Inventory Management Others |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Budget Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing AI Applications | 100 | Production Managers, AI Implementation Leads |

| Electronics Sector AI Integration | 80 | Operations Directors, Technology Officers |

| Textile Industry AI Innovations | 60 | Process Engineers, R&D Managers |

| General Manufacturing AI Trends | 90 | Manufacturing Executives, Supply Chain Analysts |

| AI in Quality Control Processes | 50 | Quality Assurance Managers, Data Analysts |

The South Korea Application of AI in Manufacturing Market is valued at approximately USD 3.5 billion, driven by the increasing adoption of automation technologies and the demand for smart manufacturing solutions across various industries.