Region:Asia

Author(s):Shubham

Product Code:KRAA0801

Pages:83

Published On:August 2025

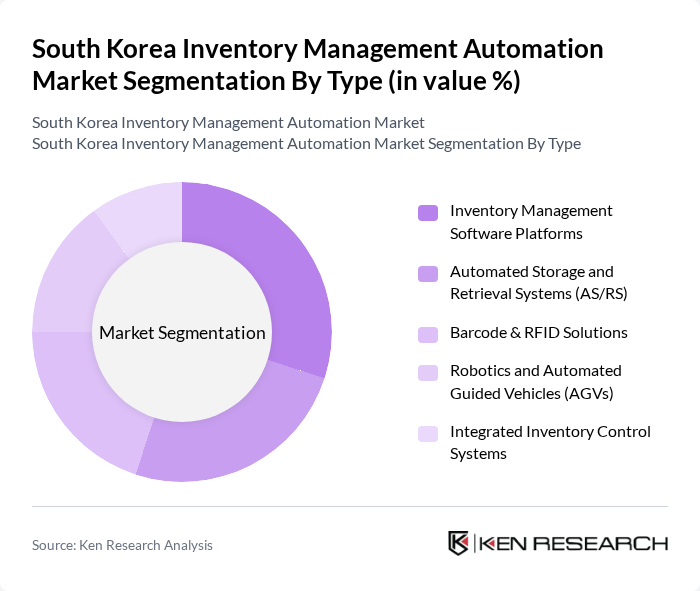

By Type:The market is segmented into various types of inventory management automation solutions, including Inventory Management Software Platforms, Automated Storage and Retrieval Systems (AS/RS), Barcode & RFID Solutions, Robotics and Automated Guided Vehicles (AGVs), and Integrated Inventory Control Systems. Each of these sub-segments plays a vital role in enhancing operational efficiency and accuracy in inventory management. The adoption of AI-powered software, IoT-enabled tracking, and robotics is accelerating, particularly in warehouse and retail environments, to meet the growing demand for real-time data and predictive analytics .

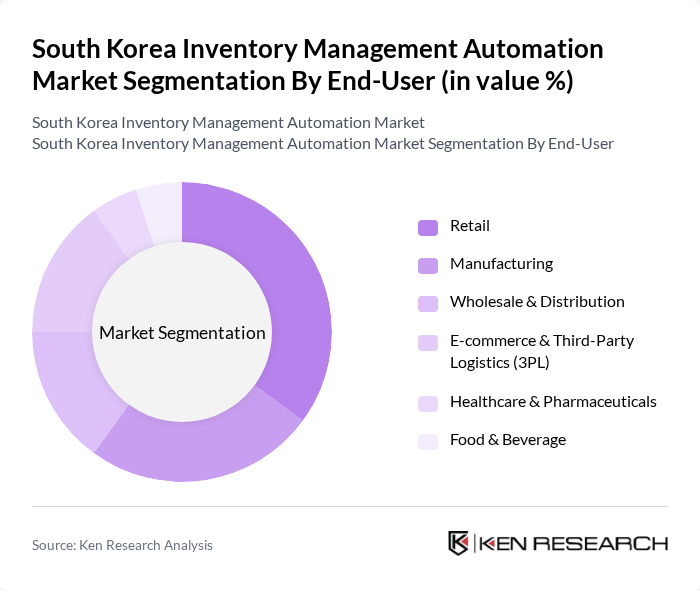

By End-User:The end-user segmentation includes Retail, Manufacturing, Wholesale & Distribution, E-commerce & Third-Party Logistics (3PL), Healthcare & Pharmaceuticals, and Food & Beverage. Each sector has unique requirements for inventory management, driving the adoption of automation solutions tailored to their specific needs. Retail and e-commerce sectors are leading in automation adoption due to the need for real-time inventory visibility and rapid fulfillment, while manufacturing and logistics sectors focus on optimizing throughput and reducing errors .

The South Korea Inventory Management Automation Market is characterized by a dynamic mix of regional and international players. Leading participants such as LG CNS, CJ Logistics, Hyundai Glovis, SFA Corporation, Eugene Robot, Hanjin Transportation, SAP SE, Oracle Corporation, Manhattan Associates, Blue Yonder, Infor, Fishbowl Inventory, Zoho Inventory, SFAWMS (SFA Warehouse Management System), and Unleashed Software contribute to innovation, geographic expansion, and service delivery in this space .

The future of the South Korean inventory management automation market appears promising, driven by technological advancements and evolving consumer expectations. As businesses increasingly prioritize efficiency and accuracy, the integration of AI and machine learning will likely enhance inventory optimization. Furthermore, the growing emphasis on sustainability practices will push companies to adopt eco-friendly inventory solutions, aligning with global trends. Government initiatives supporting automation will also play a crucial role in fostering innovation and encouraging SMEs to embrace these technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Inventory Management Software Platforms Automated Storage and Retrieval Systems (AS/RS) Barcode & RFID Solutions Robotics and Automated Guided Vehicles (AGVs) Integrated Inventory Control Systems |

| By End-User | Retail Manufacturing Wholesale & Distribution E-commerce & Third-Party Logistics (3PL) Healthcare & Pharmaceuticals Food & Beverage |

| By Application | Warehouse Management Order Fulfillment Supply Chain Optimization Demand Forecasting & Replenishment Asset Tracking |

| By Sales Channel | Direct Sales Online Sales Distributors & System Integrators |

| By Deployment Mode | Cloud-Based Solutions On-Premise Solutions Hybrid Solutions |

| By Price Range | Budget Solutions Mid-Range Solutions Premium Solutions |

| By Others | Custom Solutions Niche Market Offerings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Inventory Automation | 100 | Supply Chain Managers, IT Directors |

| Manufacturing Process Automation | 80 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Automation | 90 | Logistics Coordinators, Warehouse Managers |

| Technology Providers for Inventory Management | 50 | Product Managers, Sales Executives |

| Consultants in Supply Chain Automation | 40 | Industry Analysts, Supply Chain Consultants |

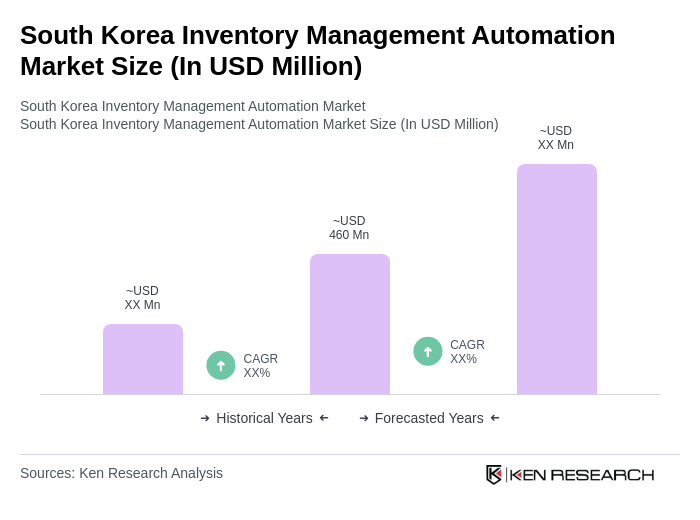

The South Korea Inventory Management Automation Market is valued at approximately USD 460 million, driven by the increasing demand for operational efficiency, e-commerce growth, and the need for real-time inventory tracking solutions.