Region:Asia

Author(s):Rebecca

Product Code:KRAB2946

Pages:92

Published On:October 2025

By Type:The luxury retail and e-commerce market can be segmented into various types, including fashion apparel, accessories, footwear, jewelry, watches, beauty products, and others. Among these, fashion apparel is the leading sub-segment, driven by the influence of K-fashion and the increasing popularity of luxury streetwear. Accessories and beauty products also show significant consumer interest, reflecting trends in personal style and self-care.

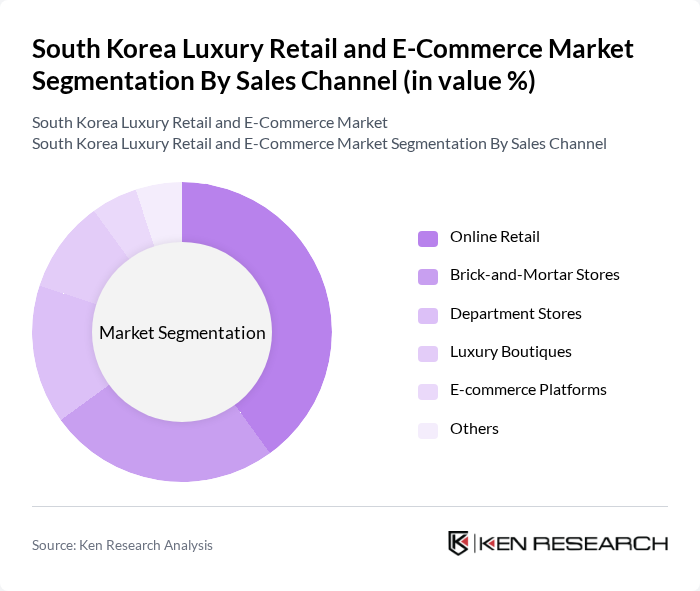

By Sales Channel:The market is also segmented by sales channels, including online retail, brick-and-mortar stores, department stores, luxury boutiques, e-commerce platforms, and others. Online retail has emerged as the dominant channel, particularly during the pandemic, as consumers increasingly prefer the convenience of shopping from home. Brick-and-mortar stores remain important for luxury brands, providing a tactile experience that online shopping cannot replicate.

The South Korea luxury retail and e-commerce market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung C&T Corporation, LG Fashion, Hyundai Department Store, Shinsegae International, Lotte Shopping, Amorepacific Corporation, Kering Group, LVMH Moët Hennessy Louis Vuitton, Chanel S.A., Gucci, Prada S.p.A., Burberry Group plc, Hermès International S.A., Tiffany & Co., Ralph Lauren Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean luxury retail and e-commerce market is poised for continued growth, driven by evolving consumer preferences and technological advancements. As personalization becomes a key focus, brands are expected to leverage data analytics to enhance customer experiences. Additionally, the integration of sustainable practices will likely resonate with environmentally conscious consumers, further shaping the market landscape. The rise of mobile shopping will also facilitate seamless transactions, making luxury goods more accessible to a broader audience.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion Apparel Accessories Footwear Jewelry Watches Beauty Products Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Department Stores Luxury Boutiques E-commerce Platforms Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Lifestyle Preferences |

| By Brand Positioning | High-End Luxury Affordable Luxury Premium Brands |

| By Product Origin | Domestic Brands International Brands |

| By Purchase Frequency | Occasional Buyers Regular Buyers Seasonal Buyers |

| By Price Range | Under $100 $100 - $500 $500 - $1000 Above $1000 |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Retail | 150 | Brand Managers, Retail Operations Directors |

| Luxury Cosmetics E-commerce | 100 | Marketing Managers, E-commerce Specialists |

| High-End Accessories Market | 80 | Product Development Managers, Sales Executives |

| Luxury Consumer Insights | 120 | Market Researchers, Consumer Behavior Analysts |

| Online Luxury Shopping Trends | 90 | Digital Marketing Managers, UX/UI Designers |

The South Korea luxury retail and e-commerce market is valued at approximately USD 20 billion, driven by increasing disposable incomes and a growing appetite for luxury goods among consumers, particularly through online shopping platforms.