Region:Europe

Author(s):Geetanshi

Product Code:KRAA4530

Pages:86

Published On:September 2025

By Type:The luxury retail market in Turkey is segmented into various types, including Fashion Apparel, Accessories, Footwear, Jewelry, Watches, Beauty Products, Home & Lifestyle Luxury Goods, Luxury Real Estate, and Others. Among these, Fashion Apparel and Beauty Products are particularly dominant due to changing fashion trends, increased exposure to global brands, and rising consumer interest in personal grooming and aesthetics .

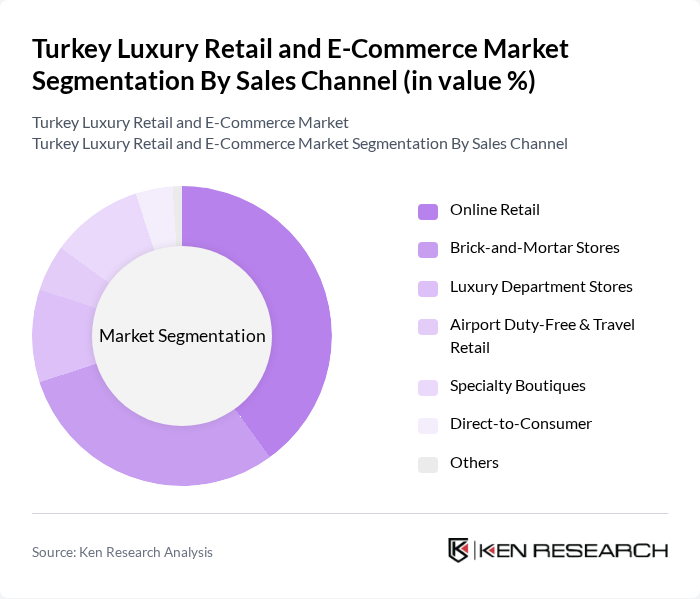

By Sales Channel:The luxury retail market is also segmented by sales channels, including Online Retail, Brick-and-Mortar Stores, Luxury Department Stores, Airport Duty-Free & Travel Retail, Specialty Boutiques, Direct-to-Consumer, and Others. Online Retail has gained significant traction, especially post-pandemic, as consumers increasingly prefer the convenience, variety, and seamless experience of shopping from home. E-commerce platforms have enhanced their logistics, delivery, and payment systems, further supporting this channel’s rapid growth .

The Turkey Luxury Retail and E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Kering SA, Richemont, Chanel S.A., Gucci, Prada S.p.A., Burberry Group plc, Hermès International SCA, Valentino S.p.A., Dolce & Gabbana, Versace, Fendi, Bvlgari, Salvatore Ferragamo, Tiffany & Co., Beymen, Vakko, Desa Deri, Mavi, Network, ?pekyol, Damat Tween, Haremlique Istanbul, Atasay Jewelry, Alt?nba? contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's luxury retail and e-commerce market appears promising, driven by evolving consumer preferences and technological advancements. As disposable incomes rise, consumers are increasingly seeking personalized shopping experiences, which luxury brands are beginning to offer. Additionally, the integration of innovative technologies, such as augmented reality, is expected to enhance online shopping experiences, attracting a tech-savvy demographic. The market is likely to see a shift towards sustainability, with brands focusing on eco-friendly practices to appeal to conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion Apparel Accessories Footwear Jewelry Watches Beauty Products Home & Lifestyle Luxury Goods Luxury Real Estate Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Department Stores Airport Duty-Free & Travel Retail Specialty Boutiques Direct-to-Consumer Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Gender Income Level Lifestyle Preferences |

| By Product Origin | Domestic Brands International Brands |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Marketing Channel | Social Media Influencer Marketing Traditional Advertising Events and Sponsorships |

| By Customer Loyalty Status | New Customers Repeat Customers Brand Advocates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Purchases | 100 | Affluent Consumers, Fashion Enthusiasts |

| High-End Cosmetics Usage | 60 | Beauty Product Consumers, Makeup Artists |

| Luxury Accessories Market | 40 | Accessory Buyers, Retail Managers |

| E-commerce Luxury Shopping Trends | 80 | Online Shoppers, Digital Marketing Experts |

| Luxury Travel and Experiences | 50 | Travel Enthusiasts, Luxury Service Providers |

The Turkey Luxury Retail and E-Commerce Market is valued at approximately USD 3 billion, driven by increasing disposable incomes, a growing middle class, and a shift towards premium products, particularly in urban areas.