Region:Asia

Author(s):Geetanshi

Product Code:KRAB5721

Pages:84

Published On:October 2025

By Type:The market is segmented into vitamins, minerals, herbal/botanical supplements, protein & amino acid supplements, omega fatty acids, probiotics & prebiotics, functional foods & beverages, and others such as fibers and specialty carbohydrates. Vitamins and minerals remain the most popular due to their essential roles in daily health and wellness. The increasing awareness of nutritional deficiencies, preventive health, and the benefits of supplementation drives consumer preference towards these categories. Functional foods and beverages are also gaining traction, supported by the popularity of products with added health benefits and convenience .

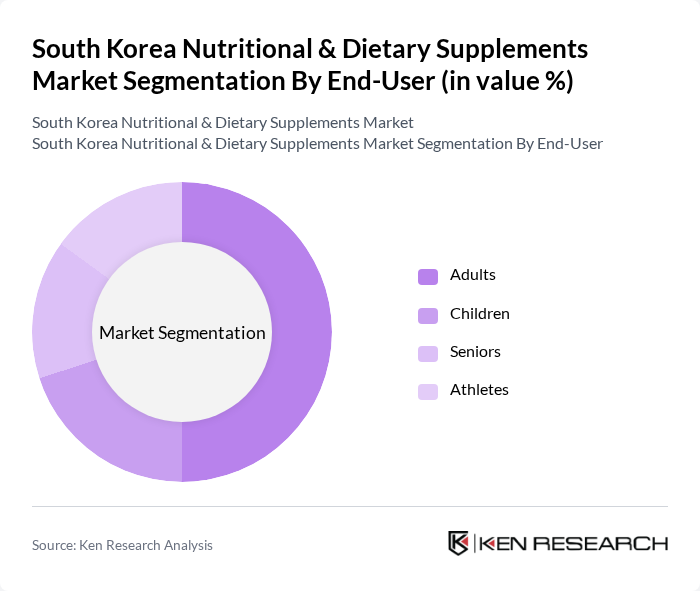

By End-User:The end-user segmentation includes adults, children, seniors, and athletes. Adults represent the largest segment, driven by a growing focus on health and wellness, particularly among working professionals. The increasing trend of fitness and sports participation has led to a rise in demand for supplements among athletes, while seniors are increasingly seeking products that support healthy aging and chronic disease management .

The South Korea Nutritional & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amway Korea Co., Ltd., Herbalife Nutrition Ltd., GNC Holdings, Inc., LG Household & Health Care Ltd., CJ CheilJedang Corporation, Daesang Corporation, Dong-A Pharmaceutical Co., Ltd., Yuhan Corporation, Kwangdong Pharmaceutical Co., Ltd., Chong Kun Dang Pharmaceutical Corp., Nutrilite (Amway brand), Nature's Way, Blackmores Limited, NOW Foods, Swisse Wellness Pty Ltd., Usana Health Sciences, Inc., Glanbia Performance Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean nutritional and dietary supplements market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As health awareness continues to rise, companies are likely to invest in innovative product formulations that cater to specific health needs. Additionally, the integration of digital health solutions, such as personalized nutrition apps, will enhance consumer engagement and product customization, fostering a more dynamic market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal/Botanical Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics & Prebiotics Functional Foods & Beverages Others (e.g., Fibers, Specialty Carbohydrates) |

| By End-User | Adults Children Seniors Athletes |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Health Food Stores Department Stores |

| By Formulation | Tablets Capsules Powders Liquids Soft Gels |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bottles Blister Packs Pouches Sachets |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Nutritional Supplements | 100 | Store Managers, Sales Representatives |

| Consumer Preferences for Dietary Products | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Market Trends in Herbal Supplements | 80 | Herbal Product Retailers, Nutrition Experts |

| Impact of Regulatory Changes on Supplement Sales | 60 | Regulatory Affairs Specialists, Industry Analysts |

| Consumer Attitudes Towards Supplement Efficacy | 90 | General Consumers, Health Bloggers |

The South Korea Nutritional & Dietary Supplements Market is valued at approximately USD 4.1 billion, reflecting a significant growth driven by increasing health consciousness and preventive healthcare measures among consumers.