Region:Asia

Author(s):Rebecca

Product Code:KRAC0324

Pages:97

Published On:August 2025

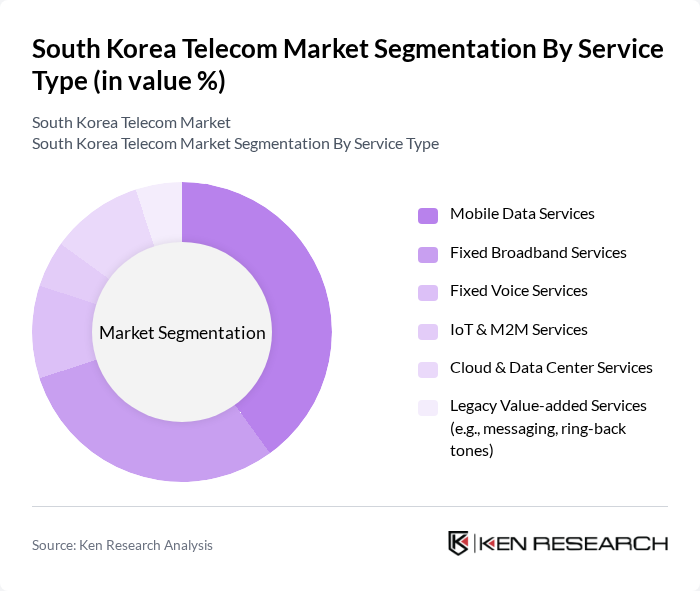

By Service Type:The service type segmentation includes various subsegments such as Mobile Data Services, Fixed Broadband Services, Fixed Voice Services, IoT & M2M Services, Cloud & Data Center Services, and Legacy Value-added Services. Among these, Mobile Data Services dominate the market due to the increasing reliance on smartphones and mobile applications, driving demand for high-speed internet access. The trend towards remote work, video streaming, and cloud gaming has further accelerated the growth of Fixed Broadband Services, making it a significant player in the market. IoT & M2M Services are the fastest-growing segment as enterprises deploy private 5G for automation and industrial connectivity.

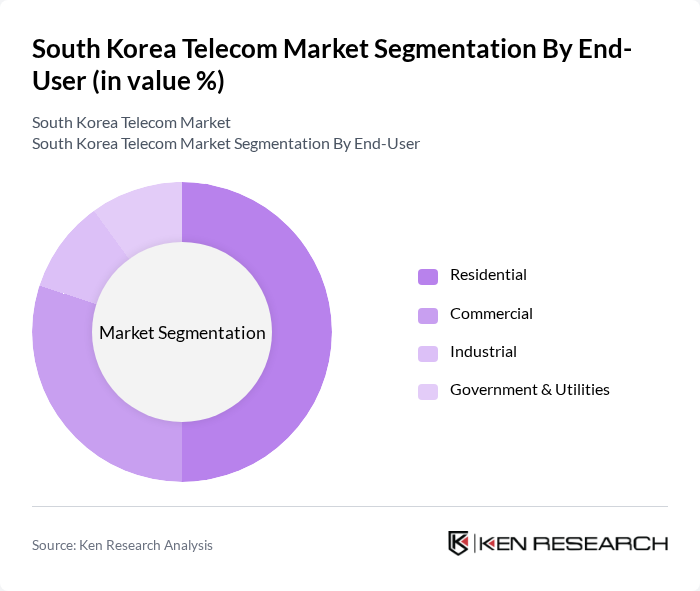

By End-User:The end-user segmentation encompasses Residential, Commercial, Industrial, and Government & Utilities sectors. The Residential segment leads the market, driven by the increasing number of households adopting high-speed internet and mobile services. The Commercial sector is also significant, as businesses increasingly rely on telecom services for operations, customer engagement, and cloud-based solutions. The Industrial segment is growing due to the rise of IoT applications and private 5G networks, while Government & Utilities are leveraging telecom services for smart city initiatives, public safety, and digital infrastructure upgrades.

The South Korea Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as SK Telecom Co., Ltd., KT Corporation, LG Uplus Corp., Samsung Electronics Co., Ltd., SK Broadband Co., Ltd., LG HelloVision Corp., KT Skylife Co., Ltd., D'LIVE Co., Ltd., T-Broad Co., Ltd., KCT Co., Ltd., CJ ENM Co., Ltd., Hanaro Telecom Inc. (now part of SK Broadband), Naver Corporation, Kakao Corp., Tmap Mobility Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean telecom market is poised for continued growth, driven by advancements in technology and increasing consumer demand for connectivity. The ongoing rollout of 5G networks will enhance service offerings, while the integration of IoT applications is expected to create new revenue streams. Additionally, the focus on sustainability and digital transformation will shape the competitive landscape, encouraging telecom providers to innovate and adapt to changing consumer preferences. Overall, the market is set to evolve significantly in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Mobile Data Services Fixed Broadband Services Fixed Voice Services IoT & M2M Services Cloud & Data Center Services Legacy Value-added Services (e.g., messaging, ring-back tones) |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Service Model | Subscription-based Pay-as-you-go Bundled Packages |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Customer Segment | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations |

| By Technology Adoption | Early Adopters (5G, IoT, Cloud) Mainstream Users (4G, Broadband) Late Adopters (Legacy Services) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Providers | 100 | Marketing Directors, Product Managers |

| Broadband Internet Services | 80 | Network Engineers, Customer Experience Managers |

| Telecom Infrastructure Vendors | 60 | Sales Executives, Technical Support Managers |

| Consumer Mobile Usage | 120 | End-users, Tech-savvy Consumers |

| 5G Adoption Trends | 40 | Industry Analysts, Telecom Consultants |

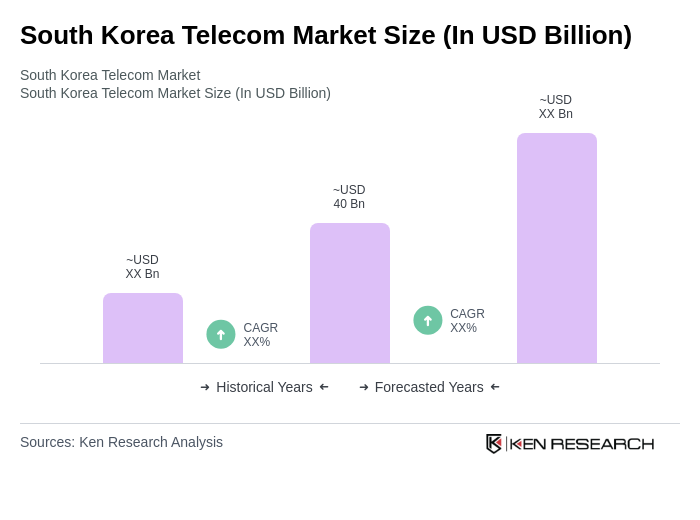

The South Korea Telecom Market is valued at approximately USD 40 billion, driven by the rapid adoption of 5G technology, increasing demand for mobile data services, and the expansion of IoT applications across various sectors.