Region:Europe

Author(s):Rebecca

Product Code:KRAB1848

Pages:82

Published On:October 2025

By Type:The market is segmented into nitrogen-based, phosphorus-based, potassium-based, organic, biofertilizers, specialty fertilizers, and others. Nitrogen-based fertilizers remain the most widely used due to their critical role in crop growth and yield improvement. Phosphorus and potassium fertilizers support root development and plant health, while organic and biofertilizers are gaining traction as sustainability and consumer health trends drive demand for eco-friendly inputs. Specialty fertilizers, including slow-release and controlled-release formulations, are increasingly adopted for targeted nutrient management in high-value crops.

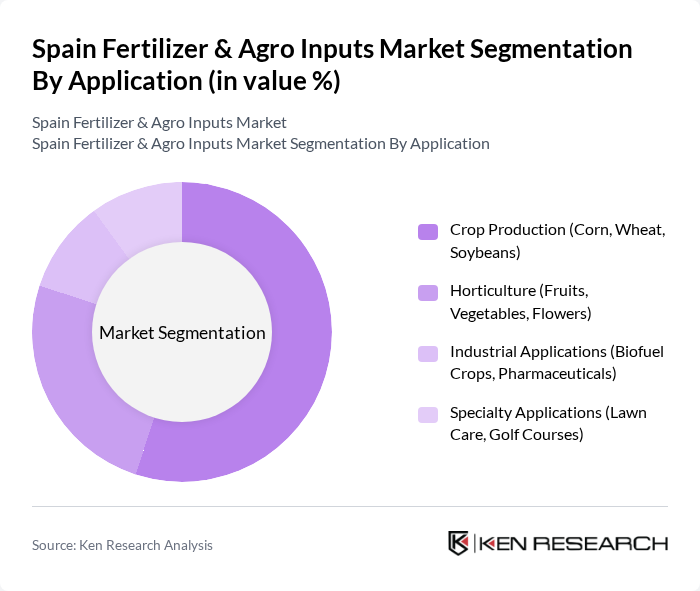

By Application:The market is segmented by application into crop production, horticulture, industrial applications, and specialty applications. Crop production is the largest segment, reflecting Spain’s focus on cereals, grains, and oilseeds for domestic consumption and export. Horticulture is expanding, driven by urban gardening, organic produce demand, and high-value fruit and vegetable cultivation. Industrial applications, including biofuel crops and pharmaceutical plants, are emerging as niche segments, while specialty applications such as lawn care and golf courses show steady growth due to landscaping trends.

The Spain Fertilizer & Agro Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, Nutrien Ltd., BASF SE, Syngenta AG, Corteva Agriscience, FMC Corporation, Haifa Group, ICL Group Ltd., Solvay S.A., K+S AG, UPL Limited, EuroChem Group AG, Aglukon Spezialdünger GmbH, Adama Agricultural Solutions Ltd., Nufarm Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain Fertilizer & Agro Inputs Market is poised for transformation, driven by a strong emphasis on sustainability and technological integration. As the demand for organic produce continues to rise, the market will likely see increased investments in bio-based fertilizers and precision agriculture technologies. Additionally, government initiatives aimed at promoting sustainable practices will further enhance the market landscape, encouraging innovation and collaboration among stakeholders to address environmental challenges while meeting agricultural needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen-Based Fertilizers (Urea, Ammonium Nitrate) Phosphorus-Based Fertilizers (Superphosphates, MAP, DAP) Potassium-Based Fertilizers (Potash, SOP) Organic Fertilizers (Compost, Green Manure) Biofertilizers (Microbial Fertilizers) Specialty Fertilizers (Slow-Release, Controlled-Release) Others |

| By Application | Crop Production (Corn, Wheat, Soybeans) Horticulture (Fruits, Vegetables, Flowers) Industrial Applications (Biofuel Crops, Pharmaceuticals) Specialty Applications (Lawn Care, Golf Courses) |

| By End-User | Farmers Agricultural Cooperatives Distributors Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Others |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain Central Spain Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Packaging Type | Bulk Packaging Bagged Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cereal Crop Fertilizer Usage | 120 | Farmers, Agronomists |

| Horticultural Inputs Market | 85 | Greenhouse Managers, Retailers |

| Organic Fertilizer Adoption | 70 | Organic Farmers, Agricultural Consultants |

| Fertilizer Distribution Channels | 95 | Distributors, Supply Chain Managers |

| Government Policy Impact on Fertilizer Use | 65 | Policy Makers, Agricultural Economists |

The Spain Fertilizer & Agro Inputs Market is valued at approximately USD 2.95 billion. This valuation reflects the demand for phosphate fertilizers and overall sector trends, driven by the need for increased food production and sustainable agricultural practices.