Region:Europe

Author(s):Rebecca

Product Code:KRAB1828

Pages:83

Published On:October 2025

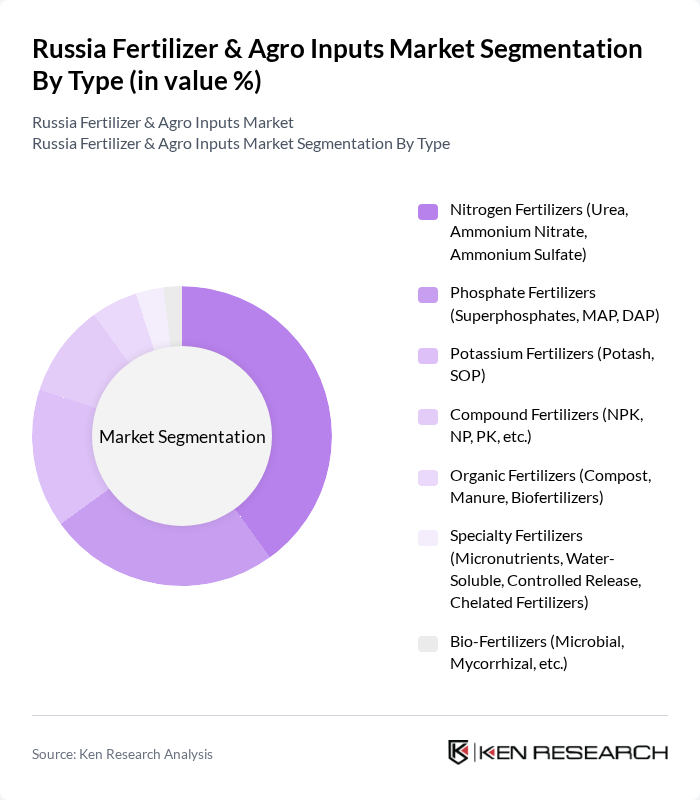

By Type:The market is segmented into various types of fertilizers, each catering to specific agricultural needs. The primary types include nitrogen fertilizers, phosphate fertilizers, potassium fertilizers, compound fertilizers, organic fertilizers, specialty fertilizers, and bio-fertilizers. Among these, nitrogen fertilizers are the most widely used due to their essential role in plant growth and high demand in crop production .

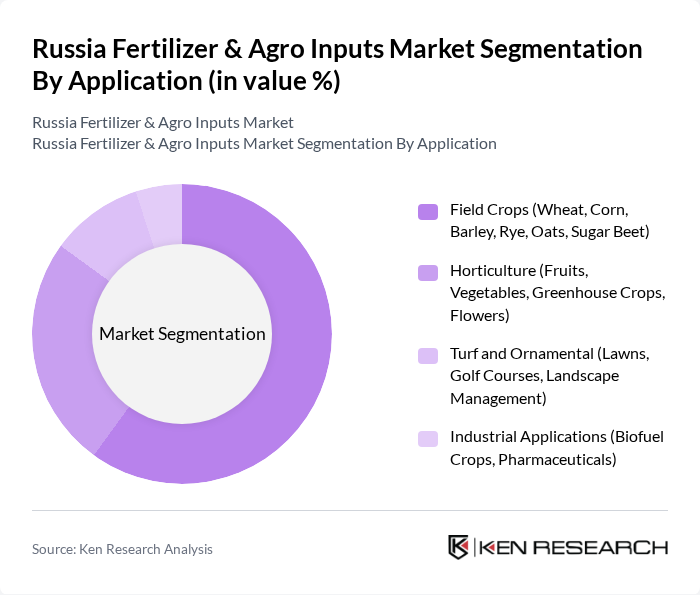

By Application:The application segment of the market includes field crops, horticulture, turf and ornamental, and industrial applications. Field crops dominate the market due to the extensive use of fertilizers in staple crops like wheat, corn, and barley, which are crucial for food security and agricultural sustainability. Russia’s field crops cover the vast majority of cultivated land, with wheat and corn being the most significant contributors to fertilizer demand .

The Russia Fertilizer & Agro Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as PhosAgro, Uralkali, Acron, EuroChem, Uralchem, Togliattiazot, Shchekinoazot, KuibyshevAzot, Dorogobuzh, Belaruskali, K+S AG, Yara International, Nutrien, CF Industries, ICL Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia fertilizer and agro inputs market appears promising, driven by increasing agricultural demands and government support. As the sector embraces technological advancements, the focus on sustainable practices will likely intensify. The shift towards organic fertilizers and precision agriculture is expected to reshape production methods. Additionally, strategic partnerships between local producers and international firms may enhance market competitiveness, fostering innovation and expanding market reach, ultimately contributing to a more resilient agricultural sector in Russia.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogen Fertilizers (Urea, Ammonium Nitrate, Ammonium Sulfate) Phosphate Fertilizers (Superphosphates, MAP, DAP) Potassium Fertilizers (Potash, SOP) Compound Fertilizers (NPK, NP, PK, etc.) Organic Fertilizers (Compost, Manure, Biofertilizers) Specialty Fertilizers (Micronutrients, Water-Soluble, Controlled Release, Chelated Fertilizers) Bio-Fertilizers (Microbial, Mycorrhizal, etc.) |

| By Application | Field Crops (Wheat, Corn, Barley, Rye, Oats, Sugar Beet) Horticulture (Fruits, Vegetables, Greenhouse Crops, Flowers) Turf and Ornamental (Lawns, Golf Courses, Landscape Management) Industrial Applications (Biofuel Crops, Pharmaceuticals) |

| By End-User | Farmers Agricultural Cooperatives Distributors Greenhouse Operators Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Agro-Dealer Networks Others |

| By Region | Central Russia Southern Russia Siberian Region Far East Region Volga Region North Caucasus Others |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 120 | Retail Managers, Store Owners |

| Agro Input Distribution Channels | 90 | Distributors, Supply Chain Managers |

| Farmers' Fertilizer Usage Patterns | 140 | Farm Owners, Agronomists |

| Government Policy Impact on Fertilizer Use | 80 | Policy Makers, Agricultural Advisors |

| Environmental Impact Assessments | 70 | Environmental Scientists, Sustainability Officers |

The Russia Fertilizer & Agro Inputs Market is valued at approximately USD 12 billion, driven by increasing agricultural productivity, expansion of arable land, and advancements in farming technologies. This growth reflects the rising demand for fertilizers to enhance crop yields and ensure food security.