Region:Europe

Author(s):Shubham

Product Code:KRAB1262

Pages:94

Published On:October 2025

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, complex, organic, biofertilizers, and specialty fertilizers. Each type serves specific agricultural needs, with nitrogenous fertilizers being the most widely used due to their essential role in plant growth and crop yield enhancement.

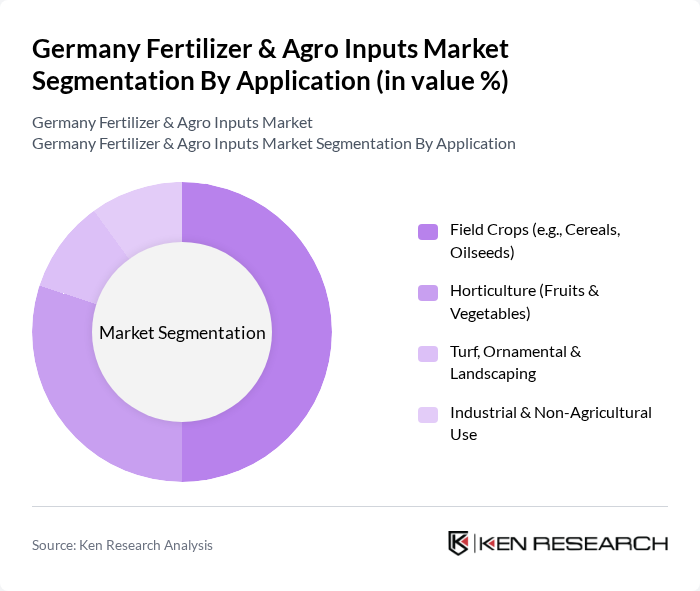

By Application:The application segment includes field crops, horticulture, turf, ornamental & landscaping, and industrial & non-agricultural use. Field crops dominate the market due to the high demand for cereals and oilseeds, which require significant fertilizer input for optimal growth and yield.

The Germany Fertilizer & Agro Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Yara International ASA, K+S AG, EuroChem Group AG, Syngenta AG, Haifa Group, ICL Group Ltd., Nutrien Ltd., UPL Limited, Adama Agricultural Solutions Ltd., FMC Corporation, Corteva Agriscience, Solvay S.A., Nufarm Limited, COMPO EXPERT GmbH, Helm AG, Agrofert Deutschland GmbH, SKW Stickstoffwerke Piesteritz GmbH, Borealis AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Germany Fertilizer & Agro Inputs Market appears promising, driven by a strong emphasis on sustainability and technological innovation. As the demand for organic and eco-friendly products continues to rise, companies are likely to invest in research and development to create customized solutions. Furthermore, the integration of digital technologies in agriculture is expected to enhance efficiency and productivity, paving the way for a more resilient and sustainable agricultural sector in Germany.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers (e.g., Urea, Ammonium Nitrate) Phosphatic Fertilizers (e.g., DAP, MAP) Potassic Fertilizers (e.g., MOP, SOP) Complex Fertilizers (NPK, NP, PK) Organic Fertilizers Biofertilizers and Biostimulants Specialty Fertilizers (e.g., Controlled Release, Water-Soluble, Liquid Fertilizers) |

| By Application | Field Crops (e.g., Cereals, Oilseeds) Horticulture (Fruits & Vegetables) Turf, Ornamental & Landscaping Industrial & Non-Agricultural Use |

| By End-User | Individual Farmers Agricultural Cooperatives Large Agricultural Enterprises Distributors & Retailers |

| By Distribution Channel | Direct Sales (Manufacturer to Farm) Agri-Input Retail Outlets Online Platforms Cooperatives & Buying Groups |

| By Region | Northern Germany Southern Germany Eastern Germany Western Germany |

| By Formulation | Granular Liquid Water-Soluble Controlled Release |

| By Policy Support | Subsidies Tax Exemptions Grants Environmental Compliance Incentives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 100 | Retail Managers, Sales Representatives |

| Crop-Specific Fertilizer Usage | 80 | Farmers, Agronomists |

| Agro Input Distribution Channels | 60 | Distributors, Supply Chain Managers |

| Sustainable Fertilizer Practices | 50 | Environmental Consultants, Policy Makers |

| Market Trends and Innovations | 40 | Research Analysts, Industry Experts |

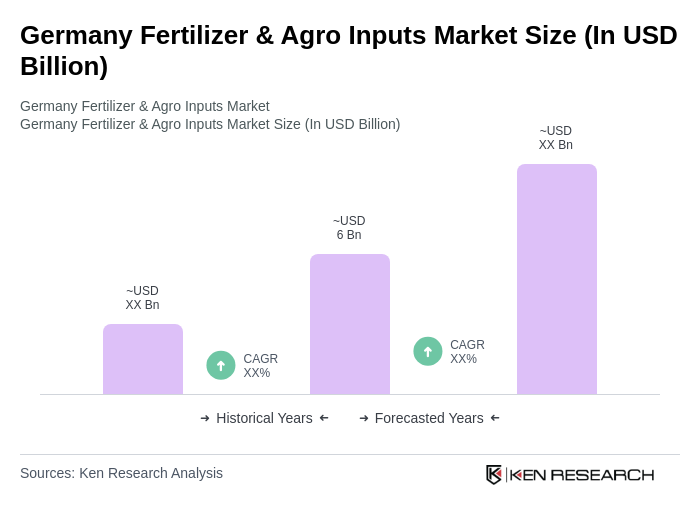

The Germany Fertilizer & Agro Inputs Market is valued at approximately USD 6 billion, reflecting a significant growth driven by increasing food production demands, advancements in agricultural technology, and a focus on sustainable farming practices.