Region:Asia

Author(s):Rebecca

Product Code:KRAB1801

Pages:87

Published On:October 2025

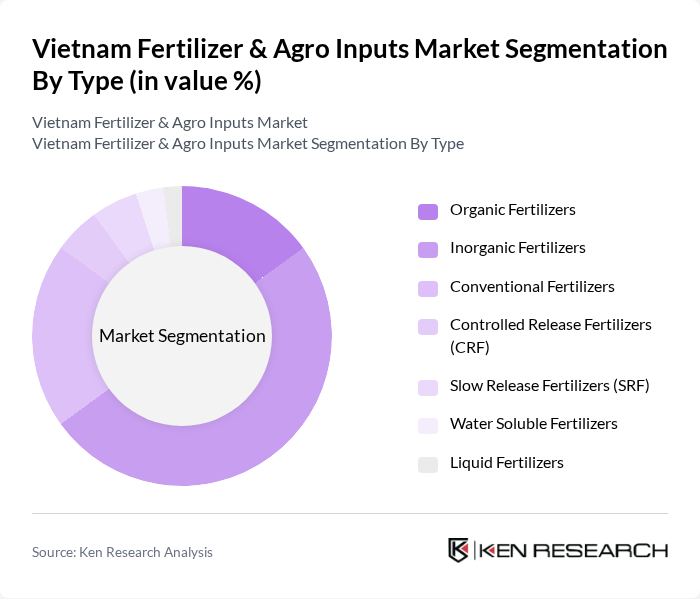

By Type:The market is segmented into various types of fertilizers, including Organic Fertilizers, Inorganic Fertilizers, Conventional Fertilizers, Controlled Release Fertilizers (CRF), Slow Release Fertilizers (SRF), Water Soluble Fertilizers, and Liquid Fertilizers. Among these,Inorganic Fertilizersdominate the market due to their widespread use in conventional farming practices. Farmers prefer inorganic options for their immediate nutrient availability and effectiveness in enhancing crop yields.Organic Fertilizersare gaining traction as sustainability becomes a priority, supported by government policy and increased awareness, but they still represent a smaller share compared to inorganic types.

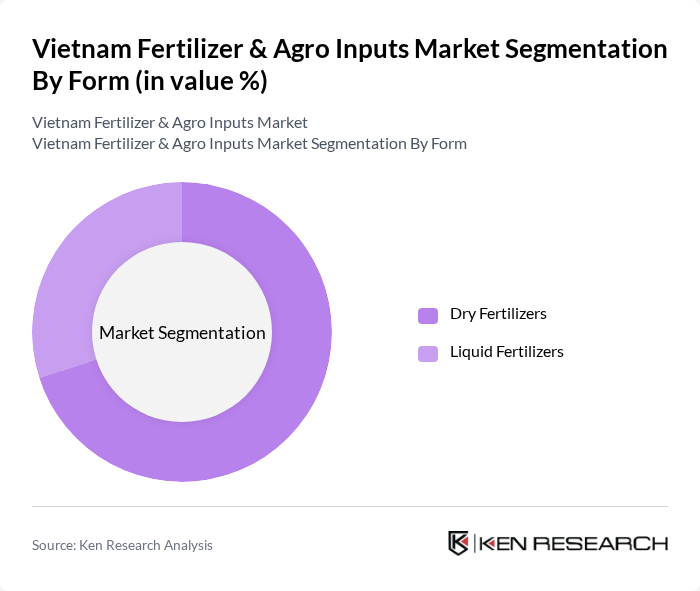

By Form:The market is categorized intoDry FertilizersandLiquid Fertilizers. Dry Fertilizers hold a significant share due to their ease of application and storage, making them a preferred choice among farmers. Liquid Fertilizers, while less common, are gaining popularity for their quick absorption and effectiveness in specific applications. The trend towards precision agriculture and specialty crops is also driving interest in liquid formulations.

The Vietnam Fertilizer & Agro Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as PetroVietnam Fertilizer and Chemicals Corporation (PVFCCo), Vietnam National Chemical Group (Vinachem), Agricultural Products Materials Joint Stock Company, Supe Lâm Thao Fertilizer Company, Binh Dien Fertilizer Joint Stock Company (Baconco), Southern Fertilizer Joint Stock Company (SFG), Ha Bac Nitrogenous Fertilizer and Chemical Company, Phu My Fertilizer Plant, Central Fertilizer and Chemical Company, An Giang Plant Protection Joint Stock Company, Ca Mau Fertilizer Joint Stock Company, Dong Nai Fertilizer Company, Quang Ngai Fertilizer Company, Long An Fertilizer Company, Hanoi Agricultural Products Company contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam fertilizer and agro inputs market is poised for significant transformation as it adapts to evolving agricultural practices and consumer preferences. The increasing emphasis on sustainability and organic farming will drive innovation in product development, while government initiatives will continue to support farmers in adopting modern techniques. As digital solutions and precision agriculture gain traction, the market will likely see enhanced efficiency and productivity, positioning Vietnam as a competitive player in the regional agricultural landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Organic Fertilizers Inorganic Fertilizers Conventional Fertilizers Controlled Release Fertilizers (CRF) Slow Release Fertilizers (SRF) Water Soluble Fertilizers Liquid Fertilizers |

| By Form | Dry Fertilizers Liquid Fertilizers |

| By Application | Agriculture Horticulture Gardening Turf and Ornamental |

| By Crop Type | Field Crops Horticultural Crops Turf and Ornamental |

| By Region | Red River Delta Mekong River Delta Southeast South Central Coast Others |

| By Price Range | Low Price Mid Price High Price |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retailers | 150 | Store Managers, Sales Representatives |

| Agro Input Distributors | 100 | Distribution Managers, Logistics Coordinators |

| Farmers (Smallholder) | 150 | Crop Farmers, Livestock Farmers |

| Large Agricultural Enterprises | 80 | Farm Managers, Procurement Officers |

| Government Agricultural Officials | 40 | Policy Makers, Agricultural Advisors |

The Vietnam Fertilizer & Agro Inputs Market is valued at approximately USD 730 million, driven by increasing agricultural productivity, expanding exports, and government initiatives aimed at modern farming and food security.