Region:Asia

Author(s):Shubham

Product Code:KRAB1141

Pages:83

Published On:October 2025

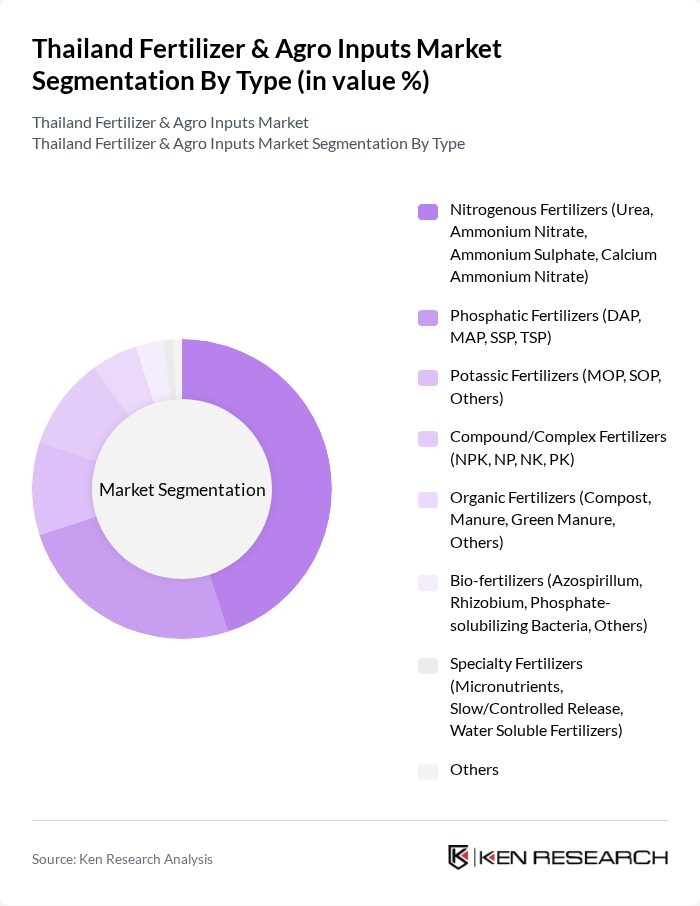

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, compound/complex, organic, bio-fertilizers, specialty fertilizers, and others. Among these, nitrogenous fertilizers, particularly urea, dominate the market due to their essential role in crop growth and high demand from farmers. The increasing focus on sustainable agriculture is also driving the growth of organic and bio-fertilizers. The market segmentation aligns with industry convention, with nitrogenous fertilizers representing the largest share, followed by phosphatic and potassic fertilizers. Organic and bio-fertilizers are experiencing notable growth due to consumer and policy-driven sustainability trends .

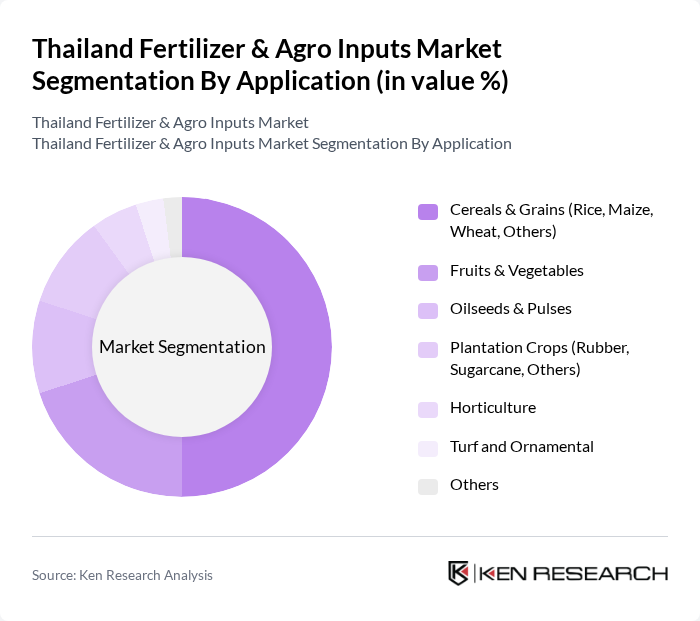

By Application:The application segment includes cereals & grains, fruits & vegetables, oilseeds & pulses, plantation crops, horticulture, turf and ornamental, and others. The cereals and grains segment, particularly rice, is the largest consumer of fertilizers in Thailand, driven by the country's status as a major rice exporter. The increasing demand for fruits and vegetables is also contributing to the growth of fertilizers in this segment. Application segmentation reflects the dominance of staple crops, with rice, maize, and cassava being the primary drivers of fertilizer consumption. Fruits and vegetables are gaining share due to changing dietary preferences and export opportunities .

The Thailand Fertilizer & Agro Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thai Central Chemical Public Company Limited, Chia Tai Company Limited, The Siam Cement Public Company Limited (SCG Chemicals), ICL Fertilizers (Ranthai Agro Co., Ltd.), Yara (Thailand) Limited, Chai Thai Company Limited, Asia Fertilizer Co., Ltd., Kaset Thai International Sugar Corporation Public Company Limited, Thai Agro Industry Co., Ltd., Ubon Bio Ethanol Co., Ltd., Mitr Phol Group, PTT Global Chemical Public Company Limited, Intercontinental Chemical Co., Ltd., Thai Agro Chemicals Co., Ltd., Green Innovation Group Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand fertilizer and agro inputs market is poised for significant transformation as sustainability becomes a central focus. With the government's commitment to increasing organic farming and the adoption of precision agriculture technologies, the market is expected to evolve rapidly. By future, innovations in smart agriculture and eco-friendly fertilizers will likely reshape production practices, enhancing efficiency and reducing environmental impact. This shift will create new avenues for growth, particularly in organic and bio-based product segments, aligning with global sustainability trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers (Urea, Ammonium Nitrate, Ammonium Sulphate, Calcium Ammonium Nitrate) Phosphatic Fertilizers (DAP, MAP, SSP, TSP) Potassic Fertilizers (MOP, SOP, Others) Compound/Complex Fertilizers (NPK, NP, NK, PK) Organic Fertilizers (Compost, Manure, Green Manure, Others) Bio-fertilizers (Azospirillum, Rhizobium, Phosphate-solubilizing Bacteria, Others) Specialty Fertilizers (Micronutrients, Slow/Controlled Release, Water Soluble Fertilizers) Others |

| By Application | Cereals & Grains (Rice, Maize, Wheat, Others) Fruits & Vegetables Oilseeds & Pulses Plantation Crops (Rubber, Sugarcane, Others) Horticulture Turf and Ornamental Others |

| By End-User | Smallholder Farmers Commercial Farms & Agribusinesses Agricultural Cooperatives Government Agencies Others |

| By Distribution Channel | Direct Sales Retail Outlets (Agro Dealers, Cooperatives) Online Platforms Distributors/Wholesalers Others |

| By Packaging Type | Bulk Packaging Bagged Packaging (25kg, 50kg, Others) Liquid Packaging Others |

| By Price Range | Low Price Mid Price High Price |

| By Brand Loyalty | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 100 | Retail Managers, Store Owners |

| Agro Input Distribution Channels | 80 | Distributors, Supply Chain Managers |

| Farmers' Fertilizer Usage | 120 | Farm Owners, Agricultural Workers |

| Government Agricultural Policy Impact | 40 | Policy Makers, Agricultural Economists |

| Research Institutions and Universities | 40 | Researchers, Academic Professors |

The Thailand Fertilizer & Agro Inputs Market is valued at approximately USD 4.6 billion, driven by increasing food production demands due to population growth, urbanization, and the adoption of modern agricultural practices.