Region:Europe

Author(s):Dev

Product Code:KRAB6098

Pages:100

Published On:October 2025

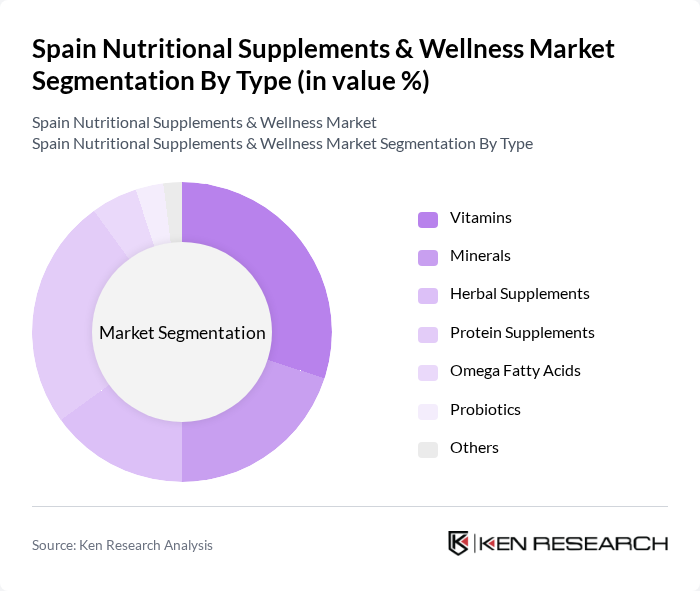

By Type:The market is segmented into various types of nutritional supplements, including Vitamins, Minerals, Herbal Supplements, Protein Supplements, Omega Fatty Acids, Probiotics, and Others. Among these, Vitamins and Protein Supplements are particularly dominant due to their widespread use among health-conscious consumers and athletes. The increasing awareness of the benefits of vitamins and proteins in maintaining health and enhancing physical performance has led to a surge in their consumption.

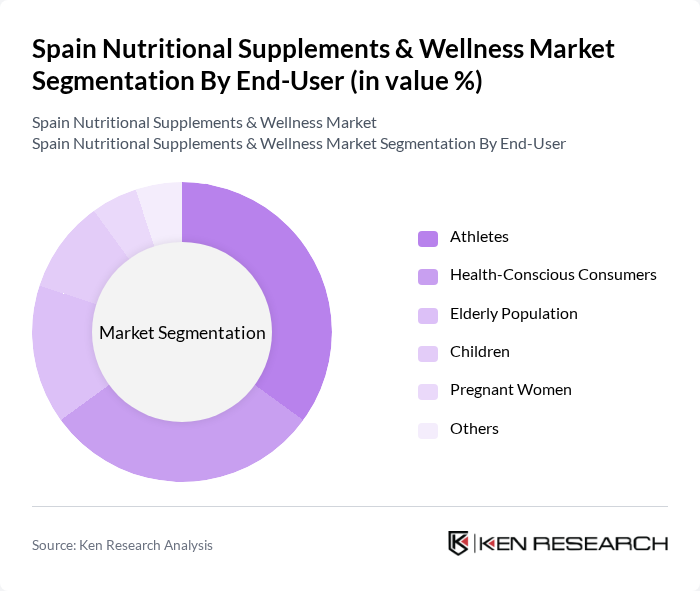

By End-User:The end-user segmentation includes Athletes, Health-Conscious Consumers, Elderly Population, Children, Pregnant Women, and Others. Athletes and Health-Conscious Consumers are the leading segments, driven by the increasing focus on fitness and nutrition. The growing trend of fitness and wellness among the general population has led to a higher demand for supplements that support athletic performance and overall health.

The Spain Nutritional Supplements & Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Nestlé S.A., Glanbia plc, GNC Holdings, Inc., DSM Nutritional Products AG, Nature's Bounty Co., Solgar Inc., USANA Health Sciences, Inc., Swisse Wellness Pty Ltd., Blackmores Limited, NOW Foods, Inc., Garden of Life, LLC, Optimum Nutrition, Inc., MusclePharm Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain nutritional supplements market appears promising, driven by ongoing trends in health awareness and preventive care. As consumers increasingly seek personalized health solutions, companies are likely to invest in innovative product formulations tailored to individual needs. Additionally, the integration of technology in health monitoring will enhance consumer engagement, allowing for more informed purchasing decisions. This evolving landscape presents opportunities for brands to differentiate themselves through quality and transparency, fostering long-term growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By End-User | Athletes Health-Conscious Consumers Elderly Population Children Pregnant Women Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Pharmacies Direct Sales Others |

| By Price Range | Budget Mid-Range Premium |

| By Formulation | Tablets Capsules Powders Liquids Gummies |

| By Targeted Health Benefit | Immune Support Digestive Health Weight Management Joint Health Cognitive Function |

| By Brand Loyalty | Brand Loyal Consumers Price-Sensitive Consumers New Entrants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Nutritional Supplements | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on Wellness Products | 100 | Store Managers, Product Buyers |

| Healthcare Professional Perspectives | 80 | Nutritionists, Dietitians, General Practitioners |

| Market Trends in Herbal Supplements | 70 | Herbal Product Manufacturers, Retailers |

| Impact of Digital Marketing on Supplement Sales | 90 | Marketing Managers, E-commerce Specialists |

The Spain Nutritional Supplements & Wellness Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by increasing health awareness and a shift towards preventive healthcare among consumers.