Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB2732

Pages:89

Published On:October 2025

By Type:The market is segmented into various types of nutritional supplements, including vitamins, minerals, herbal supplements, protein & amino acid supplements, omega fatty acids, probiotics & prebiotics, functional foods & beverages, weight management supplements, sports nutrition, and others. Among these,functional foods & beveragesandsports nutritionare experiencing the fastest growth, whilevitaminsandprotein supplementsremain particularly popular due to their perceived health benefits and widespread consumer acceptance. The market is also witnessing increased demand for iron-based and plant-derived supplements .

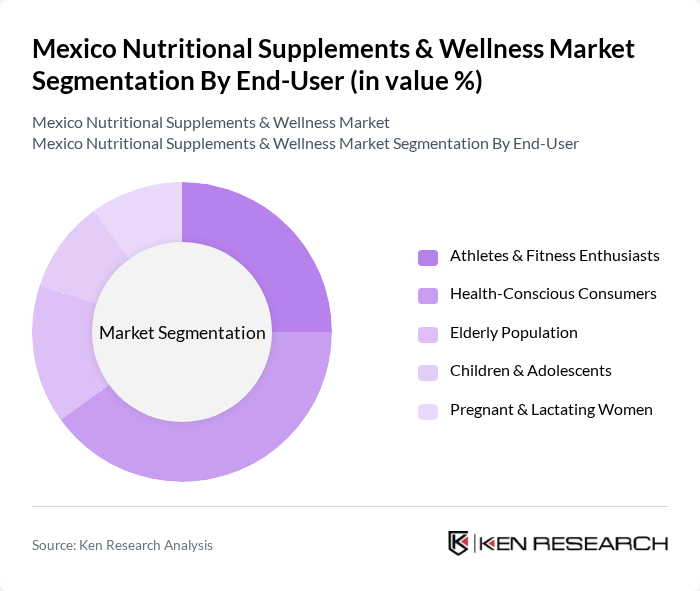

By End-User:The end-user segmentation includes athletes & fitness enthusiasts, health-conscious consumers, the elderly population, children & adolescents, and pregnant & lactating women. Thehealth-conscious consumersegment is the largest, driven by a growing awareness of health and wellness, leading to increased consumption of nutritional supplements across various demographics. There is also notable growth in demand among the elderly and sports-oriented consumers due to targeted product innovations .

The Mexico Nutritional Supplements & Wellness Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway de México S.A. de C.V., Nestlé S.A., GNC Holdings, LLC, Abbott Laboratories, Bayer AG, Glanbia plc, USANA Health Sciences, Inc., Nature's Way Products, LLC, Solgar Inc., NOW Foods, Garden of Life, LLC, MegaFood, NutraBio Labs, Inc., Jarrow Formulas, Inc., Genomma Lab Internacional, S.A.B. de C.V., Medix, S.A. de C.V., Pisa Farmacéutica, S.A. de C.V., Farmacias del Ahorro, Laboratorios Liomont, S.A. de C.V. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Mexico nutritional supplements market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As consumers continue to prioritize wellness, the demand for innovative and personalized supplements is expected to rise. Additionally, the growth of e-commerce platforms will facilitate easier access to products, enhancing market penetration. Companies that adapt to these trends and invest in consumer education will likely thrive in this evolving landscape, positioning themselves for long-term success.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics & Prebiotics Functional Foods & Beverages Weight Management Supplements Sports Nutrition Others |

| By End-User | Athletes & Fitness Enthusiasts Health-Conscious Consumers Elderly Population Children & Adolescents Pregnant & Lactating Women |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies & Drugstores Health Food Stores Direct Sales Specialty Stores |

| By Formulation | Tablets Capsules Powders Liquids Gummies & Chewables Softgels |

| By Age Group | Children Adults Seniors |

| By Price Range | Budget Mid-Range Premium |

| By Packaging Type | Bottles Blister Packs Pouches Sachets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutritional Supplement Retailers | 80 | Store Managers, Sales Representatives |

| Health and Wellness Professionals | 60 | Nutritionists, Dietitians |

| Consumers of Nutritional Supplements | 150 | Health-conscious Individuals, Fitness Enthusiasts |

| Distributors of Wellness Products | 40 | Supply Chain Managers, Product Managers |

| Online Retail Platforms | 40 | E-commerce Managers, Marketing Directors |

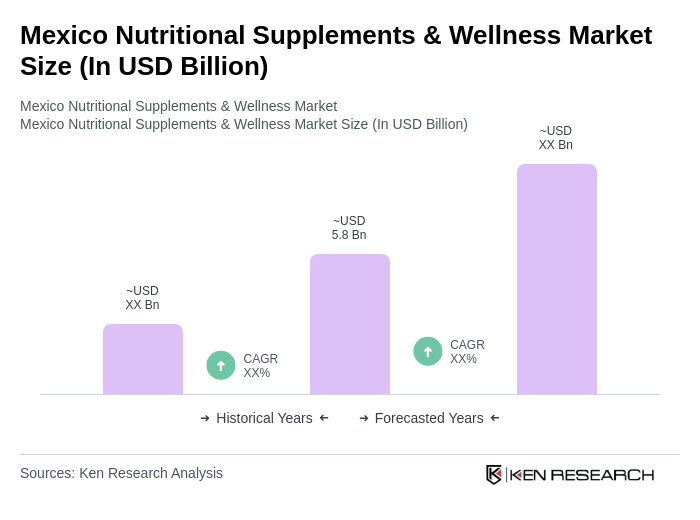

The Mexico Nutritional Supplements & Wellness Market is valued at approximately USD 5.8 billion, reflecting a significant growth trend driven by increasing health awareness and a shift towards preventive healthcare among consumers.