Region:Europe

Author(s):Geetanshi

Product Code:KRAA1944

Pages:90

Published On:August 2025

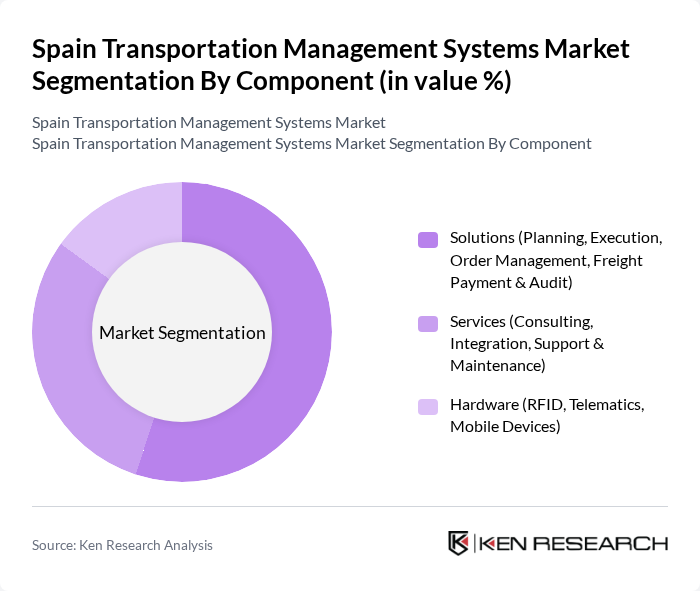

By Component:The components of transportation management systems include solutions, services, and hardware. Solutions encompass planning, execution, order management, and freight payment & audit. Services involve consulting, integration, support, and maintenance, while hardware includes RFID, telematics, and mobile devices. Thesolutions segment leads the market, driven by the need for comprehensive management tools that enhance operational efficiency, reduce costs, and enable real-time data analytics and automation for logistics providers and shippers .

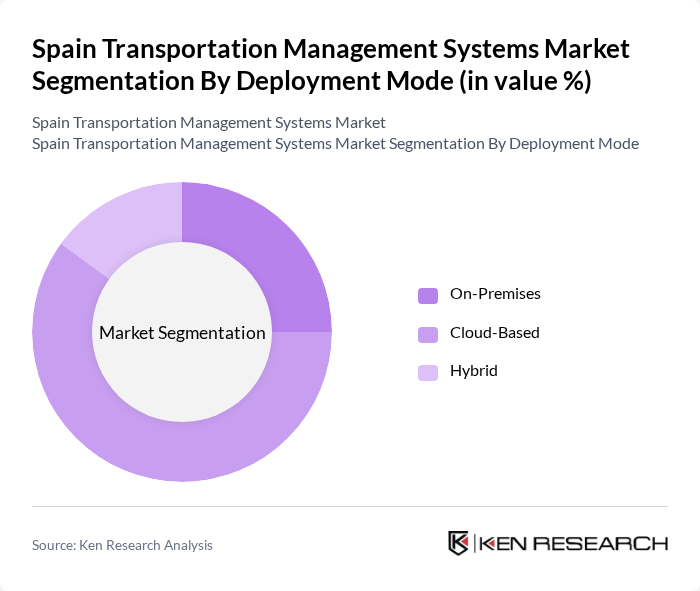

By Deployment Mode:The deployment modes for transportation management systems include on-premises, cloud-based, and hybrid solutions. Thecloud-based deployment modeis gaining significant traction due to its scalability, cost-effectiveness, and ease of integration with other digital supply chain systems. Organizations are increasingly adopting cloud-based TMS to support remote operations, real-time data exchange, and rapid system updates, making it the preferred choice for modern logistics and transportation management .

The Spain Transportation Management Systems market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Descartes Systems Group Inc., Trimble Inc., Transporeon GmbH, Generix Group, Alpega Group, Grupo Carreras, DHL Supply Chain Spain, Kuehne + Nagel Spain, Logista, Project44, FourKites, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transportation management systems market in Spain appears promising, driven by technological advancements and evolving consumer demands. As companies increasingly prioritize efficiency and sustainability, the integration of AI and IoT technologies into TMS will likely enhance operational capabilities. Furthermore, the ongoing expansion of e-commerce and cross-border trade will necessitate more sophisticated logistics solutions, positioning TMS as a critical component in the supply chain landscape for the coming years.

| Segment | Sub-Segments |

|---|---|

| By Component | Solutions (Planning, Execution, Order Management, Freight Payment & Audit) Services (Consulting, Integration, Support & Maintenance) Hardware (RFID, Telematics, Mobile Devices) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Mode of Transportation | Road Rail Air Sea |

| By Industry Vertical | Retail & E-commerce Manufacturing Logistics & Freight Forwarding Healthcare Construction Automotive Others |

| By Application | Route Optimization Freight Tracking Inventory Management Last-Mile Delivery Supply Chain Visibility Others |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Management | 90 | Logistics Managers, Fleet Operators |

| Rail Freight Systems | 50 | Operations Directors, Rail Network Planners |

| Air Cargo Management | 40 | Airline Logistics Coordinators, Cargo Managers |

| Public Transportation Systems | 45 | Transport Planners, City Officials |

| Smart Transportation Technologies | 55 | IT Managers, Technology Providers |

The Spain Transportation Management Systems market is valued at approximately USD 350 million, reflecting a significant growth driven by the increasing demand for efficient logistics, the expansion of e-commerce, and the need for real-time tracking and automation in transportation operations.