Region:Asia

Author(s):Dev

Product Code:KRAD0338

Pages:87

Published On:August 2025

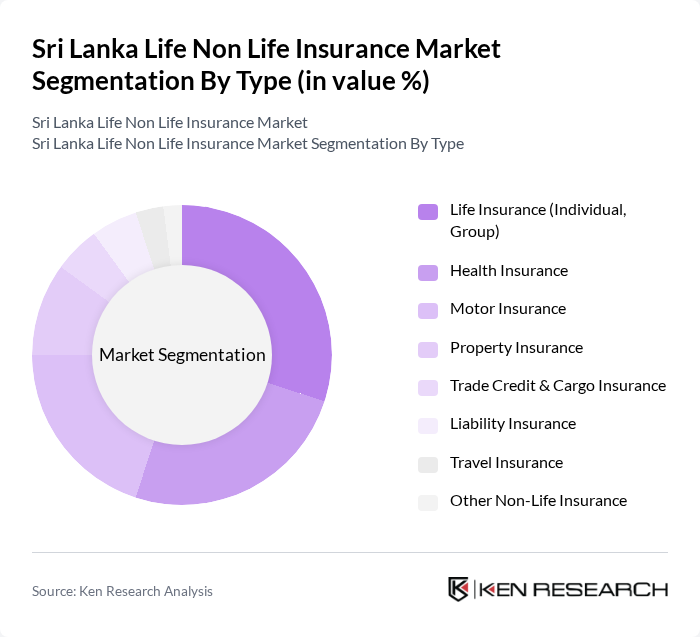

By Type:The market is segmented into Life Insurance (Individual, Group), Health Insurance, Motor Insurance, Property Insurance, Trade Credit & Cargo Insurance, Liability Insurance, Travel Insurance, and Other Non-Life Insurance. Each segment addresses distinct consumer and business needs, with life insurance focusing on long-term financial protection, health insurance covering medical expenses, motor insurance for vehicle-related risks, and property insurance safeguarding assets. Trade credit, cargo, liability, and travel insurance provide specialized coverage for commercial and personal risks, reflecting the broadening scope of insurance offerings in Sri Lanka .

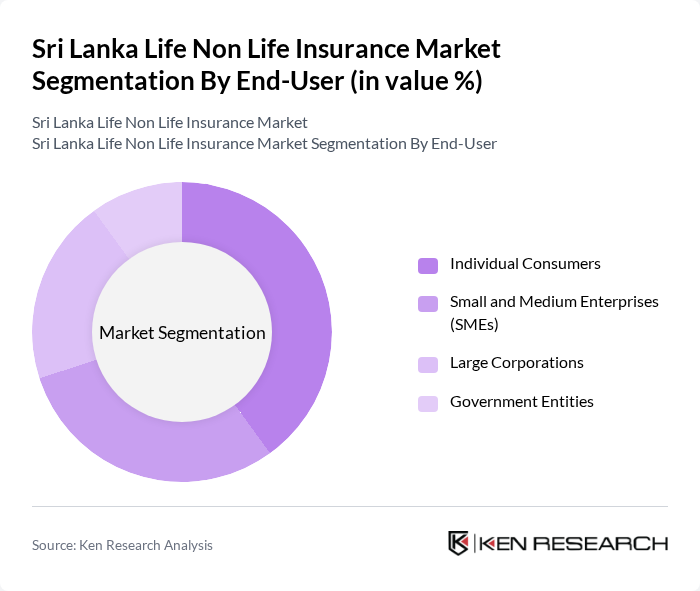

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Individual consumers primarily seek personal and family protection, SMEs and large corporations require comprehensive risk management for business continuity, and government entities focus on public sector risk coverage. This segmentation reflects the diverse insurance needs across Sri Lanka’s socio-economic landscape .

The Sri Lanka Life Non Life Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sri Lanka Insurance Corporation Ltd., Ceylinco Insurance PLC, HNB Assurance PLC, Janashakthi Insurance PLC, AIA Insurance Lanka PLC, Allianz Insurance Lanka Ltd., Union Assurance PLC, People’s Insurance PLC, LOLC General Insurance Ltd., Amana Takaful PLC, Orient Insurance Ltd., National Insurance Trust Fund (NITF), Fairfirst Insurance Ltd., Sanasa Insurance Company Ltd., Continental Insurance Lanka Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Sri Lankan life and non-life insurance market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital platforms gain traction, insurers are expected to enhance their online service offerings, catering to a tech-savvy population. Additionally, the increasing demand for personalized insurance products will encourage innovation, allowing companies to tailor solutions that meet specific customer needs. This dynamic environment presents opportunities for growth and improved customer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Life Insurance (Individual, Group) Health Insurance Motor Insurance Property Insurance Trade Credit & Cargo Insurance Liability Insurance Travel Insurance Other Non-Life Insurance |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Distribution Channel | Direct Sales Agency Brokers Bancassurance Online/Digital Platforms |

| By Policy Duration | Short-Term Policies Long-Term Policies |

| By Premium Payment Frequency | Monthly Payments Quarterly Payments Annual Payments |

| By Coverage Type | Comprehensive Coverage Basic Coverage |

| By Customer Segment | High Net-Worth Individuals Middle-Class Families Low-Income Households |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Policyholders | 100 | Individuals aged 25-60, Middle to Upper Income |

| Non-Life Insurance Customers | 80 | Small Business Owners, Property Owners |

| Insurance Agents and Brokers | 60 | Insurance Sales Professionals, Agency Managers |

| Regulatory Stakeholders | 40 | Officials from the Insurance Regulatory Commission |

| Insurance Industry Experts | 40 | Consultants, Academics specializing in Insurance |

The Sri Lanka Life Non-Life Insurance Market is valued at approximately USD 1.3 billion, reflecting a steady growth driven by increased awareness of insurance products, rising disposable incomes, and supportive government policies.