Region:Europe

Author(s):Rebecca

Product Code:KRAD0264

Pages:89

Published On:August 2025

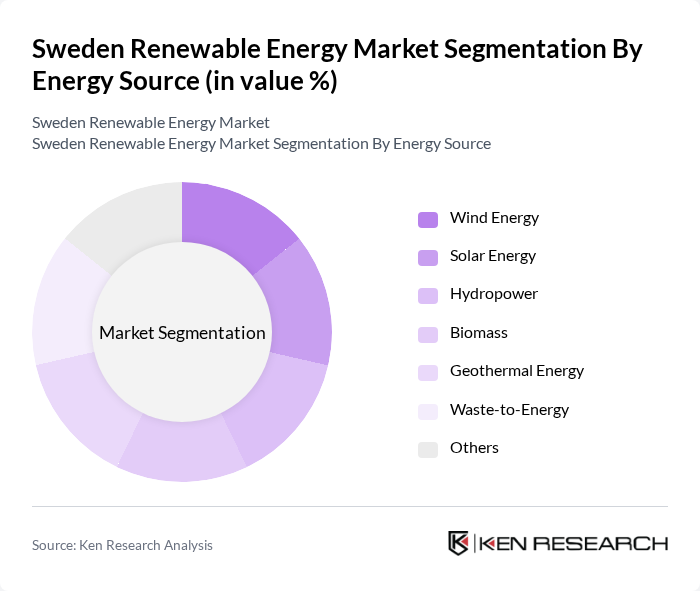

By Energy Source:The energy source segmentation includes various renewable energy types such as wind energy, solar energy, hydropower, biomass, geothermal energy, waste-to-energy, and others. Among these, wind energy remains the dominant segment due to Sweden's extensive coastline and favorable wind conditions, leading to significant investments in both onshore and offshore wind farms. Hydropower continues to play a foundational role, while solar energy is gaining traction, particularly in urban areas where rooftop installations are increasingly popular. The diversification of energy sources is crucial for achieving energy security and sustainability .

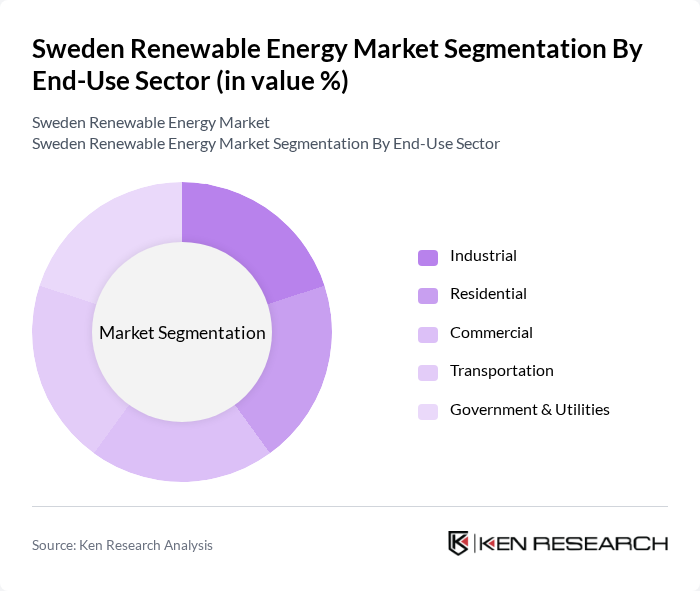

By End-Use Sector:The end-use sector segmentation encompasses residential, commercial, industrial, transportation, and government & utilities. The industrial sector is currently the leading segment, driven by the electrification of industrial processes and the rollout of green hydrogen projects. The residential sector is also expanding, supported by government incentives for solar panel installations and increasing consumer awareness. The commercial sector continues to grow as businesses seek to reduce energy costs and enhance sustainability. The transportation sector is witnessing a shift towards electric vehicles powered by renewable energy .

The Sweden Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vattenfall AB, E.ON Sverige AB, Fortum Sverige AB, Ørsted A/S, Statkraft AS, Uniper SE, Skellefteå Kraft AB, Jämtkraft AB, Soltech Energy Sweden AB, Eolus Vind AB, Svea Solar AB, Nordic Solar AS, Green Energy Nordic AB, Alight Energy AB, OX2 AB, Cloudberry Clean Energy ASA, Scandinavian Biogas Fuels International AB, and Scania AB contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Sweden renewable energy market appears promising, driven by a combination of technological advancements and increasing public support for sustainable practices. As the government continues to invest in infrastructure and incentivize renewable energy projects, the market is expected to see significant growth. Additionally, the integration of smart grid technologies and decentralized energy production will enhance efficiency and reliability, paving the way for a more resilient energy landscape in Sweden.

| Segment | Sub-Segments |

|---|---|

| By Energy Source | Wind Energy Solar Energy Hydropower Biomass Geothermal Energy Waste-to-Energy Others |

| By End-Use Sector | Residential Commercial Industrial Transportation Government & Utilities |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects |

| By Investment Source | Domestic Foreign Direct Investment (FDI) Public-Private Partnership (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Credits (RECs) |

| By Distribution Mode | Direct Sales Online Sales Distributors |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wind Energy Project Developers | 60 | Project Managers, Business Development Managers |

| Solar Energy Installers | 50 | Installation Managers, Sales Directors |

| Hydropower Operators | 40 | Operations Managers, Regulatory Compliance Officers |

| Energy Policy Experts | 40 | Government Officials, Policy Analysts |

| Renewable Energy Investors | 45 | Investment Analysts, Portfolio Managers |

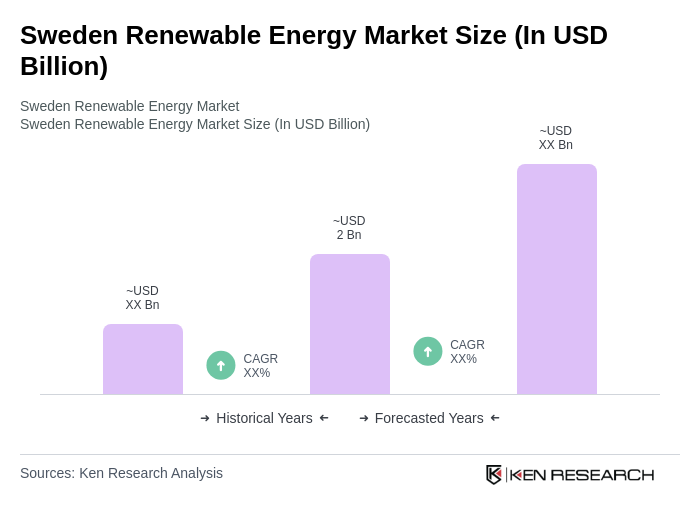

The Sweden Renewable Energy Market is valued at approximately USD 2 billion, reflecting significant growth driven by government incentives, investments in renewable technologies, and a strong commitment to sustainability and decarbonization efforts.