Region:Europe

Author(s):Dev

Product Code:KRAB0390

Pages:97

Published On:August 2025

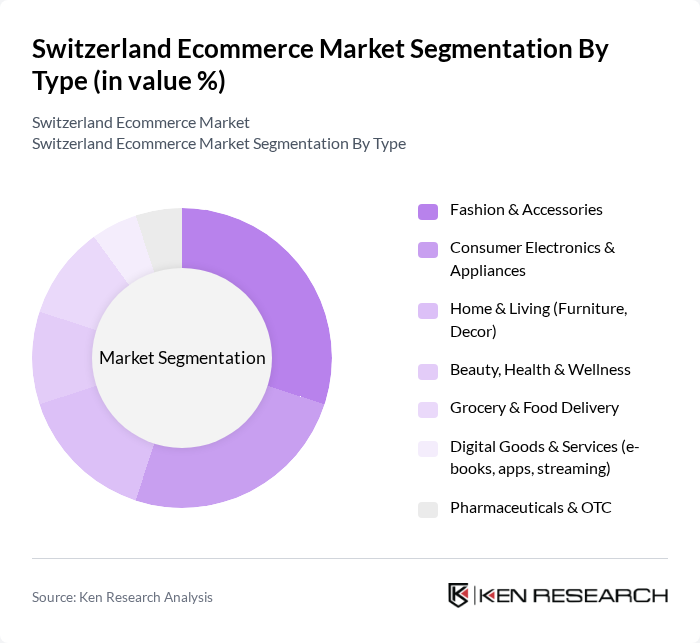

By Type:The ecommerce market in Switzerland can be segmented into various types, including Fashion & Accessories, Consumer Electronics & Appliances, Home & Living, Beauty, Health & Wellness, Grocery & Food Delivery, Digital Goods & Services, and Pharmaceuticals & OTC. Each of these segments caters to different consumer needs and preferences, contributing to the overall market dynamics.

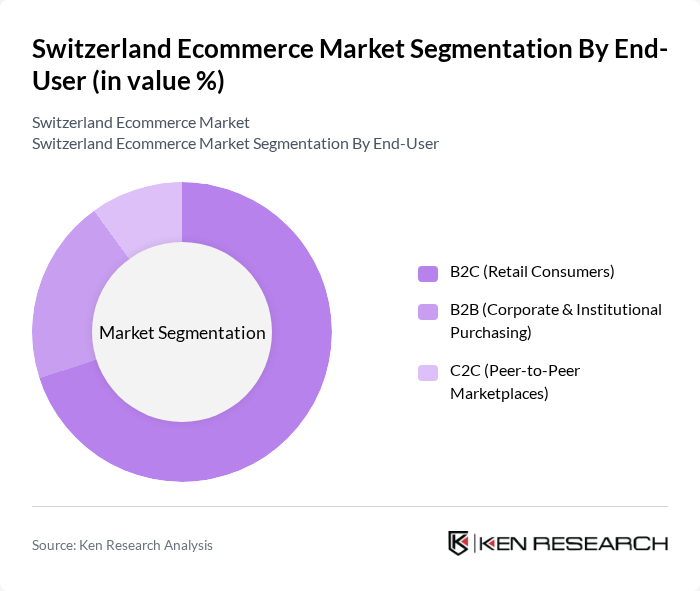

By End-User:The ecommerce market can also be segmented by end-user categories, which include B2C (Retail Consumers), B2B (Corporate & Institutional Purchasing), and C2C (Peer-to-Peer Marketplaces). Each segment serves distinct customer bases and has unique purchasing behaviors, influencing the overall market landscape.

The Switzerland Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coop Group (coop.ch, Coop Online Supermarket), Migros (migros.ch, Migros Online/LeShop), Digitec Galaxus AG (digitec.ch, galaxus.ch), Zalando SE (Switzerland), Amazon (Cross-Border to Switzerland), Manor AG (manor.ch), BRACK.CH AG (brack.ch), Ricardo AG (ricardo.ch), Swiss Post (Post CH AG, PostShop/Logistics for E-commerce), Interdiscount (interdiscount.ch), MediaMarkt Schweiz (mediamarkt.ch), Dipl. Ing. Fust AG (fust.ch), Nespresso (Nestlé Nespresso SA, nespresso.com/ch), Microspot.ch (microspot.ch), IKEA Switzerland (ikea.com/ch) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Swiss ecommerce market appears promising, driven by technological advancements and evolving consumer behaviors. As more businesses adopt AI and machine learning, personalized shopping experiences will become the norm, enhancing customer satisfaction and loyalty. Additionally, the increasing focus on sustainability will likely shape product offerings, as consumers demand eco-friendly options. The integration of omnichannel strategies will further enable retailers to provide seamless shopping experiences, bridging online and offline channels effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion & Accessories Consumer Electronics & Appliances Home & Living (Furniture, Decor) Beauty, Health & Wellness Grocery & Food Delivery Digital Goods & Services (e-books, apps, streaming) Pharmaceuticals & OTC |

| By End-User | B2C (Retail Consumers) B2B (Corporate & Institutional Purchasing) C2C (Peer-to-Peer Marketplaces) |

| By Sales Channel | Direct-to-Consumer (Brand .ch sites) Marketplaces (Domestic & Cross-Border) Social Commerce & Live Shopping |

| By Payment Method | Cards (Credit/Debit) E-Wallets & Mobile Payments (TWINT, Apple Pay, Google Pay) Bank Transfers & eBill Invoice/Buy Now Pay Later |

| By Delivery Method | Standard Home Delivery Express & Same-Day Delivery Click & Collect / Pick-up Points (PUDO, parcel lockers) |

| By Customer Demographics | Age Groups (Gen Z, Millennials, Gen X, Seniors) Income Levels Geographic Distribution (German-, French-, Italian-speaking regions) |

| By Product Category | Electronics & IT Fashion & Footwear Home, Garden & DIY Health, Beauty & Personal Care Sports, Outdoors & Hobbies Food & Beverages |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer E-commerce Behavior | 150 | Online Shoppers, Frequent Buyers |

| SME E-commerce Adoption | 100 | Business Owners, E-commerce Managers |

| Logistics and Fulfillment Insights | 80 | Logistics Coordinators, Supply Chain Managers |

| Digital Payment Preferences | 70 | Finance Managers, Payment Solution Providers |

| Market Trends and Innovations | 60 | Industry Analysts, E-commerce Consultants |

The Switzerland Ecommerce Market is valued at approximately USD 16 billion, reflecting significant growth driven by increased internet penetration, mobile commerce, and changing consumer preferences towards online shopping.