Region:Europe

Author(s):Dev

Product Code:KRAC0459

Pages:99

Published On:August 2025

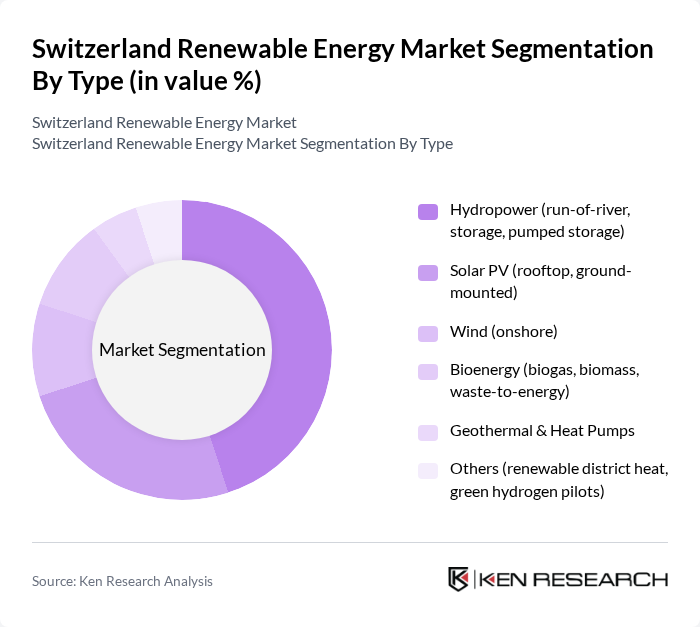

By Type:The market is segmented into various types of renewable energy sources, including hydropower, solar PV, wind, bioenergy, geothermal, and others. Each type plays a crucial role in the overall energy landscape, with hydropower being the most dominant due to Switzerland's mountainous geography and extensive run-of-river and storage capacity. Solar PV is also gaining traction, particularly on rooftops and alpine installations, as technology advances, costs decline, and policy support accelerates deployment.

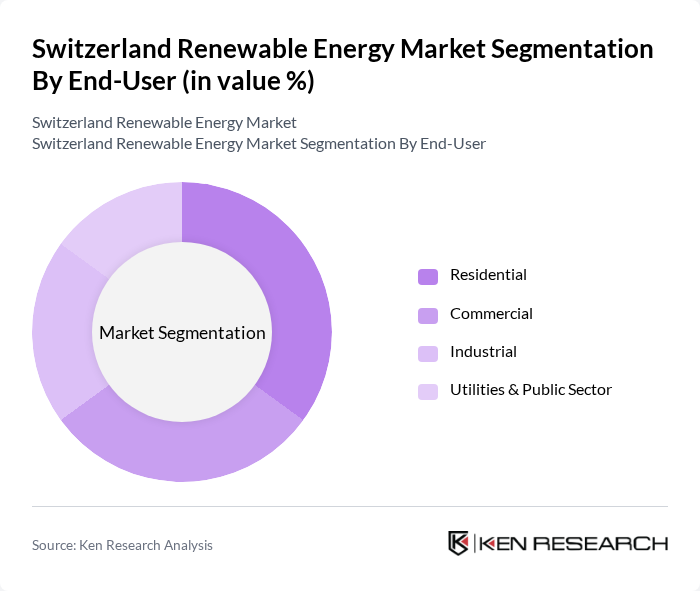

By End-User:The end-user segmentation includes residential, commercial, industrial, and utilities/public sector consumers. The residential sector is increasingly adopting renewable energy solutions, driven by government incentives and a growing awareness of sustainability. The commercial sector follows closely, with businesses seeking to reduce their carbon footprint and energy costs.

The Switzerland Renewable Energy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Axpo Holding AG, Alpiq Holding AG, BKW AG, Repower AG, CKW AG (Centralschweizerische Kraftwerke AG), Energie Wasser Bern (ewb), IWB Industrielle Werke Basel, Groupe E SA, Romande Energie Holding SA, SIG – Services Industriels de Genève, Swissgrid AG, Nant de Drance SA, JUWI AG (Switzerland) / JUWI Energie Rinnovabili Swiss, Helion Energy AG (A BKW Company), Swissolar (Swiss Solar Industry Association) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the renewable energy market in Switzerland appears promising, with a strong emphasis on sustainability and innovation. In the future, the integration of smart grid technologies is expected to enhance energy efficiency and reliability. Additionally, the expansion of community solar projects will empower local stakeholders, fostering greater public engagement. As the government continues to support renewable initiatives, the market is likely to witness increased collaboration between public and private sectors, driving further advancements in clean energy solutions.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydropower (run-of-river, storage, pumped storage) Solar PV (rooftop, ground-mounted) Wind (onshore) Bioenergy (biogas, biomass, waste-to-energy) Geothermal & Heat Pumps Others (renewable district heat, green hydrogen pilots) |

| By End-User | Residential Commercial Industrial Utilities & Public Sector |

| By Application | Grid-Connected (feed-in/remuneration, market premium) Self-Consumption / Behind-the-Meter Off-Grid / Remote & Alpine Sites Utility-Scale Projects |

| By Investment Source | Domestic (utilities, cooperatives) Foreign Direct Investment (FDI) Public–Private Partnerships (PPP) Government Programs & Incentives |

| By Policy Support | Investment Contributions/Subsidies Tax Incentives & Depreciation Feed-in Remuneration / Market Premium Guarantees of Origin (GoO) / Green Certificates |

| By Distribution Mode | Direct EPC & Utility Procurement Installer/Integrator Networks Online Sales & Marketplaces Distributors & Wholesalers |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Solar Energy Installations | 150 | Project Managers, Solar Technicians |

| Wind Energy Projects | 100 | Operations Managers, Environmental Consultants |

| Hydropower Facilities | 80 | Facility Managers, Regulatory Affairs Specialists |

| Biomass Energy Producers | 70 | Production Managers, Sustainability Officers |

| Energy Storage Solutions | 90 | Product Development Managers, Energy Analysts |

The Switzerland Renewable Energy Market is valued at approximately USD 2 billion, reflecting a significant growth driven by government incentives, public demand for sustainability, and increased investments in renewable technologies.