Region:Asia

Author(s):Rebecca

Product Code:KRAD0195

Pages:83

Published On:August 2025

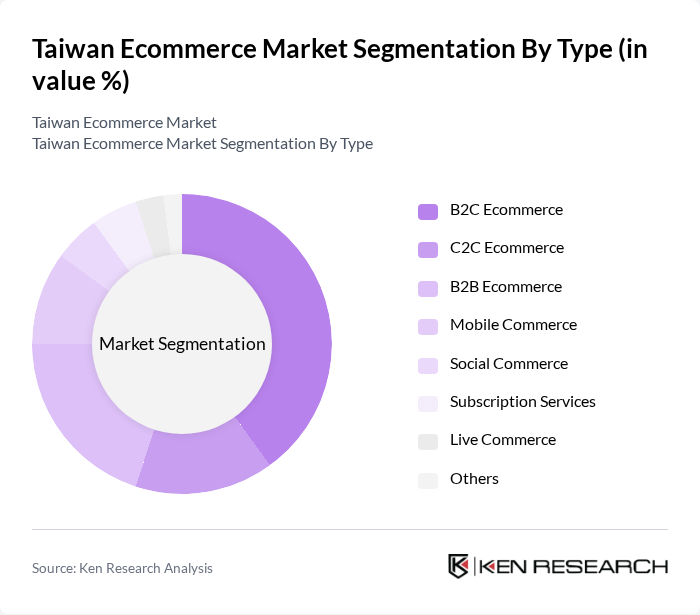

By Type:The ecommerce market in Taiwan can be segmented into B2C Ecommerce, C2C Ecommerce, B2B Ecommerce, Mobile Commerce, Social Commerce, Subscription Services, Live Commerce, and Others. B2C Ecommerce remains the largest segment, driven by established online retailers and branded platforms. C2C Ecommerce is supported by peer-to-peer marketplaces. B2B Ecommerce is expanding with digital procurement and supply chain solutions. Mobile Commerce is rapidly growing due to high smartphone penetration and app-based shopping. Social Commerce leverages social media platforms for direct sales, while Subscription Services and Live Commerce cater to evolving consumer preferences for convenience and interactive shopping experiences.

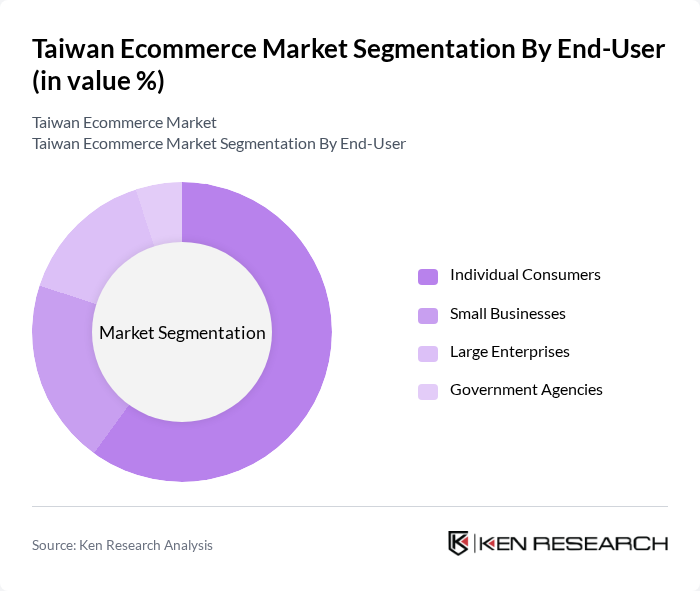

By End-User:The end-user segmentation of the ecommerce market includes Individual Consumers, Small Businesses, Large Enterprises, and Government Agencies. Individual Consumers account for the majority of transactions, reflecting high online shopping penetration and preference for convenience. Small Businesses and Large Enterprises utilize ecommerce for procurement and sales channel expansion, while Government Agencies increasingly adopt digital platforms for procurement and service delivery.

The Taiwan Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as PChome Online Inc., Momo.com Inc., Shopee Taiwan, Yahoo!?????? (Yahoo! Taiwan Shopping Center), Rakuten Taiwan, Amazon Global Store Taiwan, 17LIVE, Pinkoi, Carousell Taiwan, UDN Shopping (udn???), ETMall (?????), FunNow, iHerb Taiwan, Books.com.tw (???), and Klook Taiwan contribute to innovation, geographic expansion, and service delivery in this space.

The future of Taiwan's ecommerce market appears promising, driven by technological advancements and evolving consumer preferences. As artificial intelligence and big data analytics become more integrated into ecommerce platforms, businesses can offer personalized shopping experiences, enhancing customer engagement. Furthermore, the rise of sustainability initiatives is likely to influence purchasing decisions, with consumers increasingly favoring eco-friendly products. These trends suggest a dynamic and adaptive market landscape, positioning Taiwan as a key player in the regional ecommerce ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | B2C Ecommerce C2C Ecommerce B2B Ecommerce Mobile Commerce Social Commerce Subscription Services Live Commerce Others |

| By End-User | Individual Consumers Small Businesses Large Enterprises Government Agencies |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms Mobile Apps Live Streaming Platforms |

| By Product Category | Electronics & Gadgets Fashion and Apparel Home & Garden Beauty & Personal Care Food & Drink Health Products Digital Products Sports & Outdoor Others |

| By Payment Method | Credit/Debit Cards E-Wallets (e.g., LINE Pay, Apple Pay, Google Pay) Bank Transfers Cash on Delivery Buy Now, Pay Later |

| By Delivery Method | Standard Shipping Express Delivery Click and Collect Same-Day Delivery Locker Pickup |

| By Customer Demographics | Age Groups Income Levels Geographic Locations Lifestyle Segments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retailers | 120 | E-commerce Managers, Marketing Directors |

| Logistics Providers | 90 | Operations Managers, Supply Chain Analysts |

| Consumer Electronics Purchasers | 70 | Online Shoppers, Product Reviewers |

| Fashion E-commerce Stakeholders | 60 | Brand Managers, Retail Buyers |

| SME E-commerce Participants | 50 | Business Owners, Digital Marketing Specialists |

The Taiwan Ecommerce Market is valued at approximately USD 50 billion, reflecting significant growth driven by increased internet penetration, smartphone adoption, and consumer trust in digital transactions.