Region:Asia

Author(s):Rebecca

Product Code:KRAA6878

Pages:85

Published On:September 2025

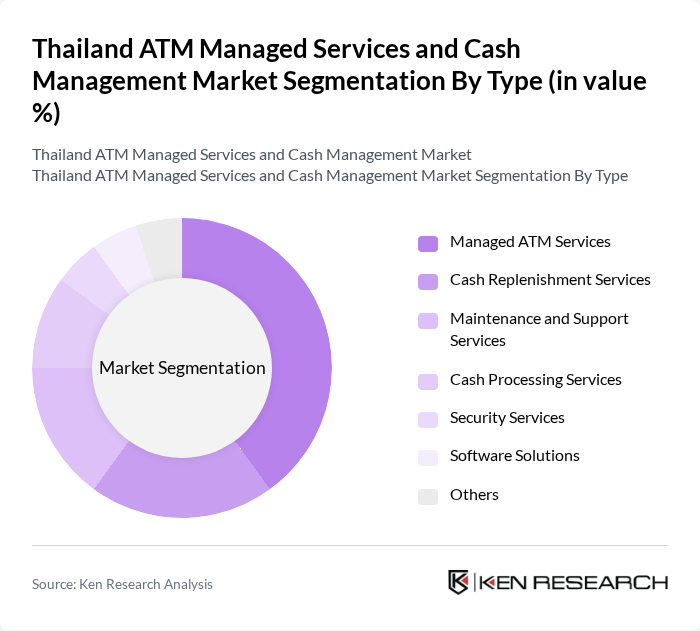

By Type:The market is segmented into various types of services that cater to the needs of financial institutions and businesses. The primary subsegments include Managed ATM Services, Cash Replenishment Services, Maintenance and Support Services, Cash Processing Services, Security Services, Software Solutions, and Others. Among these, Managed ATM Services is the leading subsegment, driven by the increasing demand for outsourcing ATM management to enhance operational efficiency and reduce costs.

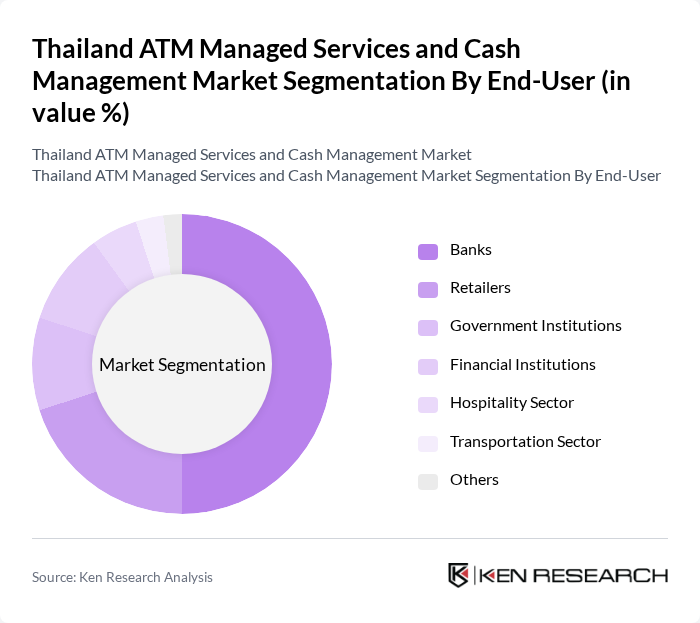

By End-User:The end-user segmentation includes Banks, Retailers, Government Institutions, Financial Institutions, Hospitality Sector, Transportation Sector, and Others. Banks are the dominant end-user segment, as they require comprehensive ATM management and cash handling solutions to serve their vast customer base efficiently and securely.

The Thailand ATM Managed Services and Cash Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kasikorn Bank, Bangkok Bank, Siam Commercial Bank, Krung Thai Bank, TMBThanachart Bank, SCB Abacus, G4S Cash Solutions (Thailand) Ltd., Securitas Thailand, Diebold Nixdorf, NCR Corporation, Hitachi Payment Services, Thales Group, FIS Global, ACI Worldwide, Verifone contribute to innovation, geographic expansion, and service delivery in this space.

The future of Thailand's ATM managed services and cash management market appears promising, driven by ongoing technological advancements and a shift towards integrated solutions. As the demand for cashless transactions continues to rise, service providers are likely to enhance their offerings, focusing on customer experience and operational efficiency. Additionally, the expansion of banking infrastructure into underserved areas will create new opportunities for growth, while regulatory support for digital payments will further bolster market development in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash Replenishment Services Maintenance and Support Services Cash Processing Services Security Services Software Solutions Others |

| By End-User | Banks Retailers Government Institutions Financial Institutions Hospitality Sector Transportation Sector Others |

| By Service Model | Full-Service ATM Management Hybrid Service Model Cash-in-Transit Services Outsourced Cash Management Others |

| By Payment Method | Cash Transactions Card Transactions Mobile Payments Digital Wallets Others |

| By Region | Central Thailand Northern Thailand Northeastern Thailand Southern Thailand Eastern Thailand Western Thailand Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations Non-Profit Organizations Others |

| By Cash Management Solution | Cash Forecasting Solutions Cash Logistics Solutions Cash Recycling Solutions Cash Handling Equipment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 150 | ATM Managers, Operations Directors |

| Cash Management Service Providers | 100 | Service Delivery Managers, Business Development Heads |

| Retail Sector ATM Usage | 80 | Retail Managers, Financial Officers |

| Regulatory Compliance in ATM Services | 60 | Compliance Officers, Risk Management Executives |

| Technology Providers for ATM Solutions | 70 | Product Managers, Technical Directors |

The Thailand ATM Managed Services and Cash Management Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and the rise in cashless transactions.