Region:Europe

Author(s):Dev

Product Code:KRAB6005

Pages:91

Published On:October 2025

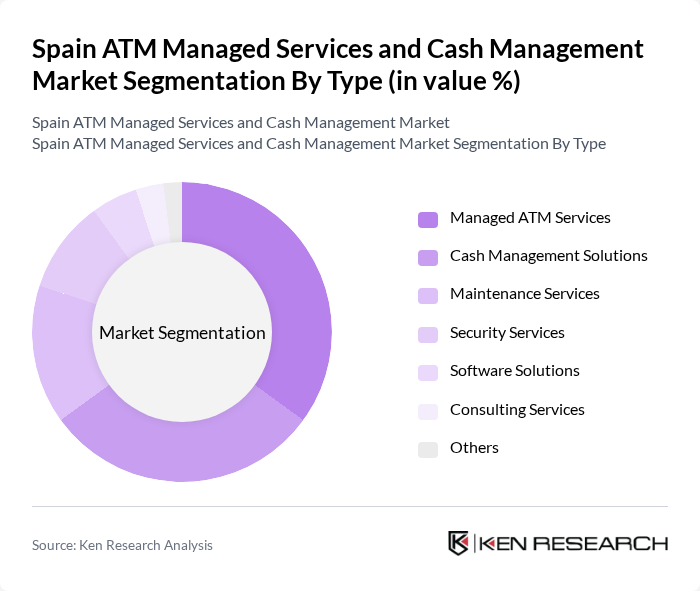

By Type:The market is segmented into various types, including Managed ATM Services, Cash Management Solutions, Maintenance Services, Security Services, Software Solutions, Consulting Services, and Others. Among these, Managed ATM Services and Cash Management Solutions are the most prominent, driven by the increasing need for efficient cash handling and operational management.

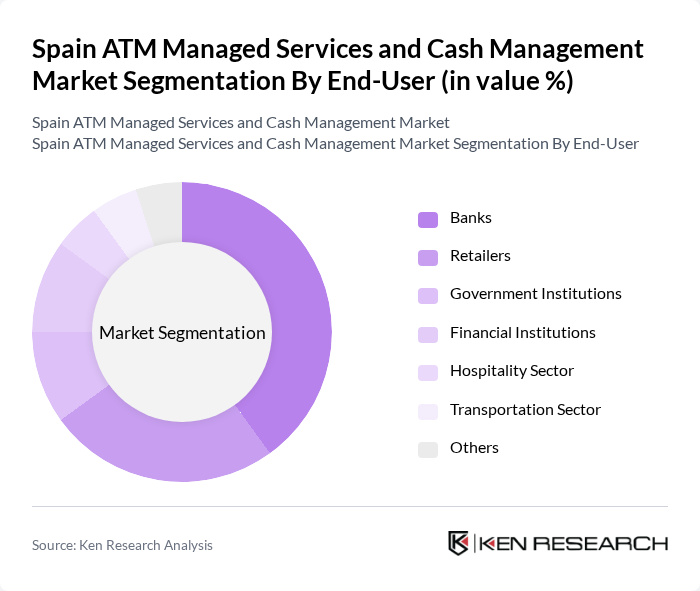

By End-User:The end-user segmentation includes Banks, Retailers, Government Institutions, Financial Institutions, Hospitality Sector, Transportation Sector, and Others. Banks and Retailers are the leading segments, as they require robust ATM and cash management solutions to cater to their customer base and ensure smooth financial transactions.

The Spain ATM Managed Services and Cash Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Prosegur Cash, SITA, G4S Cash Solutions, Loomis, Diebold Nixdorf, NCR Corporation, ATOS, Verifone, Ingenico, CashGuard, Cennox, CashTech, ACI Worldwide, FIS, Worldline contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ATM managed services and cash management market in Spain appears promising, driven by ongoing technological advancements and a growing preference for integrated cash management solutions. As banks increasingly adopt AI and machine learning to enhance operational efficiency, the market is likely to witness a surge in demand for innovative services. Additionally, the focus on sustainability will shape the development of eco-friendly ATM solutions, aligning with broader environmental goals and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash Management Solutions Maintenance Services Security Services Software Solutions Consulting Services Others |

| By End-User | Banks Retailers Government Institutions Financial Institutions Hospitality Sector Transportation Sector Others |

| By Service Model | Full-Service ATM Management Cash Replenishment Services Remote Monitoring Services On-Site Support Services Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Tourist Areas Others |

| By Payment Method | Cash Transactions Card Transactions Mobile Payments Digital Wallets Others |

| By Customer Segment | Individual Consumers Small Businesses Large Enterprises Non-Profit Organizations Others |

| By Contract Type | Long-Term Contracts Short-Term Contracts Pay-Per-Use Contracts Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Management | 150 | ATM Operations Managers, Financial Analysts |

| Cash Logistics Providers | 100 | Logistics Coordinators, Operations Directors |

| Retail Cash Management Solutions | 80 | Retail Managers, Financial Controllers |

| Technology Providers for ATM Services | 70 | Product Managers, Technical Directors |

| Regulatory Bodies and Compliance Officers | 50 | Compliance Managers, Regulatory Affairs Specialists |

The Spain ATM Managed Services and Cash Management Market is valued at approximately USD 1.5 billion, reflecting a significant growth driven by the increasing demand for efficient cash management solutions and the rising number of ATMs in urban and suburban areas.