Region:Middle East

Author(s):Dev

Product Code:KRAA5646

Pages:80

Published On:September 2025

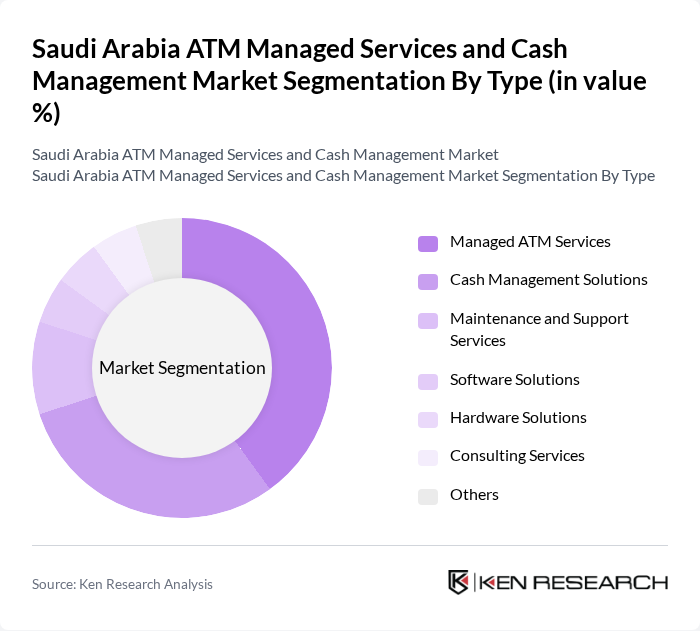

By Type:The market is segmented into various types, including Managed ATM Services, Cash Management Solutions, Maintenance and Support Services, Software Solutions, Hardware Solutions, Consulting Services, and Others. Among these, Managed ATM Services and Cash Management Solutions are the most prominent, driven by the increasing need for operational efficiency and cost reduction in banking operations.

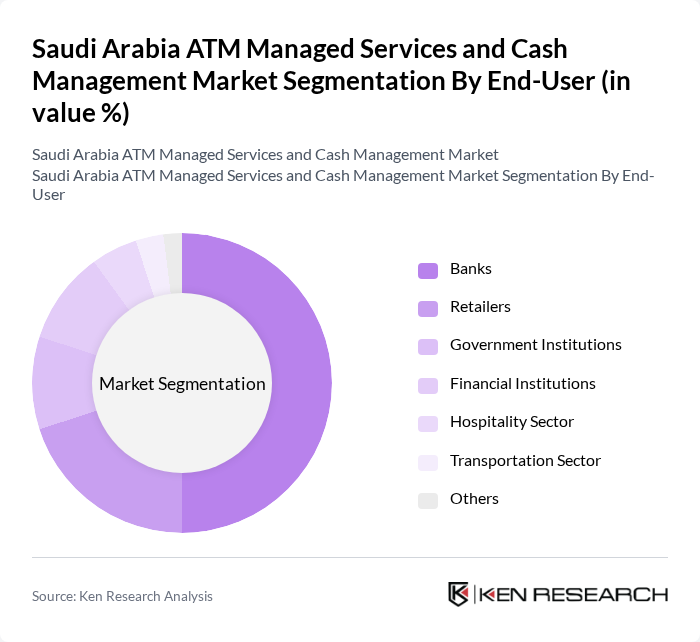

By End-User:The end-user segmentation includes Banks, Retailers, Government Institutions, Financial Institutions, Hospitality Sector, Transportation Sector, and Others. Banks are the leading end-users, as they require robust ATM management and cash handling solutions to enhance customer service and operational efficiency.

The Saudi Arabia ATM Managed Services and Cash Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, Diebold Nixdorf, GRG Banking Equipment, Hitachi-Omron Terminal Solutions, Fujitsu Limited, Wincor Nixdorf, Cennox, Cardtronics, S1 Corporation, TMD Security, G4S Cash Solutions, Loomis, Brinks, Euronet Worldwide, Cash Connect contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ATM managed services and cash management market in Saudi Arabia appears promising, driven by ongoing technological advancements and a strong push for financial inclusion. As digital payment adoption continues to rise, financial institutions are likely to invest in integrated cash management solutions that leverage AI and machine learning. Additionally, the government's commitment to enhancing banking infrastructure will further support the expansion of ATM networks, ensuring that cash management services remain relevant and efficient in a rapidly evolving financial landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash Management Solutions Maintenance and Support Services Software Solutions Hardware Solutions Consulting Services Others |

| By End-User | Banks Retailers Government Institutions Financial Institutions Hospitality Sector Transportation Sector Others |

| By Service Model | Full-Service ATM Management Cash Replenishment Services Remote Monitoring Services On-Site Maintenance Services Others |

| By Deployment Mode | On-Premise Cloud-Based Hybrid Others |

| By Payment Method | Cash Transactions Card Transactions Mobile Payments Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Customer Segment | Individual Customers Small and Medium Enterprises Large Corporations Government Agencies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Management | 150 | ATM Operations Managers, Banking Executives |

| Cash Management Solutions | 100 | Cash Management Officers, Financial Analysts |

| Retail ATM Deployment | 80 | Retail Managers, Financial Services Directors |

| Technology Providers for ATM Services | 70 | Product Managers, Technology Officers |

| Regulatory Compliance in Cash Management | 60 | Compliance Officers, Risk Management Executives |

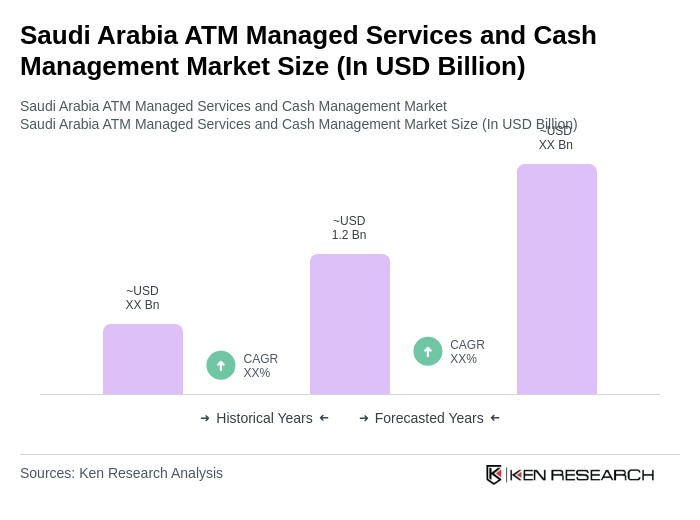

The Saudi Arabia ATM Managed Services and Cash Management Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and the demand for efficient cash management systems.