Region:Asia

Author(s):Shubham

Product Code:KRAA6233

Pages:83

Published On:September 2025

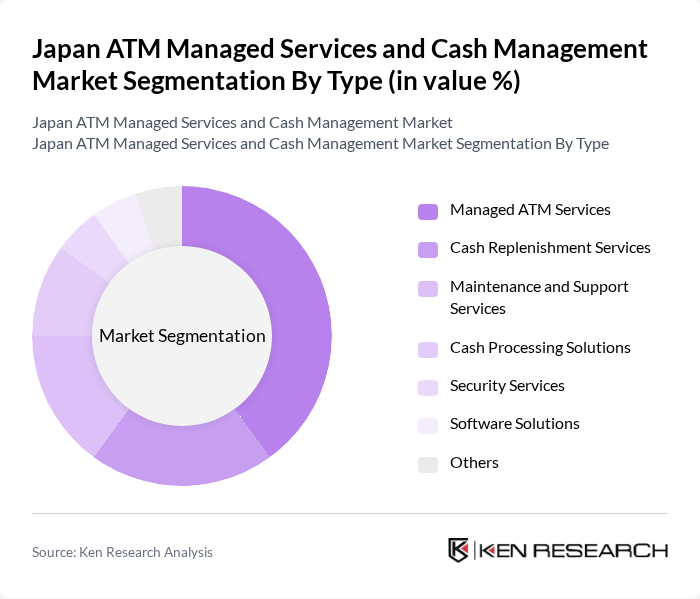

By Type:The market is segmented into various types of services that cater to the needs of financial institutions and businesses. The primary subsegments include Managed ATM Services, Cash Replenishment Services, Maintenance and Support Services, Cash Processing Solutions, Security Services, Software Solutions, and Others. Among these, Managed ATM Services is the leading subsegment, driven by the increasing reliance on outsourced ATM management to enhance operational efficiency and reduce costs.

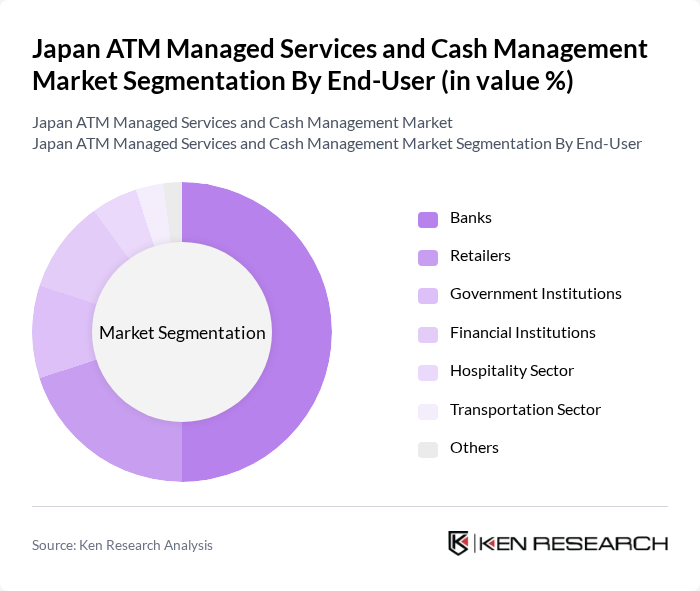

By End-User:The end-user segmentation includes Banks, Retailers, Government Institutions, Financial Institutions, Hospitality Sector, Transportation Sector, and Others. Banks are the dominant end-user segment, as they require comprehensive ATM management and cash handling solutions to ensure seamless operations and customer satisfaction. The increasing number of ATMs and the need for efficient cash flow management in banks drive this segment's growth.

The Japan ATM Managed Services and Cash Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hitachi Payment Services, Fujitsu Limited, NTT Data Corporation, Diebold Nixdorf, NCR Corporation, Toshiba TEC Corporation, SEIKO EPSON Corporation, Oki Electric Industry Co., Ltd., ACI Worldwide, S1 Corporation, Verifone Systems, Inc., Ingenico Group, Euronet Worldwide, Inc., Cardtronics, Global Cash Access Holdings, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan ATM managed services and cash management market appears promising, driven by ongoing technological innovations and a growing emphasis on integrated cash management solutions. As consumer preferences shift towards convenience and security, the adoption of AI and machine learning technologies is expected to enhance operational efficiency. Furthermore, the increasing focus on sustainability will likely lead to the development of eco-friendly ATMs, aligning with global trends and consumer expectations for responsible banking practices.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash Replenishment Services Maintenance and Support Services Cash Processing Solutions Security Services Software Solutions Others |

| By End-User | Banks Retailers Government Institutions Financial Institutions Hospitality Sector Transportation Sector Others |

| By Service Model | On-Premise Services Cloud-Based Services Hybrid Services Managed Services Others |

| By Payment Method | Cash Transactions Card Transactions Mobile Payments Digital Wallets Others |

| By Region | Kanto Region Kansai Region Chubu Region Kyushu Region Hokkaido Region Shikoku Region Others |

| By Customer Segment | Individual Consumers Small and Medium Enterprises Large Corporations Non-Profit Organizations Others |

| By Pricing Model | Subscription-Based Pricing Pay-Per-Use Pricing Tiered Pricing Flat Rate Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 150 | ATM Managers, Operations Directors |

| Cash Management Services | 100 | Cash Logistics Managers, Financial Analysts |

| Retail ATM Deployment | 80 | Retail Operations Managers, Financial Controllers |

| Technology Providers for ATMs | 70 | Product Managers, Technical Directors |

| Consumer Insights on Cash Usage | 120 | Market Researchers, Consumer Behavior Analysts |

The Japan ATM Managed Services and Cash Management Market is valued at approximately USD 5 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for efficient cash management solutions and enhanced security measures in financial transactions.