Region:Asia

Author(s):Dev

Product Code:KRAB3000

Pages:93

Published On:October 2025

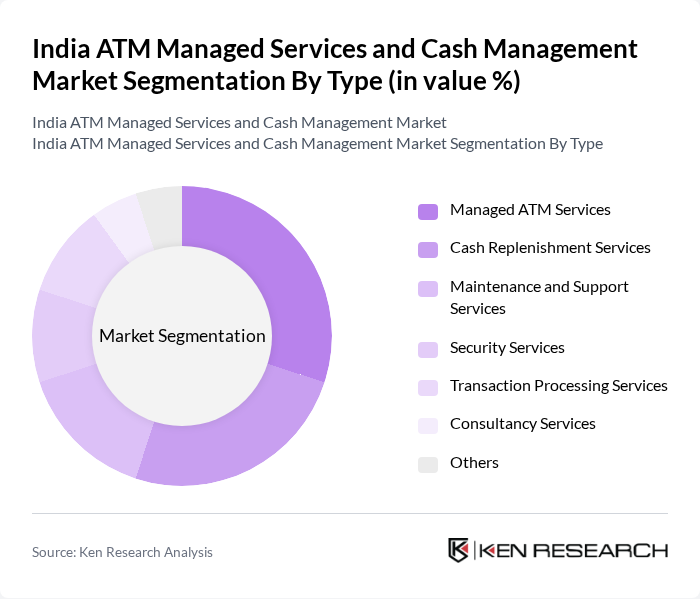

By Type:The market is segmented into various types of services, including Managed ATM Services, Cash Replenishment Services, Maintenance and Support Services, Security Services, Transaction Processing Services, Consultancy Services, and Others. Each of these segments plays a crucial role in the overall functionality and efficiency of ATM operations and cash management.

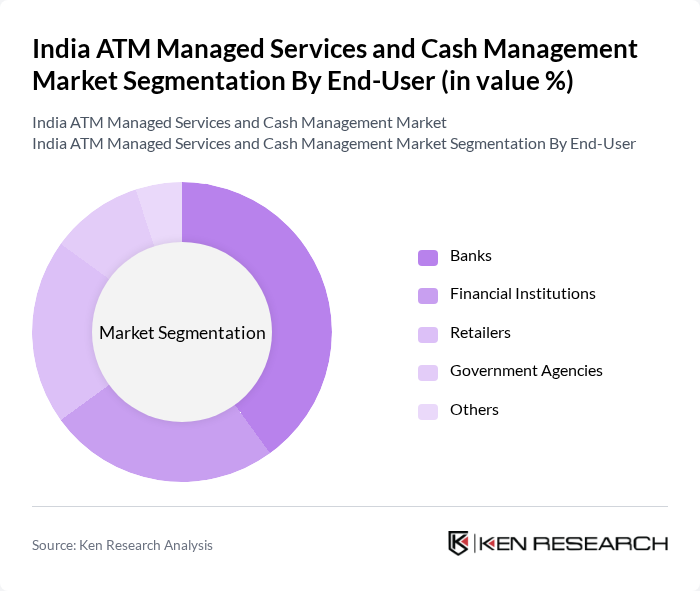

By End-User:The end-user segmentation includes Banks, Financial Institutions, Retailers, Government Agencies, and Others. Each of these segments utilizes ATM managed services and cash management solutions to enhance their operational efficiency and customer service.

The India ATM Managed Services and Cash Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as NCR Corporation, Diebold Nixdorf, FIS Global, Wincor Nixdorf, AGS Transact Technologies, Euronet Worldwide, Hitachi Payment Services, SREI Infrastructure Finance Limited, CMS Info Systems, PayPoint India, Muthoot Finance, SBI Payment Services, Axis Bank, HDFC Bank, ICICI Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India ATM managed services and cash management market appears promising, driven by technological innovations and a shift towards digital transactions. As cash remains a vital payment method, the integration of advanced technologies will enhance operational efficiency and customer experience. Additionally, the government's push for financial inclusion and digital payment initiatives will likely create new avenues for growth, ensuring that the market adapts to evolving consumer preferences and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Managed ATM Services Cash Replenishment Services Maintenance and Support Services Security Services Transaction Processing Services Consultancy Services Others |

| By End-User | Banks Financial Institutions Retailers Government Agencies Others |

| By Region | North India South India East India West India |

| By Application | Cash Withdrawal Balance Inquiry Fund Transfer Bill Payments Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Cost-Plus Pricing Dynamic Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 150 | ATM Operations Managers, Branch Managers |

| Cash Management Services | 100 | Cash Logistics Coordinators, Financial Analysts |

| Retail Cash Handling Practices | 80 | Store Managers, Finance Officers |

| Technology Integration in ATMs | 70 | IT Managers, Systems Analysts |

| Consumer ATM Usage Patterns | 90 | Bank Customers, Financial Service Users |

The India ATM Managed Services and Cash Management Market is valued at approximately INR 305 billion, driven by the increasing adoption of digital banking and the expansion of ATM networks across the country.